Serbia Travel Warning Sparks Debate Over Croatia Tourism

Serbia Travel Warning Sparks Debate Over Croatia Tourism

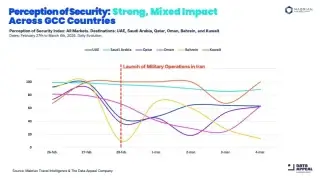

Middle East War Shifts Global Tourism Demand

Middle East War Shifts Global Tourism Demand

Airlines Reroute Flights Around the Middle East

Airlines Reroute Flights Around the Middle East

Dubai Faces Food Shortages Amid Middle East War

Dubai Faces Food Shortages Amid Middle East War

Maldives and Thailand Ease Visa Rules Amid Aviation Disruptions

Maldives and Thailand Ease Visa Rules Amid Aviation Disruptions

EU Launches Repatriation Flights for Stranded Travelers

EU Launches Repatriation Flights for Stranded Travelers

UK Tourism Faces Visitor Levy Debate

The UK government has launched a consultation that could allow local authorities in England to introduce overnight visitor levies on hotel stays and other paid accommodations. The proposal has the potential to reshape how tourism infrastructure is funded, but industry leaders warn that it may undermine the sector’s fragile recovery and international competitiveness.

What the Proposed Visitor Levy Would Do

Under the proposal, English local authorities would gain the power to impose a per-night charge on tourists staying in hotels, guesthouses and similar accommodation. Revenues would be earmarked for local infrastructure, public transport improvements, environmental initiatives and tourism services. The government has indicated that any levy would need to be proportionate and transparent.

The measure remains under consultation, and officials have stated that implementation would depend on public and stakeholder support, alongside a thorough assessment of economic impacts.

Tourism’s Role in the UK Economy

Tourism is a major pillar of the UK economy, contributing approximately £147 billion annually and supporting more than 4.5 million jobs nationwide. Although recovery from the COVID-19 pandemic has been underway, the UK has lagged behind several European peers in regaining pre-pandemic tourism levels.

Industry representatives caution that introducing new charges at a delicate stage of recovery could suppress growth, reduce visitor numbers and constrain job creation. In a post-pandemic environment where travelers are highly price sensitive, even modest additional costs may influence destination choices.

Competitiveness and Employment Concerns

According to the World Travel & Tourism Council, additional visitor levies could weaken the UK’s price competitiveness in global tourism rankings. The country already faces challenges compared to more affordable destinations, and a fragmented system of local taxes could further complicate the visitor experience.

If different regions apply varying levy structures, tourists may encounter inconsistent pricing and administrative complexity. Small and medium-sized businesses in hospitality and retail could face higher compliance burdens while simultaneously dealing with reduced demand.

Comparing the UK to European Tourist Tax Models

Several European cities, including Paris, Amsterdam and Barcelona, already apply tourist taxes. In those cases, levies are typically structured at city level and integrated into a predictable framework that funds infrastructure and enhances the visitor experience.

The UK proposal, by contrast, envisions devolving authority to local governments across England. Analysts suggest that without national coordination and clear standards, the approach could create uncertainty and weaken the country’s brand as a straightforward and competitive destination.

Investment Opportunity or Growth Risk

The government argues that visitor levies would generate dedicated funding for transport systems, urban improvements and tourism facilities. However, industry groups maintain that sustaining demand and improving competitiveness should remain the primary focus during recovery.

As reported by experts at International Investment, the long-term impact of the proposed visitor levy will depend on whether policymakers can strike a balance between raising funds for infrastructure and preserving the UK’s attractiveness as a globally competitive tourism market.