Вusiness / Investments / Analytics / Research / Real Estate / Ratings / USA / Canada / United Kingdom / Germany / China 29.07.2025

Investment Priorities 2025: Where Global Capital Is Heading

Image: Kearney

Foreign direct investment (FDI) remains one of the key tools for business growth. According to the Kearney FDI Confidence Index 2025, 84% of investors plan to increase their capital inflows over the next three years. Global investor sentiment remains strong, with a minimal decline of only 4 percentage points compared to 2024.

Developed Markets and Tech Leaders Hold Ground

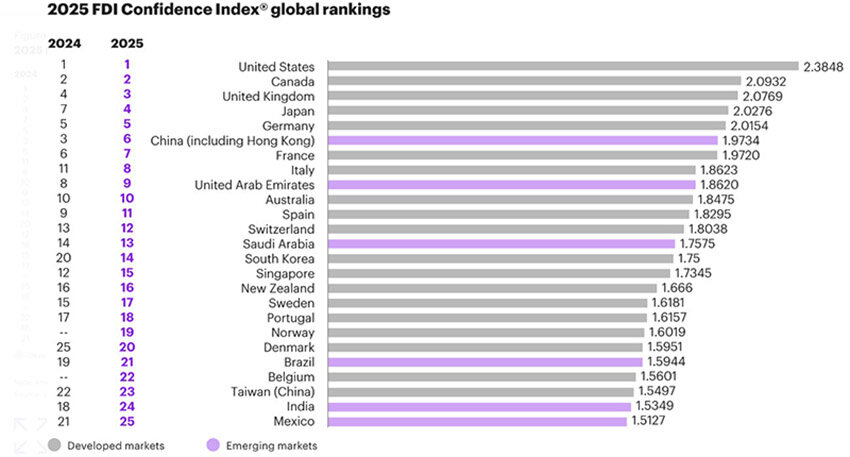

In an era of growing uncertainty, investors continue to favor countries with stable institutions, advanced infrastructure, and resilient economies. In 2025, developed markets account for 19 of the 25 spots in the index — more than last year. The United States holds the top spot for the 13th consecutive year.

Top investment drivers include technological innovation (45%) and strong macroeconomic indicators (40%). Canada maintains second place due to massive investment in infrastructure, digitalization, and green energy. The UK rises to third, buoyed by consumer demand, a strong financial sector, and innovation capacity. Germany remains fifth despite industrial difficulties, as its R&D focus and tech reputation continue to earn investor trust.

Japan climbs to fourth, backed by wage growth and innovation momentum. China falls three spots to sixth due to the real estate crisis and ongoing trade friction with the U.S. However, interest in its tech sector remains strong — recent developments like the DeepSeek AI assistant and a $1.4 trillion stimulus package suggest possible recovery.

Emerging Markets: Cautious Optimism and New Entrants

The share of emerging markets in the main index has declined. In 2025, only six emerging economies made it into the top 25, down from eight last year. Poland and Argentina dropped out, while China, the UAE, Saudi Arabia, Brazil, India, and Mexico retained their places despite slight declines. South Korea surged from 20th to 14th place, driven by major investment in semiconductors and science-based industries.

In Kearney’s separate emerging markets index, China, the UAE, and Saudi Arabia lead, followed by Brazil, India, Mexico, and South Africa. South Africa notably jumped from 11th to 7th place due to energy supply stabilization and economic recovery.

New entrants include Kuwait, joining the index thanks to liberalized business rules and vast oil reserves. Bulgaria gained recognition for its eurozone entry preparations, and Hungary climbed the ranks after major Chinese investments in infrastructure and energy. Georgia is also gaining ground, attracting investors with easy visa and transaction rules, high returns, and a booming premium real estate sector — particularly in Gonio.

Despite a 9-point drop in overall optimism year-on-year, emerging markets still show positive investor expectations — only Peru posted a neutral sentiment.

Europe and the Middle East Strengthen Their Positions

The number of European countries in the index rose to 11. Norway and Belgium returned to the list, while Poland exited. The EU remains a trusted region: 68% of investors view it positively, and 60% prefer to conduct business there. Key factors include strong infrastructure, high education levels, and the rule of law. Denmark stands out, climbing five positions due to its green transition focus and tech innovation.

However, perspectives vary by region. Only 36% of European investors believe the EU will increase its global influence over the next three years, compared to over 50% in Asia and the Americas. Top perceived risks include sluggish GDP growth (1.5% annual forecast through 2029), escalation of the Ukraine conflict, and market fragmentation.

The Middle East is represented by the UAE and Saudi Arabia. The Emirates remain in ninth place with strong GDP projections — 4.8% in 2025 and 6.2% in 2026 — and continued logistics expansion through the Etihad Rail project. Saudi Arabia ranks 13th, doubling down on tech with its $100 billion Transcendence AI ecosystem.

Changing Priorities and Investment Risks

In 2025, investors have shifted focus in country selection. Economic dynamics and regulatory efficiency now top the list of priorities (16% each), up from 16th place just a year ago. In 12 of the 25 ranked countries, macroeconomic stability was the main investment driver.

Risks have become more complex. 38% expect commodity price hikes, 35% foresee rising geopolitical tension, and 32% anticipate tougher regulations in developed markets. Notably, 37% are concerned about a potential economic crisis in a major economy. In January 2025, for example, the U.S. government blocked Japan’s Nippon Steel from acquiring US Steel on national security grounds.

Regulatory criticism in the EU persists: nearly half of respondents view tech and sustainability rules as too strict. Still, many also highlight the benefits: 58% say GDPR helps business, and 56% support the CSDDD sustainability directive. These frameworks foster legal certainty and reduce risk.

The 2025 FDI Confidence Index reaffirms the global shift toward transparent regulations, institutional maturity, and economic resilience. FDI remains a key tool of global competition — but with more selective, risk-managed strategies.