Over €175 Million in Tax Refunds Remain Unclaimed in Greece

Over €175 Million in Tax Refunds Remain Unclaimed in Greece

Citizenship in South America: How the Mercosur Agreement Works

Citizenship in South America: How the Mercosur Agreement Works

Rising Crime Levels in Several Canadian Cities

Rising Crime Levels in Several Canadian Cities

Türkiye strengthens its role in global tourism

Türkiye strengthens its role in global tourism

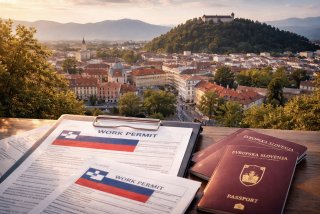

Slovenia Work Permits Become a Key Hiring Bottleneck

Slovenia Work Permits Become a Key Hiring Bottleneck

Asset Reinvention Reshapes Thailand’s Hotel Market

Asset Reinvention Reshapes Thailand’s Hotel Market

Poland’s Central Bank Holds Rates Amid Accelerating Economic Growth

NBP Decision: Rate Stability with Economic Momentum

Monetary Policy Balancing Act

The NBP’s decision embodies a cautious and balanced monetary policy stance. On one hand, the easing inflation trend gives room for flexibility, but on the other hand, the central bank chooses to maintain the current rate until it gains more clarity on whether disinflation is structurally entrenched. This careful approach aims to support price stability without stifling economic momentum or introducing volatility into financial markets.

Market participants are watching key indicators such as wage growth, employment trends, and incoming inflation data, as these will heavily influence future decisions on whether to ease or tighten monetary policy further.

Outlook from Economists and Markets

Analysts highlight that the NBP’s rate hold underscores its commitment to data-dependent policy making in an uncertain global economic environment. While inflation has eased, it remains crucial for the central bank to confirm consistent disinflation before embarking on additional rate cuts.

As International Investment experts report: Poland’s central bank decision to keep interest rates unchanged reflects a prudent stance amidst accelerating economic growth and disinflationary signs. For long-term economic stability, monetary policy continuity based on data-driven assessments of price trends and economic output will be critical in shaping investor confidence and sustaining growth.