read also

Over €175 Million in Tax Refunds Remain Unclaimed in Greece

Over €175 Million in Tax Refunds Remain Unclaimed in Greece

Citizenship in South America: How the Mercosur Agreement Works

Citizenship in South America: How the Mercosur Agreement Works

Rising Crime Levels in Several Canadian Cities

Rising Crime Levels in Several Canadian Cities

Türkiye strengthens its role in global tourism

Türkiye strengthens its role in global tourism

Slovenia Work Permits Become a Key Hiring Bottleneck

Slovenia Work Permits Become a Key Hiring Bottleneck

Asset Reinvention Reshapes Thailand’s Hotel Market

Asset Reinvention Reshapes Thailand’s Hotel Market

Вusiness / Investments / Tourism & hospitality / Analytics / Research / Albania / Bulgaria / United Kingdom / Netherlands / Ireland / Spain / Italy / Latvia / Norway / Poland / Serbia / Slovakia / Slovenia / France / Montenegro / Кипр / Russia 16.01.2026

Europe’s Hotel Market: Demand Above Pre-Pandemic Levels Amid Moderate Occupancy

Europe’s hotel market in the first half of 2025 demonstrated steady demand growth and stabilisation of key operating indicators, noted in a study by Cushman & Wakefield. The number of overnight stays exceeded pre-pandemic levels by 17%, with Eastern and Southern Europe providing the main contribution to the overall dynamics. RevPAR increased by 29% to €98.

Economic conditions

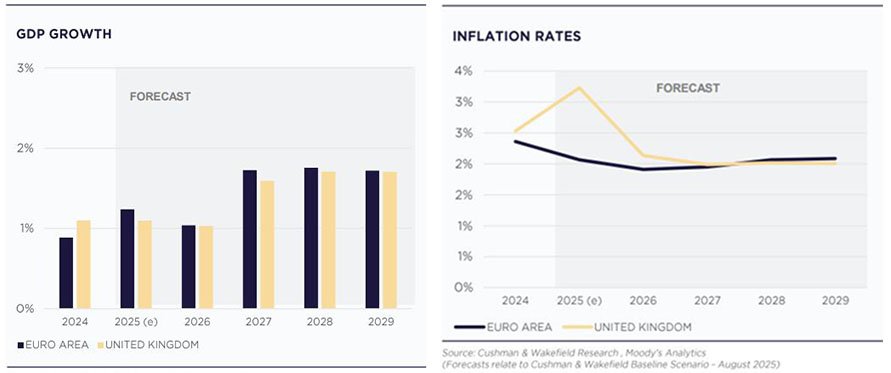

Eurozone GDP grew by 1.5% in the first quarter of 2025, while in the second quarter the rate slowed to 1%. A deceleration was recorded in Portugal and the United Kingdom, whereas acceleration was observed in Spain, the Czech Republic and Poland. No significant changes were noted in France and Germany.

Geopolitical uncertainty and ongoing issues related to trade relations with the United States continued to restrain economic activity. At the same time, the services sector showed weak but positive growth, while PMI readings pointed to a moderate recovery in business activity in June and July.

Tourism flows

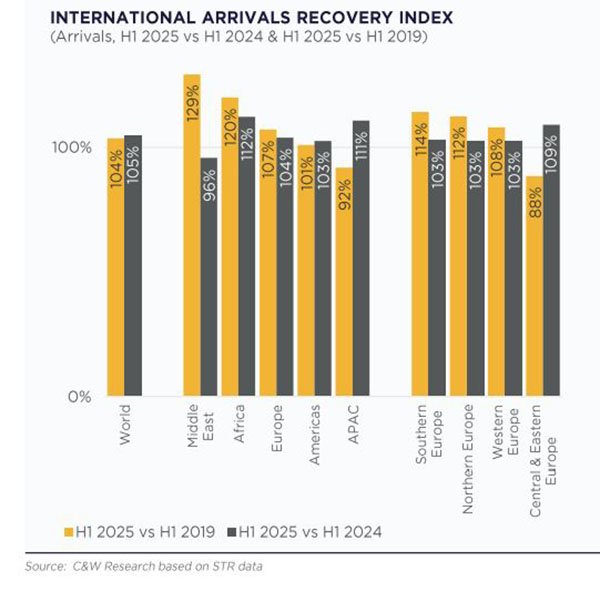

In the first half of 2025, international visits to Europe on average exceeded pre-pandemic levels by 17%. Compared with the first half of 2019, growth was recorded across all sub-regions, although the pace of recovery varied significantly.

The strongest momentum was observed in Central and Eastern Europe, where the international arrivals recovery index reached 129% relative to the same period of 2019. Southern Europe recorded 114%, while Northern Europe reached 112%. Western Europe recovered more moderately, with international visits at around 108% of pre-pandemic levels.

