read also

Real Estate / Investments / Research / Analytics / Georgia / Real Estate Georgia / Tourism & hospitality / Tourism Georgia 19.05.2023

Batumi hotel business survey, 2022: research by the Global Investment Group Georgia (GIG)

The hotel business in Batumi is actively developing due to the construction of new hotels and apart-hotels, as well as the growth of domestic and foreign investments. Being one of the most popular tourist destinations in the post-Soviet space, the capital of the Autonomous Republic of Adjara attracts various target tourist audiences. Batumi is dominated by beach, gastronomic and gaming tourism destinations. Excursion, health, ecological and skiing (due to the proximity of the Goderdzi resort) directions are also developing. In the period from 2016 to 2022, there is an expansion of the tourist season in Batumi with a gradual increase in tourist activity during the off-season.

This study is a statistical analysis of the market by the Global Investment Group Georgia (GIG) reflecting the main indicators for 2022 compared to 2016-2021.

Economy of Georgia in the post-COVID period

In recent years, Georgia has undergone significant changes both politically and economically. The country rebuilt the economy after a difficult period of the 90s to a developed market economy, carried out major reforms and achieved significant economic growth, which, combined with a unique natural and cultural heritage, made it one of the most attractive destinations in the region for investors and tourists.

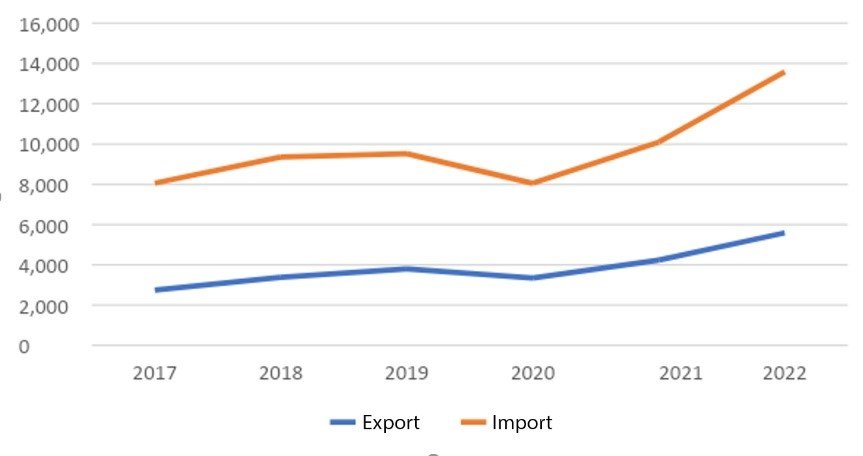

According to the World Bank estimates, Georgia occupied the leading positions among the world economies in terms of ease of doing business (Table 1), ranking seventh in 2019. In terms of ease of registering businesses, the country was second only to New Zealand, and in terms of ease of registering property, it outstripped the United States and Great Britain by more than 30 positions in the ranking. According to World Bank estimates, Georgia still occupies a leading position in the world, however, due to the pandemic, the official ranking has not been maintained since 2020.

A report published by the international agency Standard & Poor's in 2019 upgraded the country's rating from "Stable" to "Positive". And Fitch has changed its assessment of Georgia's sovereign credit rating outlook from "stable" to "positive" in 2023. The rating itself has been upgraded from BB– to BB with the prospect of further growth. In the World Bank rating, Georgia ranked 48th in the area of combating corruption.

In 2020, Georgia entered the top 5 best countries in terms of economic freedom according to the Cato Institute, in 2022 it was in the top 30 best countries in the world according to Heritage.

