Hungary's Guest Investor Program Attracts Just 25 Applicants in 2025, Mostly from China and Vietnam

In the first two months of 2025, only 25 people applied for Hungary’s Guest Investor program, with the majority of applicants coming from China and Vietnam, according to Schengen.news. The program, designed to attract wealthy foreign investors outside the EU in exchange for Hungarian residency, has so far struggled to generate strong interest.

Program Overview and Investment Requirements

Hungary’s Golden Visa legislation was approved in 2024, initially offering a 10-year residency permit in return for investments in one of three categories:

- €250,000 in a specialized real estate fund

- €500,000 in direct real estate investments (this option was removed in 2025)

- €1,000,000 in projects of public interest through designated asset management funds

As of January 1, 2025, the program excluded real estate investments, following concerns that rising property prices were worsening housing affordability for Hungarian citizens.

Industry experts highlight key reasons behind this change:

- László Kiss, Managing Director at Discus Holdings – Removing real estate investments prevents further pressure on Hungary’s property market.

- Armand Arton, President of Arton Capital – Investments through regulated funds are more transparent and predictable than direct real estate purchases.

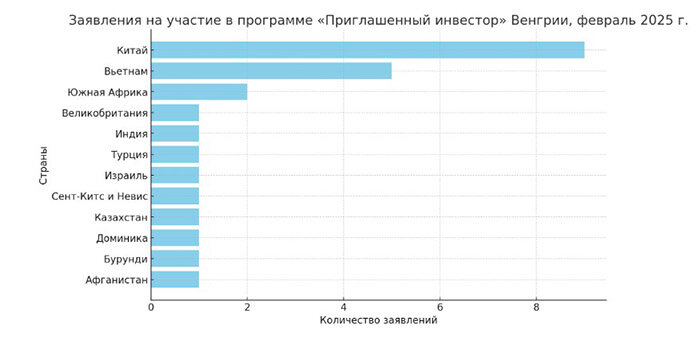

Who is Applying?

By the end of February 2025, the majority of applicants were from China and Vietnam:

- 9 Chinese applications – 4 approved, 5 under review

- 5 Vietnamese applications – 2 approved, 3 pending

- 2 applications from South Africa

Single applications from the UK, Israel, Turkey, India, Kazakhstan, Afghanistan, and Burundi

Can Hungary’s Golden Visa Program Succeed?

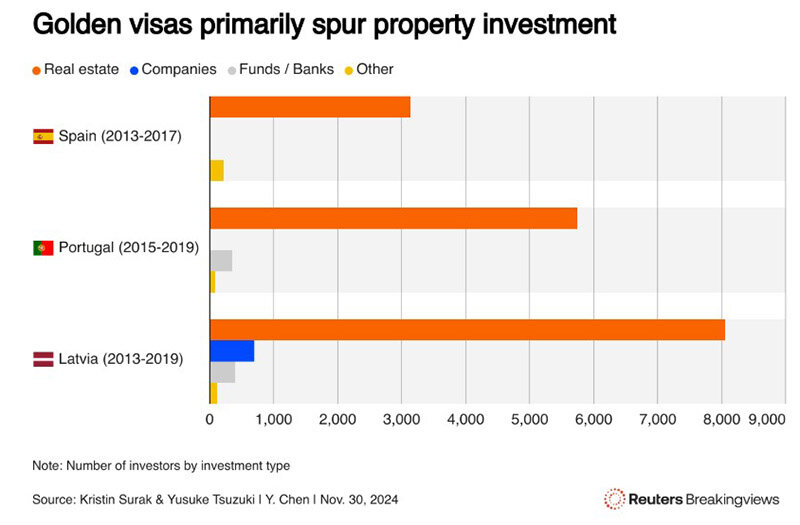

A recent Reuters report suggests that Hungary’s Golden Visa initiative is an attempt to revive the economy by attracting wealthy foreign investors. However, global trends indicate that real estate is the primary draw for investment visa applicants, while other investment categories tend to be less appealing.

Comparing Hungary with other countries:

Spain, Greece, and Portugal previously used real estate-based Golden Visa programs to boost their economies, particularly after the 2008 financial crisis. However, research from the London School of Economics and Harvard University indicates that Golden Visa programs contribute only a small fraction of total foreign direct investment (FDI), with limited economic impact.

For example:

Spain’s Golden Visa attracted the second-highest number of applications among studied countries, yet contributed just 3% of FDI and less than 0.1% of GDP between 2014-2019.

Portugal’s Golden Visa generated over 14% of FDI but accounted for less than 0.4% of GDP.

In contrast, tourism contributes over 10% of Spain’s GDP annually.

Social and Political Challenges

Golden Visa programs have also sparked public backlash in several European countries due to concerns over rising housing prices. Protests have occurred in Spain, Greece, and Portugal, with activists blaming foreign investors for making homeownership increasingly unaffordable for locals.

EU Opposition to Golden Visas

The European Union remains critical of such programs, citing concerns over tax evasion, national security, corruption, and money laundering. Many countries have already phased out their Golden Visa programs, particularly following the February 2022 geopolitical tensions, which prompted stricter vetting of Russian applicants in remaining programs.

Will Hungary’s Guest Investor program succeed without a real estate investment option? Analysts suggest that unless more attractive investment categories are introduced, the program may struggle to compete with other European residency schemes.

Подсказки: Golden visa, EU, Euro Union, Europe, residency by investment, EU residency, Schengen residency