Luxury Real Estate Markets Continue to Grow

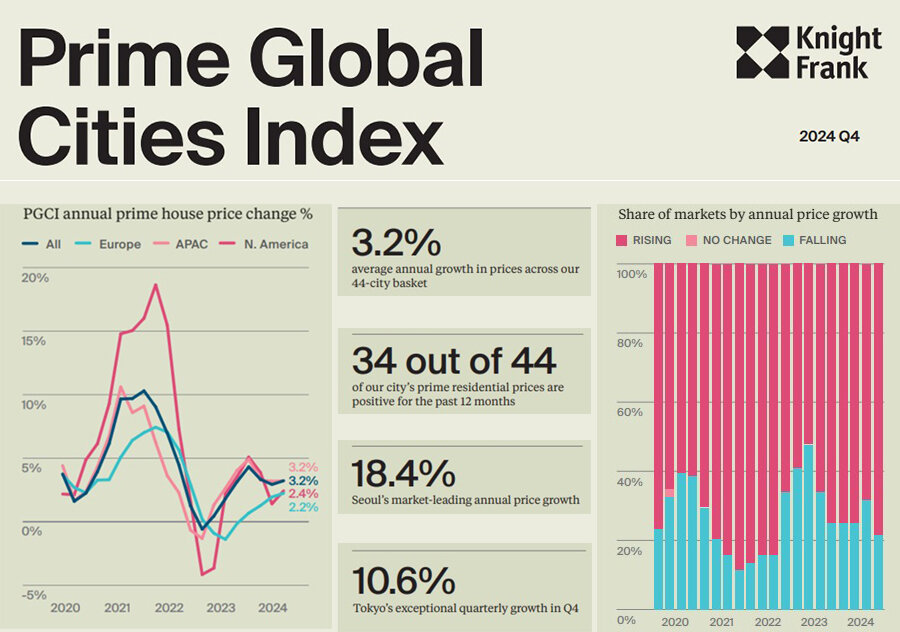

Knight Frank has published its Prime Global Cities Index for Q4 2024, tracking luxury real estate price trends in major cities worldwide. The latest report indicates a 3.2% price increase, the highest growth rate since Q1 2024, when the index rose by 4.1%.

Experts remain optimistic about the current pace but note that the 20-year average growth rate is 5.3%. Over the past 12 months, 34 out of 44 cities recorded positive luxury housing price changes. Seoul leads the ranking with an 18.4% increase, while Tokyo saw an exceptional quarterly growth of 10.6%.

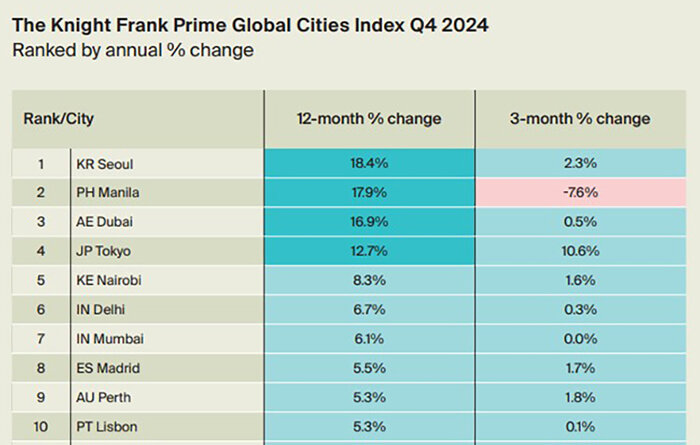

Seoul’s Rapid Rise

At the beginning of 2024, Seoul ranked sixth, with a 9.6% annual increase. However, its half-year performance was negative, with a 5.1% decline, while the quarterly rise was just 0.1%.

In Q2, Seoul dropped to ninth place, with a 4.6% annual rise and 5% quarterly growth.

In Q3, it maintained similar growth rates but fell to 14th place in the rankings.

Despite this, Seoul topped the Q4 list, overtaking Manila, which had previously dominated the rankings.

Manila’s Decline

Throughout 2024, Manila led the luxury market with impressive growth:

Q1: 26.2% annual increase

Q2: 26% rise

Q3: 29.2% surge

However, in Q4, it dropped below Seoul, growing by 17.9% annually but experiencing a 7.6% price decline over three months—the largest quarterly drop among 44 cities.

Dubai’s Comeback

Dubai ranked third in Q4, with luxury property prices rising 16.9% YoY and 0.5% QoQ.

In Q1, it ranked eighth, with 8.6% annual growth and 4.2% quarterly growth, followed by a 2.7% decline over six months.

