Hotels in Vietnam: weak service and climate risks

Photo: Unsplash

Vietnam’s hotel market is rapidly developing thanks to the growth of tourism and rising household incomes, writes Technavio. In 2024 the country welcomed 17 million foreign visitors, up 39.5% compared to 2023, bringing the industry $34.44 billion. At the same time, risks remain in the business—climatic, economic, and related to the level of service.

The recovery of international tourism after pandemic restrictions has been a key driver for the occupancy growth of high-end hotels. In 2024 foreigners strengthened the position of chain and upscale hotels in Hanoi, Ho Chi Minh City, and Da Nang. Vietnamese travelers are increasingly moving within the country, creating stable demand for mid-range and budget hotels in coastal provinces and resorts.

In 2024 Vietnam became the leader in growth rates among Southeast Asian countries, surpassing Singapore in guest numbers. Thailand and Malaysia still lead overall, with 35 million and 25 million visitors respectively. The National Tourism Administration recorded a return of 98% of flows to 2019 levels—the best result among neighbors. In January–February 2025 almost 4 million people visited the country, and in Q1 already more than 6 million. This is 29.6% higher than in 2024 and 134% above the pre-pandemic level.

Most often visitors came from China—1.58 million. Last year their number rose by 78.3%, which analysts link to easing restrictions in China. South Korea ranked second with 1.26 million (+2.2%). Together, these two countries accounted for 47% of all international arrivals.

The fastest growth was from Russia—110.5%, as well as Cambodia (+105.6%) and the Philippines (+95.1%). Significant growth also came from Taiwan, the USA, Japan, Australia, and India, as well as from Europe, where the UK (+23.5%), France (+28.3%), Germany (+23.3%), and Italy (+29%) stood out. By the end of 2025 the authorities expect 23 million foreign tourists, and by 2026—25 million.

Tourism development is linked to visa liberalization. In 2023 the duration of stay under an e-visa was extended to 90 days, and the list of visa-free countries expanded. Growth was also supported by Vietnam Airlines’ direct flights to the US, the opening of new international hotel brand properties, and the appearance of Michelin-starred restaurants.

On March 15, 2025 Vietnam introduced a three-year visa-free regime for citizens of 12 countries, including key markets—South Korea and Japan, as well as Russia, Germany, France, Italy, Spain, the UK, Denmark, Sweden, Norway, and Finland. Travelers from these states may stay in the country without a visa for up to 45 days regardless of purpose. The measure will be in effect until March 14, 2028 and complements previous agreements that offered similar conditions for Switzerland, Poland, and the Czech Republic.

The government continues to ease entry rules and is considering visa exemptions for more countries. These steps are expected to support not only tourism growth but also business ties. Vietnam is implementing a strategy until 2030 aimed at sustainable industry growth. Plans include developing marine, island, and eco-tourism, and digitalizing services. The goal is to reach 35 million foreign arrivals per year and raise tourism’s contribution to GDP to 13–14%.

Hotels in Vietnam are already introducing new technologies to simplify booking and property management. They launch mobile apps, use online agencies, and promote services via social media. Property Management Systems (PMS) and Hotel Management Systems (HMS) are used to flexibly adjust rates and boost occupancy. More players are introducing keyless access and virtual concierges to personalize service and reduce time spent on routine tasks.

Travelers increasingly rely on reviews and digital reputation when choosing hotels. Hotels therefore monitor comments on social networks and online platforms, respond to guests, and build loyalty programs. Social media is becoming a key promotion channel. Hotels post visual content, run ad campaigns, and partner with bloggers to attract new audiences. Facebook remains central: over 55 million Vietnamese use it, and many search for travel information there.

Another transformation is “green” initiatives. Trends include energy-saving systems, renewable energy sources, and waste reduction. These steps help cut costs and attract eco-conscious tourists.

Yet innovations are not widespread, and the industry faces problems. Only 10–15% of foreign guests return to Vietnam. Reasons include underdeveloped transport and service infrastructure, low digitalization, and environmental issues at resorts. Rapid tourist growth increases the load on coastal zones, and plastic waste is becoming a major challenge. Moreover, in the World Economic Forum’s Travel & Tourism Development Index Vietnam fell by seven positions, highlighting the need for modernization and improved service quality.

A serious risk factor for Vietnam’s hotel market remains the climate. Natural disasters and sudden weather changes lead to trip cancellations and falling occupancy. Analysts estimate recovery after such events may take 20–27 months, affecting hotel profitability. These threats have to be factored in and response plans developed to minimize losses.

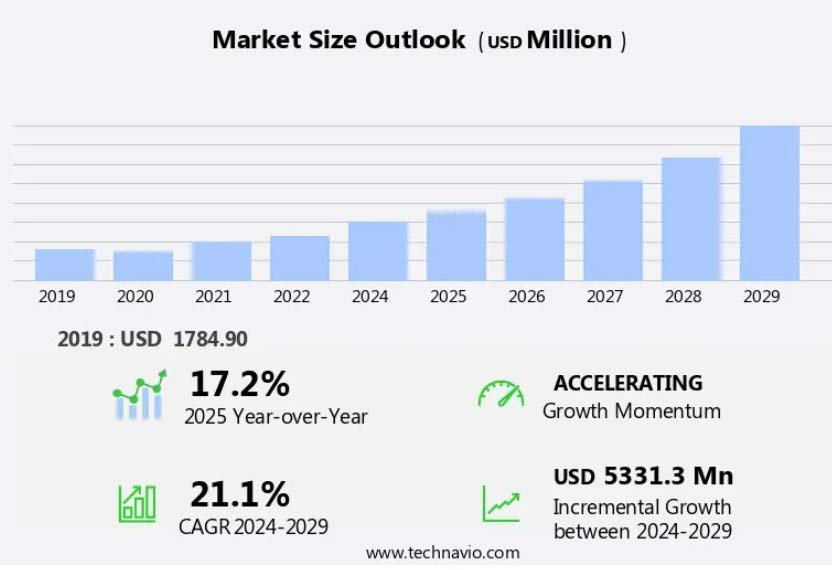

According to Technavio, Vietnam’s hotel market will grow by $5.33 billion in 2025–2029, with a CAGR of 21.1%. However, further development will depend on the stability of tourist flows and solutions to key industry problems.

Experts note that the overall economic environment also remains difficult. The World Bank forecasts Vietnam’s GDP growth at 6.8% in 2025, slowing to 6.5% in 2026—below the government’s official target of at least 8%. Global trade slowdown and uncertainty in relations with partners, including the US and China, could have negative impacts. At the same time, stronger state investment may partly offset external challenges and support domestic demand.

Read more:

Vietnam Approves Dual Citizenship Law

Vietnam Real Estate Market: Growth in Hanoi, Stagnation in Ho Chi Minh City

Vietnam’s Ministry of Finance Proposes Real Estate Sales Tax Reform