read also

Вusiness / Investments / Tourism & hospitality / Real Estate / Analytics / Research / USA / Real Estate USA / Tourism USA 30.11.2025

How the U.S. Hotel Market Has Changed: Weak Tourist Flows and the Growth of the Luxury Segment

The U.S. hotel sector is closing out 2025 with moderate growth in revenue per available room and weaker travel flows, according to a new PwC study. From January to August 2025, RevPAR increased by 0.2%, the average daily rate (ADR) rose by 1%, while occupancy declined by 0.8%. The gap between demand for luxury and budget segments is widening. At the same time, artificial intelligence is being actively adopted, reshaping personalization, revenue management, and hotel operations.

International tourism

Inbound travel to the U.S. remains one of the most vulnerable components of the hotel sector. According to the World Travel & Tourism Council, international visitor spending in 2025 will be 6.6% lower than in 2024 — a decline equivalent to US$12.5 billion. A Tourism Economics forecast also points to weaker growth in arrivals, down 8.2%. PwC stresses that this is a structural decline rather than a temporary deviation.

Reduced interest from international travelers is driven by a combination of factors: tougher geopolitical conditions, shifts in global travel flows, and the growing perception of the U.S. as an expensive destination. A key factor is the strengthening of the dollar against several major currencies, which makes trips more costly and limits the ability to plan travel in a high-inflation global environment. Large urban markets that rely heavily on foreign visitors feel this pressure most acutely.

Segment performance

Trends across hotel categories differ significantly under the influence of macroeconomic instability. Weakening consumer confidence and rising uncertainty primarily affect lower-income households, limiting their ability to spend on discretionary travel. This is reducing demand at the lower end of the price spectrum: the University of Michigan’s consumer sentiment index fell by 21% between September 2024 and September 2025, directly impacting performance in the economy and mid-scale segments. At the same time, upscale and luxury hotels maintain a stable guest flow due to their more affluent client base and rising asset values.

Pressure on the lower end of the market is further amplified by competition from short-term rentals. Platforms such as Airbnb and VRBO continue to expand alternative supply, constraining rate growth potential for traditional hotels. In major cities, this leads to a redistribution of guest flows and a heightened risk of under-occupancy for economy properties.

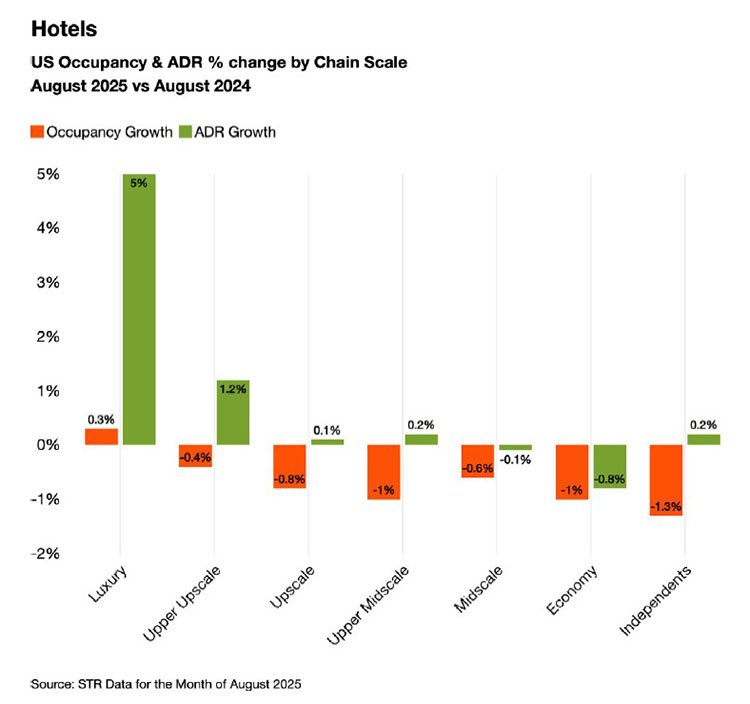

STR data confirms deepening polarization. In August 2025, luxury hotels posted the strongest ADR growth at 5%, while keeping occupancy stable. In the upper-upscale segment ADR rose by 1.2% amid a moderate decline in occupancy. Mid-tier categories show the opposite trend: in the upscale, upper-midscale, and midscale segments, ADR is down by 0.8–1%, with occupancy hovering near flat. The weakest results are recorded in the economy segment and among independent hotels: ADR is down by 0.8–1.3%, while occupancy has fallen by around 1%. These figures underscore the widening gap between the upper and lower ends of the market.

Technological transformation

Artificial intelligence is becoming one of the core drivers of transformation in the U.S. hotel industry, reshaping both marketing and operations. According to PwC, consumer markets are shifting from traditional SEO-focused models to AI-driven discovery and booking. For more than a decade, most bookings were generated through Google and online travel agencies (OTAs), but an increasing share of travelers now plan their trips via AI services — including getting hotel recommendations from tools like ChatGPT. A Pew Research Center survey in April 2025 found that 57% of U.S. adults use AI several times a week.

