Singapore Housing Prices Surge Ahead of New Tax Measures

Photo: Unsplash

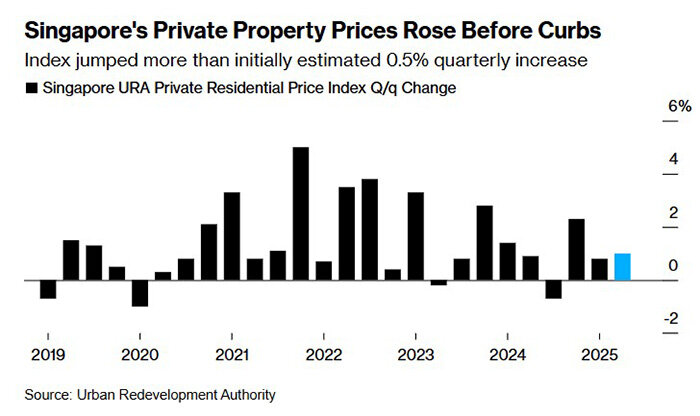

In Q2 2025, Singapore’s private housing prices rose twice as fast as expected, Bloomberg reported, citing the Urban Redevelopment Authority (URA). This surge occurred just before a new set of cooling measures were implemented and raised concerns about another property market boom.

The government introduced a new round of property tax hikes in early July 2025. As clarified by The Edge Malaysia, Seller’s Stamp Duty (SSD) rates increased:

1st year: from 12% → 16%

2nd year: from 8% → 12%

3rd year: from 4% → 8%

4th year: a new 4% rate added

The minimum holding period before SSD exemption now extends from three to four years. These measures aim to deter short-term flipping and speculative resale of uncompleted units, which have pushed prices up and worsened housing affordability.

Just before these tax changes took effect, housing prices outpaced projections. The private residential property price index rose by 1% in Q2 (compared to the previously estimated 0.5%). This marked the ninth consecutive month of price growth. Meanwhile, rental rates rose by 0.8% in April–June, after a 0.4% increase in Q1. Rental costs remain high after surging to multi-year peaks in previous cycles.

June was traditionally quiet, but July saw a spike in launches, right after the new rules were enacted.

At The Shorefront in Pasir Ris, 94% of 163 units sold on launch day. Prices started from SGD 1.35 million (~$1 million) for two-bedroom apartments.

However, the luxury segment struggled. At Marina View Residences in the CBD, which offers 683 units, only two units were sold in the early days. With prices starting at SGD 3 million (~$2.3 million), buyers hesitated, and investors adopted a wait-and-see approach. Similar patterns were seen at Holland Grove Residences, where only half of the inventory was sold. Analysts believe that interest in luxury units may recover by year-end, depending on sentiment.

One of the key drivers behind tighter rules was a spike in speculative flipping of uncompleted properties. According to Bloomberg, some investors doubled their returns before completion.

For example, a unit at Northpoint Residences purchased for SGD 1.2 million resold for SGD 2.4 million. Similar activity was seen at SkyVista, where even partially processed purchases were flipped. This drove prices up and further reduced affordability.

In response, the July policy package targets such transactions. However, Nicholas Mak, head of research at Mogul.sg, called it a "light warning." He suggests that price growth may persist or accelerate in Q3, despite the changes.

Uncertainty around U.S. tariff policy continues to weigh on the market, but developers are pushing forward with new launches, especially in the mass-market segment where demand remains strong. Still, frustration is growing among developers.

Chia Ngiang Hong, GM of City Developments Ltd., warned that repeated policy tightening has created major challenges.

"With high land and construction costs, these new restrictions make it harder to launch new projects."