Вusiness / Real Estate / Investments / Analytics / Reviews / News / United Kingdom / Germany / Finland 14.05.2025

European Commercial Real Estate: Transactions Decline and Investment Freeze Returns

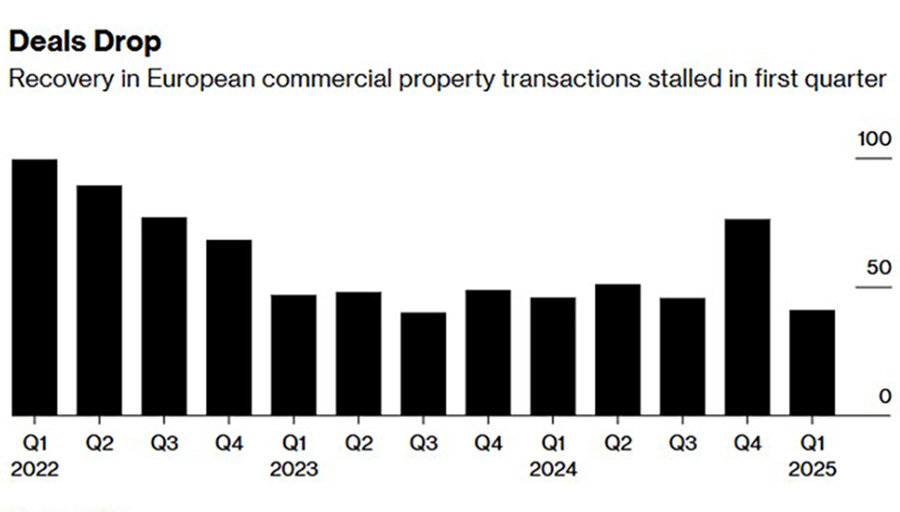

Europe’s commercial real estate market, which showed signs of recovery in 2024, has stalled again in Q1 2025. According to Bloomberg, citing MSCI data, total transaction volume declined by 11% quarter-on-quarter, reaching €41 billion — the lowest since Q3 2023 and the second-lowest quarterly result since 2012.

Key Factors Behind the Decline

Tom Leahy, head of EMEA real assets research at MSCI, attributes the slowdown to rising concerns over:

New global trade tariffs

Macroeconomic instability

Trump administration policies

And most notably — the pricing gap between buyers and sellers.

This gap began in 2022–2023 with the end of the ultra-low interest rate era. Investors began demanding higher yields, while sellers resisted rapid revaluations. The market endured seven straight quarters of decline before briefly stabilizing in mid-2024.

UK Lending & Warning Signs

While Europe’s overall investment pace slowed, UK commercial lending showed resilience. According to Bayes Business School, new loans rose 11% YoY to £36.3 billion in 2024, driven by two rate cuts from the Bank of England.

However, delinquency rates rose from 4.9% to 5.9% in six months, suggesting underlying stress. This may deter further credit expansion in 2025 amid global volatility.

Prime vs. Peripheral Offices

According to Financial Times, demand for prime office spaces in central districts — such as London — is strong. In contrast, peripheral properties are struggling.

Savills notes that over the past five years, rents in CBDs doubled compared to outer districts. In Milan, vacancy in central business districts was 2.4% in Q1, vs 11% in other zones, per CBRE. In Helsinki, Sponda (owned by Blackstone) reports growing demand for downtown relocations, pushing rents up 14% in a year.

In total, MSCI reports that CBD office deals totaled €26 billion (up 25% YoY), while non-CBD office volumes fell 10% to €20 billion.

Germany: Signs of Rebound

Colliers reports cautious optimism in Germany. Q1 2025 saw:

- Deal volume of €5.2 billion (–9% YoY)

- But transaction count increased by 10%

Yields remained stable in the office and logistics segments. However, market uncertainty remains due to:

- Political reshuffling

- Rising long-term bond yields

- Investor frustration with expensive debt

Yet, volatility in alternatives may push institutional capital back into property in late 2025.

Specialized Infrastructure and Data Centers Boom

Beyond traditional sectors, data centers are booming. According to CBRE, 2025 will see 937 megawatts of new capacity in Europe — a 43% increase YoY.

The top five data center markets (Frankfurt, London, Amsterdam, Paris, Dublin) are set for record investments, driven by digitalization and AI expansion.

Direct Real Estate Gains New Appeal

MSCI suggests that volatility in public markets may benefit direct investments in real assets. As Tom Leahy notes, illiquidity and stability are now considered virtues, especially as public equity and bond markets remain turbulent.

This sentiment may influence institutional strategies, particularly in an unpredictable geopolitical climate. While demand exists in select sectors, overall momentum still hinges on macroeconomic signals and political clarity.

Подсказки: Europe, real estate, commercial property, investment, offices, logistics, data centers, market trends, MSCI, CBRE, Savills, Germany, UK, institutional capital