Вusiness / Real Estate / Investments / Analytics / Reviews / Portugal / Real Estate Portugal 10.06.2025

Portugal Real Estate: Housing Market Imbalances and New Dynamics in the Commercial Sector

The Portuguese real estate market shows a mixed trajectory: while housing prices continue to grow steadily, commercial property prices are rising at a more moderate pace. However, in 2025, analysts report signs of renewed activity in the commercial segment as well, particularly in Lisbon and tourist-heavy regions.

Residential Real Estate

Housing prices in Portugal increased by 9.1% in 2024, according to The Portugal News. The number of transactions also rose by 15.2%, reaching 134,540 deals. Notably, purchases by institutional investors—especially corporate entities—grew sharply. These buyers acquired 21,785 properties, up 10.3% compared to 2023, with total transaction volume reaching €5.1 billion (+13.1%).

In 2024, housing deals by legal entities grew quarterly between 2.7% and 5.2%, with acceleration in the second half of the year. This indicates steady investor interest in residential assets, despite general economic uncertainty.

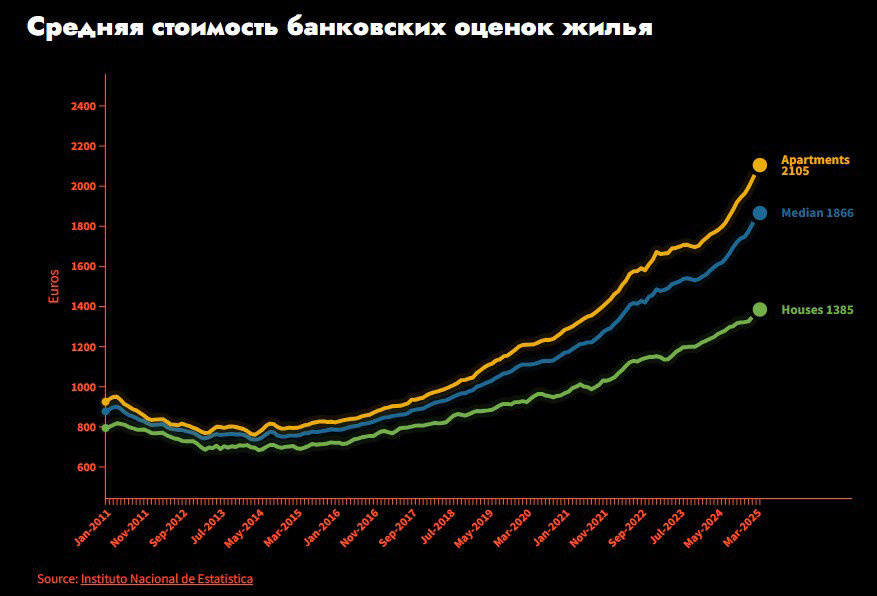

Yet, signs of overheating are becoming visible in this segment. According to Roca Estate, the median housing price in April 2025 reached €1,866 per sq.m—up 16.9% year-on-year. Similar growth was observed in March. Apartment prices jumped by 19% to €2,105 per sq.m. In Lisbon and the Algarve, prices exceeded €2,800 and €2,480, respectively. House prices also increased by 11%, especially in those same regions.

Roca Estate notes that the number of bank property valuations fell by 2.3% compared to March, which may indicate cooling demand and a disconnect between prices and actual market activity. In Madeira, apartment prices surged 24.5% over the year, while in Alentejo, villa prices fell 1.7% month-on-month. These regional discrepancies increase risks for investors—especially those using leverage.

Commercial Real Estate

The growth rate for commercial real estate prices dropped from 5.5% in 2023 to 4.7% in 2024. However, a study by BNP Paribas Real Estate and Worx suggests investment volumes in European commercial assets may rise by 7% annually over the next five years, with Portugal expected to see 5% growth. Declining inflation and easing interest rates are making financing more accessible. Lisbon ranked among the top three European capitals for office space growth potential. It also placed fourth in retail development prospects and eighth in logistics.

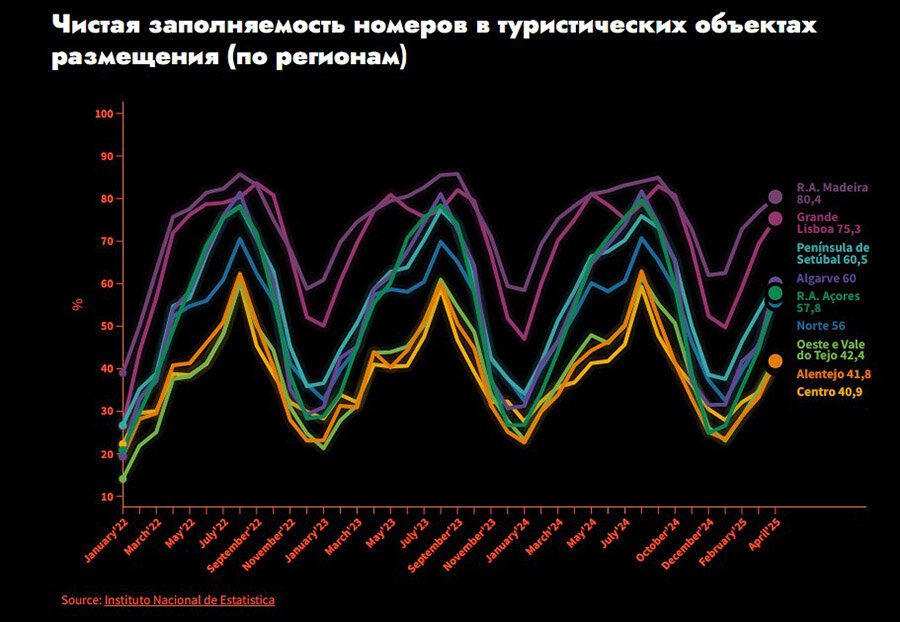

April 2025’s tourism season added momentum to the commercial sector. According to Roca Estate, Easter and a sharp increase in tourism drove hospitality sector revenues up by 12.6% year-on-year, reaching €571.1 million, including €436 million from accommodation alone (+13.9%).

Domestic tourism showed particularly strong growth: Portuguese overnight stays increased by 13.1%, while foreign tourist stays rose by 7.7%. This makes domestic-focused properties more resilient to external shocks. Average RevPAR (revenue per available room) rose to €69.5 (+10.8%), with the highest growth seen in Central Portugal (+27.7%) and Madeira (+24%). Secondary regions with the strongest demand and revenue growth are becoming new investment hotspots. For example, in Central Portugal, total revenue rose by 29.4%, and accommodation income by 31.7%.

Conclusion

Analysts caution that holiday-related seasonality may distort April figures and advise careful interpretation. Nonetheless, structural trends—such as growing domestic tourism, a shift toward secondary locations, and expectations of higher rental yields—signal sustainable sector recovery.

In 2025, Portugal's real estate market continues to attract strong investment activity in both the residential segment (especially Lisbon, Algarve, and Madeira) and commercial properties. Office and hospitality assets in capital regions and emerging tourist zones appear particularly promising.

Amid price disparity and regional divergence, diversification—accounting for local nuances, seasonality, and evolving demand patterns—emerges as a winning strategy.