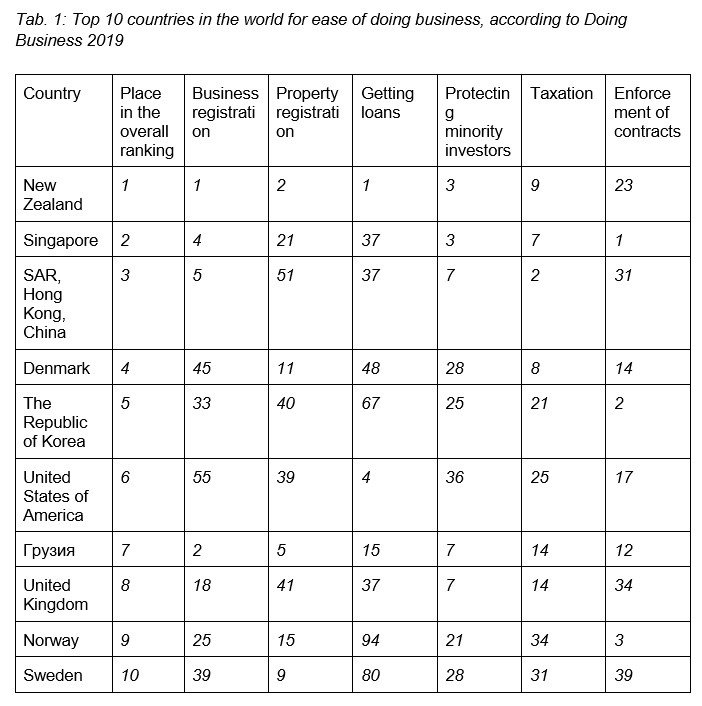

According to the National Office of Statistics of Georgia, the pandemic years of 2020 and 2021 had a negative impact on the country's GDP, but already in 2022 the economy returned to growth. The ratio of the indicator 2019/2022 was more than 39% (Fig. 1). With an average global growth of 3.1% in 2021/2022, the country posted a more than convincing 55.6% over the same period. According to the IMF forecast for 2022-2028, Georgia ranks second in the world and first in the Eastern Hemisphere in terms of GDP per capita growth, and by 2028 the indicator is expected to grow by 51%, which is higher than that of 193 countries of the world. GDP per capita at purchasing power parity by 2028 will be $31.5 thousand, and GDP at constant prices (adjusted for inflation) - $23.3 thousand.

Fig. 1: Georgia's GDP, billion USD

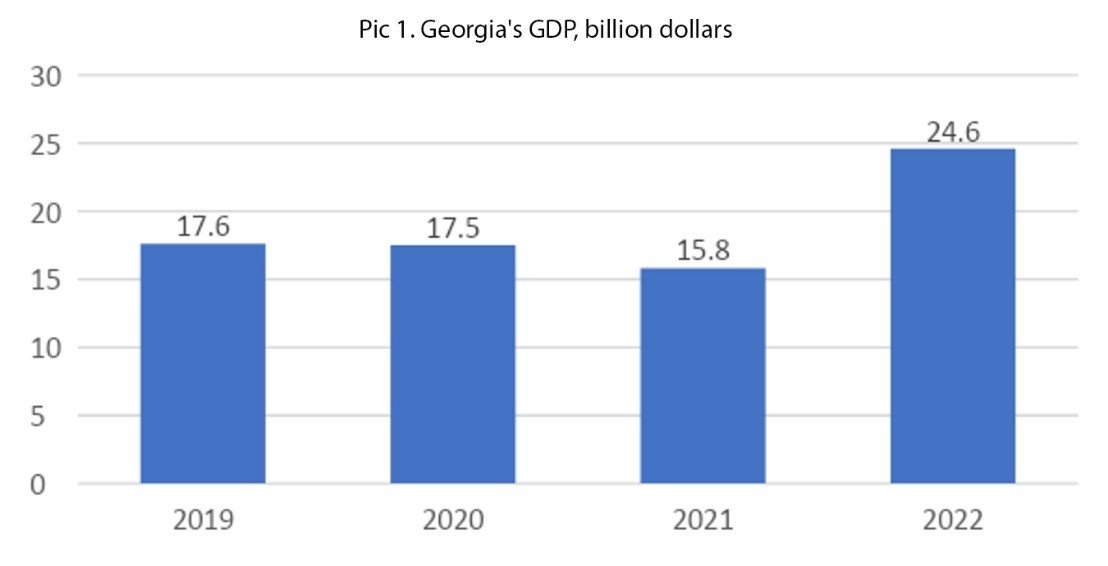

Foreign direct investment (Figure 2) set a record for the country in 2022, due to the active support of tourism by the authorities, the ease of doing business for expats, and a favorable tax climate. Also, positive dynamics is observed in the import and export of Georgia (Fig. 3), despite the global negative impact of the pandemic on the economy.

Fig. 2: Foreign direct investment in Georgia thousand $

Fig. 3: Dynamics of exports and imports to Georgia from 2017 to 2019, thousand USD

Tourist Flow

Trends towards recovery growth in tourism are also observed in passenger traffic. The Georgian Civil Aviation Agency reports that in 2022, the country's airports served more than 4.4 million tourists, which is 78% more than a year earlier, and the largest traffic came from the region's three largest air hubs: Tbilisi, Kutaisi and Batumi. Adjara's main airport served over 600,000 people, an increase of 20% compared to 2021 (Figure 4).

