Вusiness / Real Estate / Investments / Analytics / Reviews / Belgium / Real Estate Belgium / Research 22.12.2025

Airbnb in Brussels: the short-term rental market and returns

Photo: Unsplash

Belgium’s capital attracts substantial international demand: the share of foreign guests in Brussels’ short-term rental market via Airbnb reaches 97%, as noted in an AirROI review. Returns are generated at moderate occupancy thanks to relatively high average rates and pronounced seasonality, with a peak at the end of the year. Apartments rented as entire units dominate the supply structure.

Overall market parameters

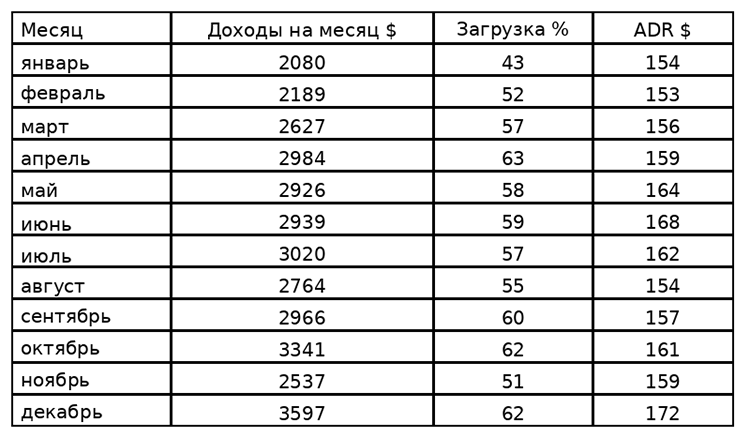

Average occupancy in Brussels’ short-term rental market stands at about 53.5%, with an average daily rate of $159. This combination creates a stable income model without targeting maximum occupancy. Typical annual revenue per active listing is estimated at $25,374. Around 1,280 active listings are available on Airbnb, with most of the supply consisting of entire homes rather than rooms.

The audience is international in nature: roughly 97% of Airbnb guests in Brussels are foreigners, with a predominance of users preferring English and French. This shapes demand primarily toward short stays and business trips. The regulatory environment for short-term rentals in Brussels remains relatively soft by European standards and does not create significant barriers for owners.

Seasonal highs and lows

Peak values in the Brussels market are recorded in December. This month delivers the absolute revenue high at $3,597, with 62% occupancy and an average daily rate of $172—the highest ADR of the year. The result is driven primarily by pricing: with occupancy comparable to autumn levels, higher rates push December to the top in terms of revenue.

April shows near-peak performance. With the highest occupancy of the year at 63%, monthly revenue reaches $2,984 and ADR stands at $159. Higher occupancy compared with December does not offset the noticeably lower price, underscoring the key role of tariffs in shaping financial outcomes.

The lowest figures fall in January. During this period, revenue declines to $2,080 and occupancy drops to 43%—the lowest level of the year—at an ADR of $154. Weak revenue is explained by a sharp contraction in demand rather than price correction. The lowest average daily rate is recorded in February at $153, with 52% occupancy and revenue of $2,189. Despite cheaper accommodation, total revenue exceeds January’s, indicating a stronger impact of occupancy than minor price fluctuations.

Gap between segments

Brussels’ short-term rental market shows pronounced differentiation between segments. The top 10% of listings generate monthly revenue of $5,366 and above. They typically achieve occupancy of 91% or higher, with average rates starting at $282 per night. Such results are usually linked to effective management, dynamic pricing, and high-quality guest experience.

About 25% of high-performing properties earn from $3,634 per month. Their occupancy exceeds 81%, and the average daily rate is at least $187. These listings are usually located in sought-after areas and offer amenities aligned with international guest expectations.

A typical market listing generates around $2,401 per month. Average occupancy in this segment is roughly 63%, with a rate of about $130 per night, reflecting an average market model without pronounced competitive advantages. The least efficient 25% of listings earn about $1,367 per month. They feature lower occupancy and rates—around $92 per night—pointing to significant optimization potential through pricing strategy, offering quality, and management.

Key districts

Popular districts of Brussels for short-term rentals differ by demand profile—from tourist and cultural locations to business-oriented and more residential neighborhoods. Area selection directly affects guest type, rate levels, and occupancy stability.

Sablon — a historic district with antique shops, chocolate boutiques, and galleries, catering to tourists seeking a cultural and more premium accommodation format.

Saint-Géry — a vibrant quarter with bars, restaurants, and active nightlife, popular among younger audiences and short visits.

Ixelles — one of the most sought-after areas among expats and locals, combining a multicultural environment, restaurants, cafés, and art spaces.

Montmartre — a neighborhood with a strong artistic past and an intimate atmosphere, appealing to guests seeking an authentic experience and city views.

European Quarter — Brussels’ business hub, oriented primarily toward business travelers and longer professional stays.

Marolles — a bohemian quarter with a flea market, vintage shops, and local art cafés.

Brussels City Center — the historic and tourist core of the city with steady demand from both leisure and business guests.

Uccle — a green residential area aimed at families and guests planning longer stays.

Investment takeaways

Analysts at International Investment note that overall, Brussels’ short-term rental market is characterized by a stable yet heterogeneous return profile. Occupancy remains moderate, while average rates are comparatively high. Key advantages include an international audience profile and soft regulation, allowing investment strategies to be adapted to different demand formats.

At the same time, investors should account for a moderate level of gross rental yields—around 4.21%, according to Global Property Guide. After operating costs, taxes, and marketing expenses, the figure typically drops by several percentage points, leaving net returns just above 2%. With potential vacancies, it may fall further. Brussels is primarily attractive for its predictability and stability; such markets are more often viewed as capital preservation tools rather than vehicles for aggressive income growth.