International travel accounted for 52% of all activity in the hotel market. The number of nights spent by foreign guests increased by 2.9%, while the domestic segment grew by 1.2%. The main flows were driven by intra-regional travel: from January to May, trips between European countries rose by 4.1%. Residents of the United Kingdom, Germany and France most frequently chose destinations in Southern and Eastern Europe, including Albania, Malta and Cyprus. Price affordability and climate considerations played a key role, further boosting interest in the Baltic region and northern Poland.

Demand for accommodation

The growth in tourism flows directly translated into the hotel sector. Demand for accommodation exceeded 2019 levels by 17% and increased by 4% compared with the previous year. Eastern Europe made the largest contribution to this trend, with volumes up by 9%. Southern Europe recorded a 6% increase. In Western Europe, demand was 11% above pre-pandemic levels, although year-on-year growth was limited to 2%. Northern Europe showed the most restrained dynamics, with a 10% increase versus 2019 and around 1% year-on-year growth.

The volume of hotel accommodation in Europe reached a historic high in the first half of 2025, with 1.3 billion overnight stays recorded, up 2% year on year. Over the twelve months ending in June, the cumulative total exceeded 3 billion nights, corresponding to annual growth of 2.4%.

Across individual countries, demand dynamics varied markedly, as reflected in index values compared with the previous year. The strongest growth was recorded in Albania, where volumes reached 132.7% of the prior-year level. This was followed by Malta (112.7%) and Kosovo (111.3%). Above-baseline values were also observed in Latvia (108.6%), Poland (108.5%), Slovenia (107.8%), North Macedonia (107.5%), Slovakia (107.0%), Bulgaria (106.4%) and Norway (105.1%).

Among Europe’s largest markets, the highest demand index values were recorded in Poland, where the indicator reached 108.5% compared with the first half of 2024. France (103.8%) and the Netherlands (103.2%) were close behind, though still lagging Poland.

Overall, positive dynamics covered 88% of European markets. Declines in activity were recorded in only four countries: Liechtenstein (–5.1%), Serbia (–4.1%), Ireland (–3.5%) and Montenegro (–0.9%).

Occupancy and revenues

Growth in accommodation volumes did not lead to a sharp increase in occupancy, reflecting an expansion of room supply and a more even distribution of demand across regions. The European average stood at 68%, compared with 67% in 2024. The most notable increase was recorded in Eastern Europe, where occupancy rose from 61% to 63%. In Northern and Southern Europe, occupancy remained stable at 73% and 67% respectively, while Western Europe recorded 65%.

Average occupancy remained more than two percentage points below pre-pandemic levels, which in the first half of 2019 approached 70%. This indicates continued potential for further recovery, particularly in markets with more subdued demand dynamics. The highest occupancy levels were observed in Ireland, the United Kingdom, Spain and the Netherlands. The most pronounced increases were recorded in Latvia, up by five percentage points, as well as in Bulgaria and Croatia.

Revenue growth per room continued to outpace occupancy dynamics. Average RevPAR in Europe reached €98, exceeding the 2024 level by 3% and the 2019 level by 29%. This increase was driven by higher average daily rates alongside moderate occupancy growth. The strongest gains relative to pre-pandemic levels were recorded in Southern Europe, at 42%. Northern and Eastern Europe also showed significant increases of 29%, while Western Europe recorded an 18% rise.

On a year-on-year basis, Russia led in RevPAR growth at 23%, followed by Latvia (+13%) and Bulgaria (+12%). In six countries, RevPAR growth exceeded 10%. Among major urban markets, the highest absolute values were recorded in Paris, Geneva and Rome. The strongest year-on-year dynamics compared with 2024 were observed in Moscow (+33%), St. Petersburg (+30%), Riga (+16%), Vilnius (+15%) and Warsaw (+13%).

Conclusion

In the first half of 2025, Europe’s hotel market consolidated its position in a phase of sustainable recovery, combining rising tourist demand with gradual normalisation of operating indicators. Despite ongoing regional disparities, Eastern and Southern Europe remained the main drivers of growth, while Western and Northern European markets continued to recover at a more moderate pace. Rising revenues amid still-incomplete occupancy recovery highlight the growing role of pricing and support the sector’s operational resilience, underpinning continued investment interest in European hotel real estate.

Analysts at International Investment note that emerging markets in the hotel sector often demonstrate more resilient dynamics than mature European economies. A lower base, faster growth in tourist flows and constrained supply enable such countries to recover more quickly and move beyond pre-pandemic benchmarks. Georgia remains a telling example, where key indicators have already exceeded 2019 levels. In prime areas of Batumi, hotel occupancy consistently stands at around 80% and is becoming less dependent on seasonality, reaching 90–100% during the summer months.

Similar trends are evident in other countries with developing tourism infrastructure, where rising demand is accompanied by growing investor interest in high-quality hotel assets. In these conditions, branded luxury hotels remain the most resilient segment, combining managerial expertise, standardised service and a more predictable operating model. This supports higher returns and greater resistance to market volatility, reinforcing the segment’s long-term investment appeal.