read also

Saudi Arabia’s Real Estate in 2025: Who Stands to Gain from the New Investment Landscape?

Saudi Arabia's real estate sector is undergoing a major transformation in 2025. With surging housing prices, diminishing affordability, and rising interest rates, the government is pushing for liberalization and greater foreign investment to balance the market, expand rental supply, and fund long-term growth.

Prices Rise, Affordability Falls

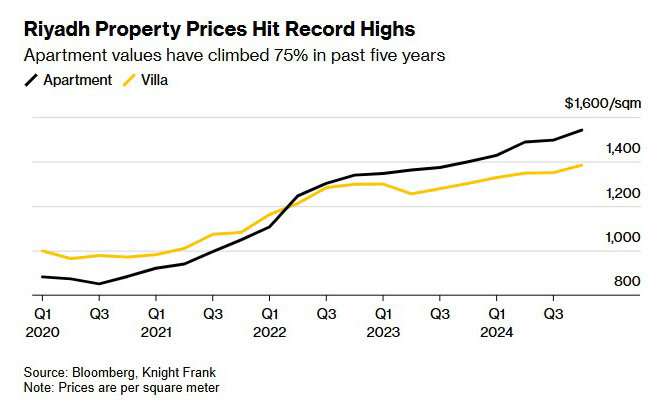

According to a report by Knight Frank, the share of first-time homebuyers in the Kingdom dropped sharply from 40% in 2023 to 29% in 2024. Rising property prices and insufficient mortgage flexibility are driving potential homeowners away. In Riyadh, apartment prices surged nearly 11% to an average of $1,500 per square meter, while villas climbed over 6% to around $1,400.

Faisal Durrani, Head of Middle East Research at Knight Frank, notes: “The core issue is a mismatch between buyer expectations and what's being built. We're supplying the wrong product for the market.” Current development largely targets high-end buyers, while middle-class Saudis are increasingly priced out.

Knight Frank estimates the country must deliver at least 115,000 new housing units annually for the next six years. Leading the development charge are state-backed Roshn and private developer Dar Global Plc, which recently partnered with the Trump Organization for projects in Riyadh.

Luxury Saturation Risk, Rental Potential

A growing concern is the potential oversupply in the luxury segment. “There is a real risk of a glut in the luxury residential market over the next five years unless international buyer interest expands,” warns Durrani.

Meanwhile, demand is booming for rental units, particularly in Riyadh, where young Saudis and foreign professionals are relocating. “They’re not buying — they’re renting. And the market doesn’t offer enough options,” says Durrani. Knight Frank identifies strong opportunities in the build-to-rent (BTR) space and highlights the need to scale mid-market rental housing.

Investment Liberalization in Makkah & Madinah

In a landmark move, Saudi Arabia opened its real estate market in Makkah and Madinah to foreign investors in January 2025. Bloomberg reports that foreigners can now invest in public companies that own residential or commercial real estate in the holy cities.

While direct ownership by non-Muslims remains restricted, foreigners can purchase shares and debt securities of listed companies operating in these cities. This change boosts liquidity in a market heavily reliant on revenues from religious tourism, which reached $12 billion in 2019. Saudi Arabia plans to welcome up to 30 million pilgrims annually by 2030.

Following the regulatory shift, shares of major developers like Jabal Omar Development and Makkah Construction and Development rose by over 10%, reflecting strong market optimism. Christopher Payne, Chief Economist for MENA at Knight Frank, emphasized: “This is a recognition of the pivotal role foreign capital plays in powering future development.”

Vision 2030: New Rules for Foreign Investors

Under Vision 2030, Saudi Arabia continues to modernize its investment laws. Foreigners can now obtain premium residency by investing 4 million SAR ($1.1 million) in existing residential properties. This status includes perks like visa-free entry, exemption from levies, family sponsorship, and property ownership rights.

Starting in 2025, foreign investors will register directly with the Ministry of Investment, eliminating the need for a MISA license. Legal safeguards against expropriation and a broader scope of permitted sectors also aim to boost investor confidence, though strategic industries like defense, oil, and healthcare remain off-limits.

Conclusion: Reform, Risk, and Reward

The Saudi real estate market in 2025 is defined by contrast: soaring prices and falling accessibility on one hand, and expanding foreign investor rights on the other. While the state is making bold moves to open the sector and attract international capital, challenges remain — including regulatory risks, cultural limitations, and an oversupply of luxury properties.

Ultimately, investors with an appetite for high-growth, frontier real estate markets — particularly in mid-range rentals and institutional-grade developments — may find Saudi Arabia an increasingly compelling option in the coming years.