read also

World Bank Predicts Stagnation in Russia’s Economy

Photo: Pexels

The World Bank (WB) warns of a prolonged weakening of Russia’s economy: in 2025–2027, GDP growth will not exceed 1% per year. Analysts point to cooling consumption, costly credit, and reduced budget support. Russian officials describe the process as a “managed landing,” expecting the country to remain resilient.

Development Balance Is Broken

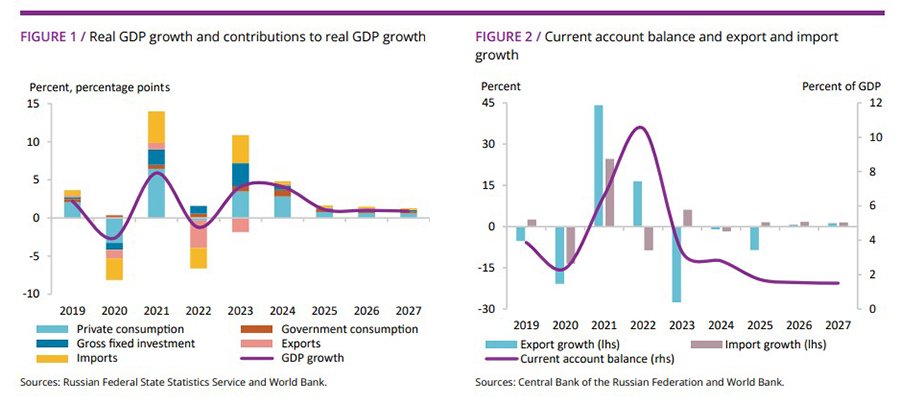

WB analysts report that in H1 2025 GDP growth was 1.2% versus 4.3% a year earlier. Over the previous three years, cumulative stimulus totaled about 11% of GDP—via concessional lending and the National Wealth Fund. The report stresses that this growth model is unsustainable, raising fiscal burdens and vulnerability.

Domestic consumption remains the main driver but is losing momentum. Household lending fell 9.4% year-on-year, while the corporate sector nearly halted new borrowing, constraining investment. Total loans declined 2.7% in real terms. The share of overdue payments rose to 12.1% from 7.6%, signaling rising financial risks.

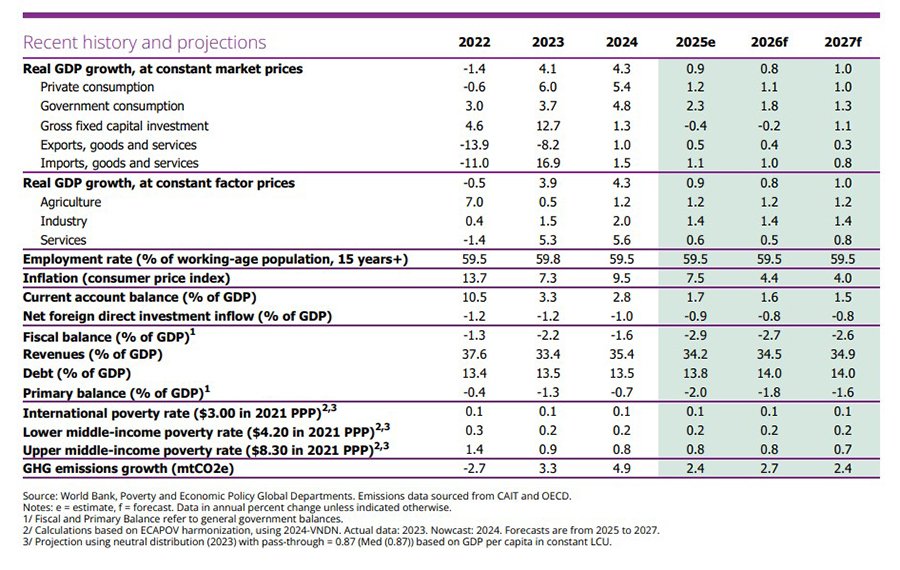

The sectoral mix is also less balanced. Retail sales are sluggish, extractive industries shrink. Manufacturing holds up mainly on military orders and import-substitution, deepening reliance on the state and defense. External metrics weaken: the current-account surplus narrowed to 2.1% of GDP; trade surplus slipped from 7% to 5% of GDP amid lower global oil prices and reduced gas exports. At the same time, imports rose 0.9%, and the ruble appreciated 4.6% year-to-date.

