read also

Hospitality Sector on the Rise: Steady Growth and a Shift Towards Transformation

The hospitality industry continues to demonstrate resilience amid economic uncertainty. According to JLL, as of November 2024, key performance indicators show positive momentum: urban hotel occupancy accelerated, business and international travel revived, and limited new supply supported profitability levels.

Accommodation demand reached 4.8 billion overnight stays — 102 million more than the previous year. Revenue per available room (RevPAR) increased by 3.7%. Resort destinations, which were the first to recover post-pandemic, are returning to pre-crisis occupancy levels. Meanwhile, city hotels are showing accelerated growth due to the rebound of corporate, group, and international travel, alongside modest supply expansion.

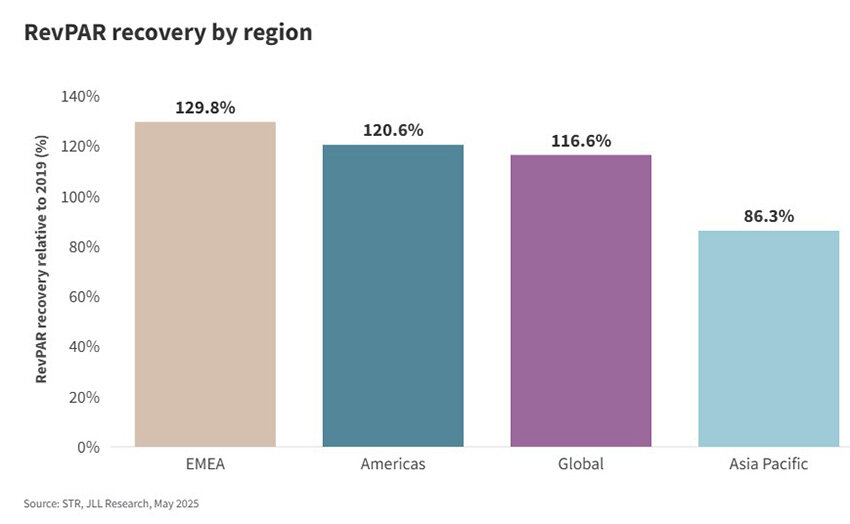

In the EMEA region (Europe, Middle East, and Africa), RevPAR from January to November 2024 exceeded pre-COVID levels, rising 25.3% compared to 2019 and 5.6% versus the same period in 2023. A strong U.S. dollar boosted inbound tourism from the United States. Global events such as the Paris Olympics and Taylor Swift’s world tour gave additional momentum to demand.

Asia-Pacific saw more modest gains — RevPAR grew just 1.6% year-over-year and remains below 2019 levels. China's economic slowdown and lingering visa restrictions continue to weigh on performance. Still, currency weakness is attracting international visitors. In the Americas, RevPAR hit a record high, though annual growth was limited to 1.9% due to reduced leisure travel and declining household savings.

According to Business Research Insights, the hospitality industry is expected to maintain a strong compound annual growth rate through at least 2032. Accommodation now spans formats from short-term rentals and budget apartments to full-service hotels. Food and beverage remain integral to the sector, fueled by gastronomic tourism and demand for non-standard service models. Entertainment is growing fastest — concerts, festivals, sports events, and theme parks are becoming essential to modern travel.

Technological transformation is accelerating the sector’s evolution. Infrared sensors, contactless payments, robot-enabled delivery services, and AI platforms are enhancing operational efficiency and personalization. These technologies meet rising demand for unique experiences and unconventional accommodations.

Regionally, the strongest growth is observed in Asia-Pacific, driven by investments and infrastructure initiatives in India, China, and Japan. Europe benefits from urbanization and diverse tourist flows. North America remains large but with slower growth in the leisure segment.

Major players — Marriott, Hilton, Accor, Wyndham — are focusing on tech, partnerships, and ESG initiatives to expand their footprint and compete in high-potential markets.

JLL analysts note that hotel owners are navigating rising costs and modest revenue growth in 2025, which may impact profitability and trigger increased investment activity. With upcoming loan maturities and mounting capital expenditure needs, more properties may enter the market.

Private equity firms, international investors, high-net-worth individuals, and real estate funds are expected to drive transactions. High construction costs are likely to restrain new development, boosting interest in M&A opportunities. Hotel brands will seek assets that expand room supply — a key driver of shareholder value. JLL forecasts global RevPAR to grow 3–5% in 2025, supported by the revival of business and international travel and tight supply.

In the long term, hotel chains will expand beyond traditional accommodation, adapting to blurred lines between living, working, and leisure. Investors will increasingly target alternative formats, such as branded residences and non-traditional lodging options.

Подсказки: hospitality, tourism, hotels, investment, RevPAR, JLL, real estate, technology, travel trends, 2025