Вusiness / Real Estate / Investments / Tourism & hospitality / Analytics / Research / USA / China / United Kingdom / Germany / France / Italy / Spain / United Arab Emirates / Georgia 01.10.2025

The Future of Five-Star Hotels: Global Trends

Photo: Pixabay

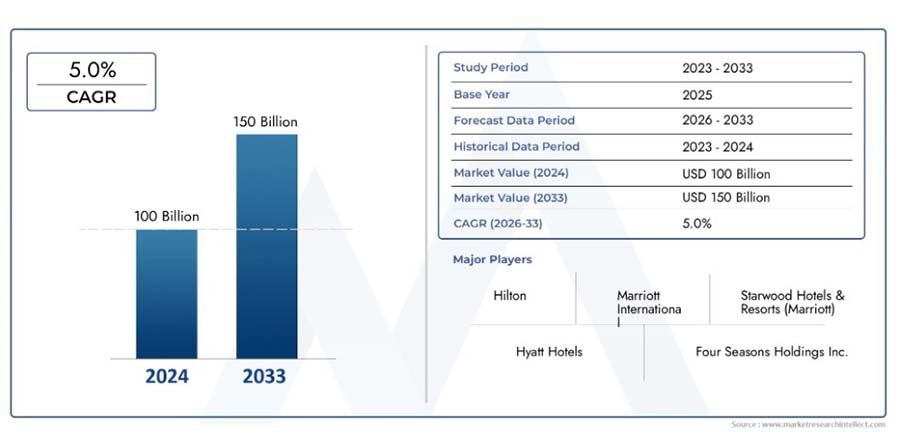

The five-star hotel market continues to expand. The sector reached $100 billion in 2024 and may increase to $150 billion by 2033, according to Market Research Intellect. The premium hospitality business benefits from the recovery of international tourism, rising incomes, and growing interest in exclusive leisure and personalized service.

Growth factors

The key clients of the segment remain wealthy travelers and corporate customers: business trips, conferences, and international events account for a significant share of occupancy. Additional momentum comes from infrastructure investments and the development of the MICE sector (meetings, incentives, conferences, and exhibitions): premium hotels are equipped with modern conference halls and business centers. Technology plays an increasing role: digital check-in, “smart” rooms, AI-based services, and mobile apps enhance convenience and strengthen guest loyalty.

At the same time, five-star hotels strive to offer more than accommodation: gastronomic masterclasses, tailor-made tours, spa and wellness retreats, and also medical tourism. Sustainability is gaining importance: energy-efficient buildings, architecture using natural materials, and regenerative tourism projects where hotels invest in preserving ecosystems and supporting local communities. All this shapes a new standard – a combination of luxury, innovation, and sustainable approaches.

Where demand is growing: from the US to the Black Sea

In North America, the US leads with the largest room stock. In Europe, the UK, Germany, France, Italy, and Spain maintain consistently strong positions, though the market is close to saturation. The highest momentum is observed in Asia and the Middle East: China and India are actively building new complexes, while the UAE and Saudi Arabia are implementing large-scale state programs to develop tourism. In Latin America, Brazil, Argentina, and Mexico are expanding, while in Africa, South Africa and Nigeria are emerging as centers.

Georgia is gradually entering the map of global luxury tourism. The main source of capital comes from private, including foreign, investments. On the Black Sea coast, international chains are launching projects, raising the country’s status in the eyes of wealthy travelers. Batumi and its coastal district of Gonio attract particular attention. Here, projects under the Radisson Blu, Wyndham, and Rotana brands are underway. In 2025, Eagle Hills (UAE) announced an investment of $5.5–6 billion in the 260-hectare Gonio Marina project with residential quarters, hotels, a yacht marina, and retail zones.

According to NAPR and Galt & Taggart, in Gonio real estate sales over the year increased by 11%, while prices rose by 45%, setting a record for the region. Clean beaches, a mild climate, and new investments are turning the district into the future “pearl” of the Black Sea and one of Georgia’s most promising locations.

Global players and their strategies

The largest chains are actively strengthening in the five-star segment. Wyndham Hotels & Resorts leads in the number of franchised hotels: about 9,300 properties in more than 95 countries and approximately 907,000 rooms under 25 brands. The company is expanding in Europe, the Middle East, and Asia, also developing projects, as noted, in Georgia.

Marriott International remains one of the most influential players with broad geography and a diverse portfolio of luxury brands. Hilton is betting on India and plans to quadruple its room stock in the country over the next five years. Hyatt is strengthening the all-inclusive format through the acquisition of Playa Hotels & Resorts for $2.6 billion (including $900 million in debt). InterContinental Hotels Group is channeling capital to shareholders – in 2025, the company plans to distribute more than $1.1 billion through buybacks and higher dividends, which underlines its resilience.

What the luxury segment will look like in 10 years

Over the next decade, three areas will remain the key drivers: wellness and holistic leisure, digital technologies, and sustainable development. Wellness and holistic resorts go beyond classical SPAs, offering medical programs, yoga, and retreats. Artificial intelligence and the Internet of Things are being integrated into services – from personalized offers to automated room management. Sustainability is transforming into regenerative tourism, where hotels not only reduce their carbon footprint but also invest in preserving ecosystems and supporting local communities.

The global map will change unevenly. The greatest potential remains with Asia and the Middle East, where government megaprojects are creating new tourism centers. In Europe and the US, by contrast, market saturation will push players to seek differentiation through unique services and hyper-personalized programs. By 2033, the winners will be those brands that manage to combine luxury, innovation, and responsibility: this formula will be the decisive one.