Fiscal policy in 2025 remains expansionary. In January–June, government spending rose 8.9% in real terms, reaching 39.3% of GDP, while revenues fell 3.2%. The deficit widened to 3.6% of GDP, financed mainly by domestic borrowing.

According to the World Bank, Russia will persistently grow slowly: 0.9% in 2025, 0.8% in 2026, and around 1% in 2027. Investment will keep declining due to high costs and the rollback of preferential programs. The fiscal deficit should hover around 3% of GDP, public debt remain moderate at about 14% of GDP, and inflation ease to 4% by 2027.

Experts warn that key risks remain significant: lower commodity prices, tighter sanctions, and reduced fiscal stimuli may cap long-term growth potential.

A Calm Autumn Without Turbulence

State Duma deputy Alexey Govyrin argues[/leech

] that Russia entered Q4 without signs of overheating or new shocks. Contrary to the WB’s view, he calls consumer demand stable, with September’s neutral dynamics a “breather” after summer acceleration.

He emphasized active public procurement—electronic platforms recorded millions of tenders. New rules easing the supply of standard goods made the system more transparent: enterprises gained direct access to contracts, while citizens received uninterrupted access to goods and services.

On foreign trade, the deputy sees balance: exports keep bringing in FX, while imports are gradually recovering, replenishing the domestic market. Volumes are still below 2021, but supply flows are leveling out, benefiting businesses.

The credit sector is “fine,” in his view: corporates continue borrowing for development, households actively use mortgages and targeted programs. The labor market remains strong, unemployment at historic lows, and staffing needs rising from construction to IT. Exchange-rate swings, he believes, will have limited impact on the economy.

Govyrin describes October as “calm, without difficulties,” yet rich in opportunities for those ready to act. He stresses that domestic dynamics remain the key to resilience: “As long as people work, get paid and spend, the economy will move forward.”

A “Managed Landing”

Economic Development Minister Maxim Reshetnikov [leech=https://www.rbc.ru/economics/06/10/2025/68e396389a79473a2462ce91]said that high interest rates limit growth and business development, weighing on profitability and investment. Authorities are working to ease conditions. Since January 2025, the key rate was cut three times: from 21% in January to 20% in June, 18% in July, and down another 1 pp in September.

The minister noted slowing inflation: 8% YoY in September. Yet the real policy stance tightened— the gap between the key rate and inflation tripled since early 2025, signaling restrictive monetary conditions and cooling risks.

In April, the ministry raised its 2025 inflation forecast from 4.5% to 7.6%. By end-2026, inflation should hit the 4% target. GDP in 2025 is expected to grow 2.5% (the Central Bank projects 1–2%). Overall, the economy is still expanding, but more moderately. “This is a managed soft landing to reduce inflationary pressure and achieve balanced, sustainable growth in subsequent years,” Reshetnikov explained. Central Bank Governor Elvira Nabiullina has voiced a similar view, citing cooling domestic demand and less strain in the labor market as signs of stabilization without sharp swings.

Reshetnikov added that targets are not guaranteed: external risks include lower global prices and weaker demand for Russian exports; internal risks include uncertain policy easing paths and its effects on investment and consumption.

Подсказки: Russia, economy, World Bank, GDP, inflation, fiscal policy, monetary policy, consumption, investment, sanctions, ruble, current account, trade, public debt, outlook 2025, outlook 2026, outlook 2027