In Q2, Dubai’s position plummeted to 35th place, with prices falling 8.4% in a single quarter.

By Q3, Dubai rebounded to second place, maintaining the same growth rates as in Q4.

Tokyo’s Record-High Growth

Tokyo secured fourth place in Q4 2024, with a 12.6% annual increase. The city also recorded a stunning 10.6% quarterly growth, the highest among all cities.

Analysts note that Japan’s interest rates have reached a 17-year high, diverging from trends in other major economies. However, the weaker yen continues to attract foreign buyers to Tokyo’s luxury market.

Q1: Tokyo ranked second, with a 12.5% annual growth.

Q2: It fell to 22nd place, growing only 2.1% annually but 7.2% quarterly.

Q3: Tokyo climbed to third place, with a 12.8% annual increase but a 2.8% quarterly drop.

Nairobi Enters the Top 5

Nairobi, Kenya, rounded out the top five luxury real estate markets in Q4 2024, with:

✔ 8.3% annual growth

✔ 1.6% quarterly increase

The city steadily climbed the rankings throughout the year:

Q1: 19th place (4.6% YoY growth)

Q2: 6th place (6.6% increase)

Q3: 7th place (6.9% rise)

Other Top Performers

The top 10 luxury markets in Q4 also included:

✔ Delhi, India (+6.7%)

✔ Mumbai, India (+6.1%)

✔ Madrid, Spain (+5.5%)

✔ Perth, Australia (+5.3%)

✔ Lisbon, Portugal (+5.3%)

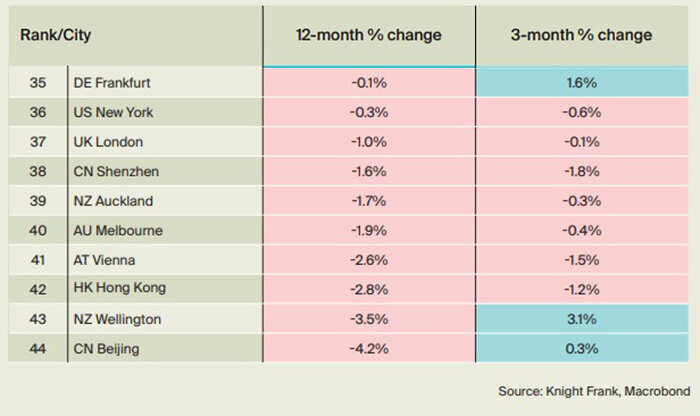

Luxury Real Estate Prices Decline in Some Markets

Several major cities saw negative annual price trends in Q4 2024:

✔ Frankfurt, Germany (-0.1%)

✔ New York, USA (-0.3%)

✔ London, UK (-1.0%)

✔ Shenzhen, China (-1.6%)

✔ Auckland, New Zealand (-1.7%)

✔ Melbourne, Australia (-1.9%)

✔ Vienna, Austria (-2.6%)

✔ Hong Kong (-2.8%)

The worst performers:

✔ Wellington, New Zealand (-3.5%)

✔ Beijing, China (-4.2%)

Georgia’s Rising Luxury Market

Georgia’s luxury real estate sector is also experiencing significant growth. By 2028, the country will add 22 new hotels from international brands.

In 2025, major hotel openings in Georgia will include:

✔ Hilton Garden Inn Adjara & Hilton Tbilisi – 200 rooms each

✔ Hotel Sololaki Hills – 188 rooms

✔ Ambassador Batumi – 182 rooms

✔ Paragraph Golf & Spa Resort Tabori Hill – 177 rooms

Additionally, Georgia will debut its first all-inclusive 5-star resort, Wyndham Grand Batumi Gonio, featuring 1,055 units, including luxury residences, townhouses, and beachfront villas.

A major Abu Dhabi developer, Eagle Hills Properties LLC, is also launching a large-scale real estate project in Gonio, including branded residences, hotels, shopping districts, public parks, and a yacht marina covering 260 hectares.

Market Resilience Despite Global Uncertainty

Knight Frank experts highlight that luxury real estate markets have demonstrated remarkable resilience despite political and economic uncertainty.

✔ Two-thirds of global cities saw annual price increases.

✔ Fewer than 20% of cities recorded declines.

By the end of 2024, luxury market growth rates across all regions converged at 3.2%, indicating a more balanced recovery after pandemic-induced volatility.

Liam Bailey, Head of Research at Knight Frank, warns that persistent inflation has complicated interest rate reductions in major economies.

However, rate cuts have begun, and further reductions in 2025 could drive higher housing price growth in the near future.