AI is also being actively integrated into hotel operating models. Technology is used to personalize the guest experience — from tailored offers to customized on-property services — based on guest profiles, request histories, and behavioral data. In revenue management, algorithms process information on bookings, local events, weather, and sales dynamics, adjusting rates in real time and improving demand forecasting accuracy. AI also helps forecast occupancy, optimize staffing schedules, and manage energy consumption through predictive maintenance of equipment.

The report highlights measurable impact in hotel call centers. According to PwC, AI-enabled systems have reduced the share of abandoned calls by 6–8% and increased booking conversion by 25–35%. At the same time, inbound call volumes have declined by 20–30%, while average handling time is down 15–25%, reducing staff workload and boosting overall efficiency.

Investor sentiment

Investment sentiment toward the U.S. hotel sector shows a clear shift in favor of higher-end properties. According to Emerging Trends in Real Estate 2026, luxury and upscale hotels receive the largest share of Buy and Strong Buy recommendations, while negative ratings are almost non-existent. The midscale segment is dominated by neutral expectations, and limited-service properties occupy the weakest position: they have the highest share of Sell recommendations, reflecting limited growth potential at the lower end of the market.

Perceptions of current asset valuations reinforce this pattern. Luxury properties are most often viewed as fairly priced or even undervalued, underscoring strong investor confidence in the segment’s ability to sustain revenues despite macroeconomic volatility. Upscale hotels also maintain predominantly positive valuation views. By contrast, midscale and limited-service properties are more frequently seen as overpriced amid weak occupancy dynamics and mounting pressure from short-term rentals, which undermines their long-term investment appeal.

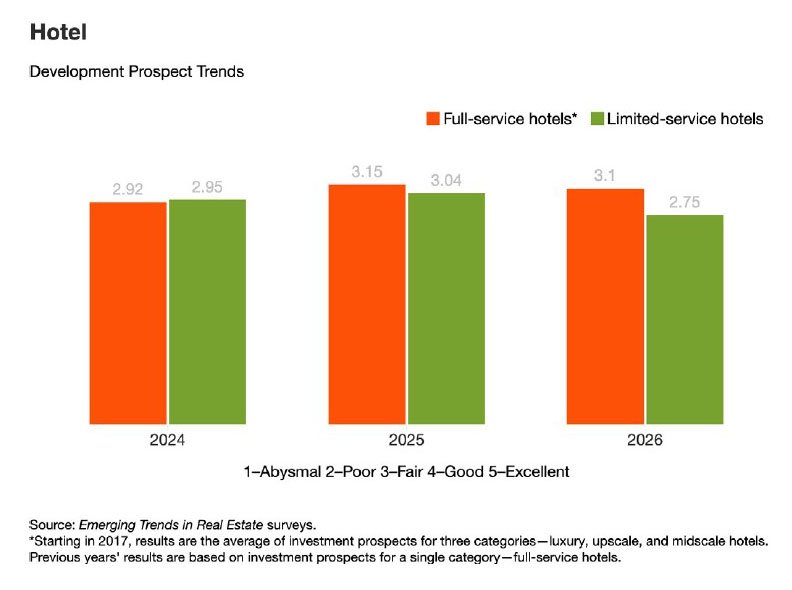

Longer-term expectations support this divergence. Emerging Trends surveys indicate improving prospects for full-service hotels in 2025–2026, with stable indicators following the gains of 2024. For limited-service hotels, the outlook is less favorable: after modest improvement in 2025, expectations for 2026 weaken noticeably. Over the extended 2008–2026 horizon, the trend consistently points to greater resilience in full-service categories, while limited-service formats remain more vulnerable to demand fluctuations and shifts in market conditions.

Conclusion

The outlook for the U.S. hotel market is shaped by a mix of opposing forces. Inbound tourism is expected to recover only gradually: major events, including the 2026 FIFA World Cup, will narrow but not fully close the gap between current visitor numbers and pre-crisis levels. Additional pressure comes from changes in visa and migration policy, including tighter requirements and higher fees, which weigh on the recovery of international travel.

At the same time, technological transformation is accelerating. Hotels are upgrading their digital platforms and data architectures to align with new operating models. Investment in digital infrastructure is becoming a prerequisite for competitiveness: properties that fail to adapt to an AI-driven environment risk losing access to an audience that increasingly chooses hotels through intelligent services.

Luxury hotels maintain the strongest position, with the ability to raise rates, sustain stable demand, and deliver highly personalized guest experiences. PwC expects further deepening of the luxury segment: the affluent clientele’s desire for exclusivity, curated experiences, and individualized service provides a solid foundation for revenue even amid uneven demand.

Analysts International Investment note that the adoption of new technology and the strengthening of the luxury segment reflect global structural trends. In mature markets, demand is shifting toward more expensive and differentiated products, while digitalization becomes a non-negotiable condition for competitiveness. Operators that combine technological efficiency with a high level of personalization create the best conditions for growth and remain the most attractive to investors: this is the segment that delivers resilient returns and robust value-creation potential.