New Business Registrations and Bankruptcies in the EU: Early Signals from 2025

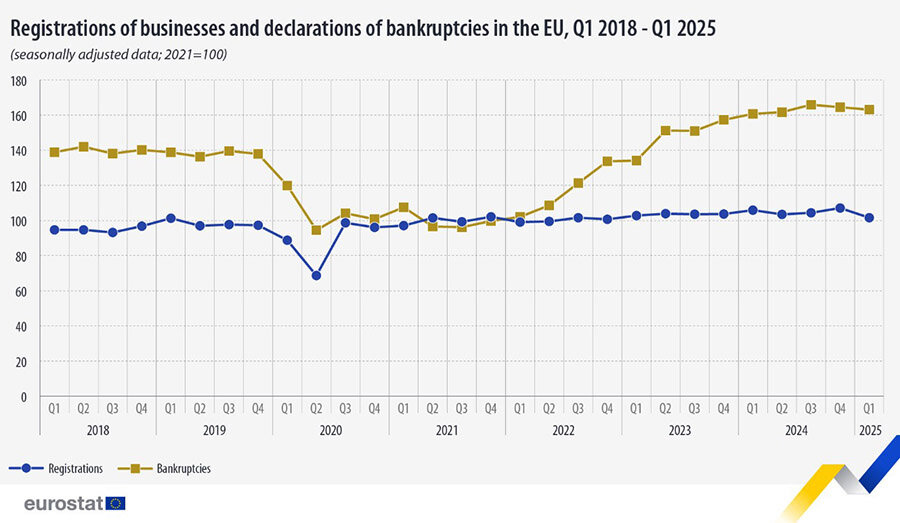

In Q1 2025, the number of company bankruptcies in the European Union fell by 0.9% compared to Q4 2024, while new business registrations declined by 5.1%, according to Eurostat. Despite the decrease, both indicators remain above their levels from 2018–2021.

Overall Trends

Between 2018 and the end of 2019, new business registrations showed no strong upward trend. The number dropped significantly in the first two quarters of 2020, then rebounded in Q3. From Q1 2022 to Q1 2024, registrations climbed steadily, peaking before slowing again. Despite the Q1 2025 decline, the numbers remain higher than pre-pandemic levels.

Bankruptcies followed a similar path, with steady increases from late 2021 through Q3 2024. While Q4 2024 and Q1 2025 showed modest declines, insolvency levels are still above historical norms, suggesting structural shifts in the EU business environment or the tapering of pandemic-era support.

Country-Level Differences

In Q1 2025, the largest drops in new company registrations were in the Netherlands (-38.4%), Romania (-32.3%), and Spain (-16.1%). Growth was observed in Cyprus (+9.8%), Lithuania (+8.9%), and Croatia (+4.2%). These variances reflect local tax changes, regulatory reforms, and startup support policies.

Greece (+35.9%), Sweden (+22.7%), and Estonia (+20.4%) recorded the highest increases in bankruptcies. Cyprus (-70%), Malta (-66.6%), and Latvia (-21%) posted the steepest declines. In smaller economies, minor fluctuations can heavily skew percentages, while national laws—like thresholds for bankruptcy filings—also play a major role.

Sector Analysis

Most industries saw declining business activity in early 2025, particularly in construction, retail, and IT. In some cases (e.g., hospitality and construction), metrics are lower than in late 2019, prior to the pandemic.

Bankruptcy trends varied more widely. Hospitality, IT, and education sectors saw more filings, while transportation and construction reported declines. This reflects continuing challenges for sectors hit hard by rising costs and subdued demand.

Methodology Notes

Eurostat publishes quarterly data on registrations and bankruptcies. A registration means a company was added to the registry, showing intent to start operations. Bankruptcy is logged when a legal filing occurs but doesn't always mean operations stop.

Quarterly stats differ from annual data, which measures actual business activity. Variations in national registration laws and company structures make cross-country comparisons indirect.

Conclusion

Q1 2025 signals short-term stabilization after the 2023–2024 wave of bankruptcies. Still, the drop in new business formation shows cautious sentiment among entrepreneurs. While overall levels remain above pre-crisis figures, the late 2024 recovery momentum has softened. Future quarters will show whether this pause leads to sustained recovery—or marks a temporary lull.