Fig. 4: Number of tourists served by Kutaisi Airport in 2021-2022, people

According to the National Tourism Administration of Georgia, the number of tourists entering the country in 2022 increased by 210.6% and 188.6% compared to 2020 and 2021, respectively, and the tourist flow to the country has almost returned to pre-pandemic levels. The leaders in this indicator are the regions of Tbilisi, Kvemo Kartli and Adjara. It should be noted that, unlike the first two, which lost more than a third of tourists compared to 2019 (-122.9 thousand people and -75.9 thousand people, respectively), the Batumi agglomeration has practically restored this flow to sub-type values, missing only 16.2 thousand people. compared to 2019.

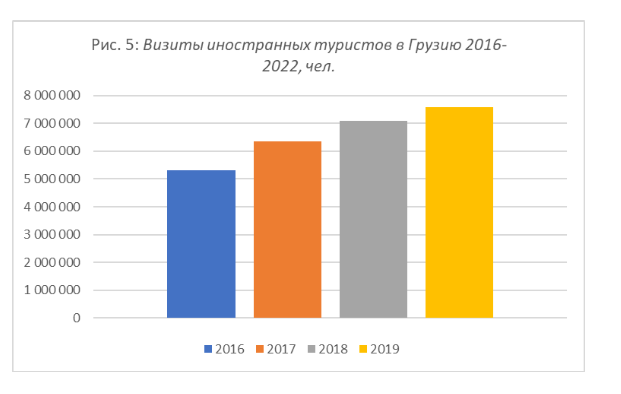

The growth rates of the total tourist flow until 2020 were quite high (Fig. 5). Thus, the dynamics in 2016/2017, 2017/2018, 2018/2019 amounted to +19.4%, +11.4% and +6.9%, respectively. At the same time, global rates for the same period ranged from +4% to +7%

Fig. 5: Visits of foreign tourists to Georgia 2016-2022, people

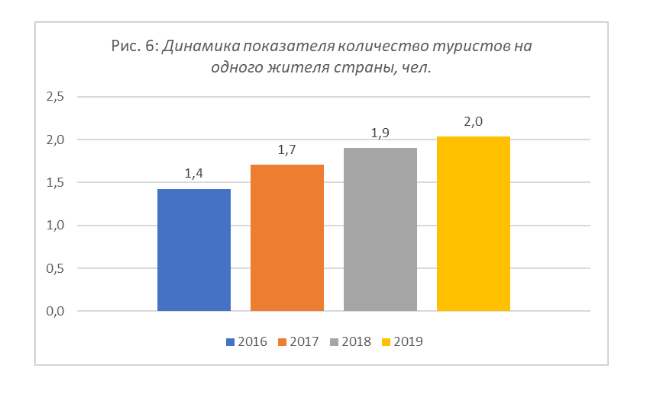

The World Tourism Organization in the pre-pandemic period called the standard of tourist traffic for developed economies an indicator of 4 people per 1 inhabitant of the country. In Georgia, this ratio reached a peak of 2 (Fig. 6). This suggests that the region's tourism market is greatly underestimated and, as of 2019, had at least a twofold growth potential. Now, due to the recovery period, the indicator is slightly higher and has more than a 300 percent growth margin.

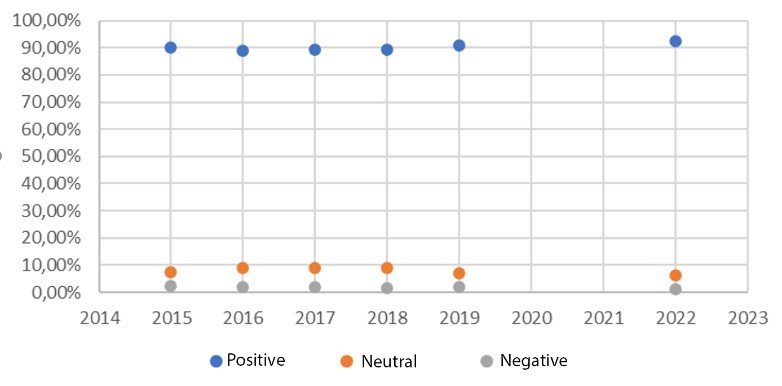

From the report of the National Office of Statistics of Georgia Geostat, there is a clear trend towards an increase in the number of respondents who assess their experience of staying in the country as positive (Fig. 7). Data for 2020 and 2021 are not available due to the fact that the country was closed to the public.

Fig. 7: Satisfaction with the services provided in Georgia by tourists aged 15 and over, %

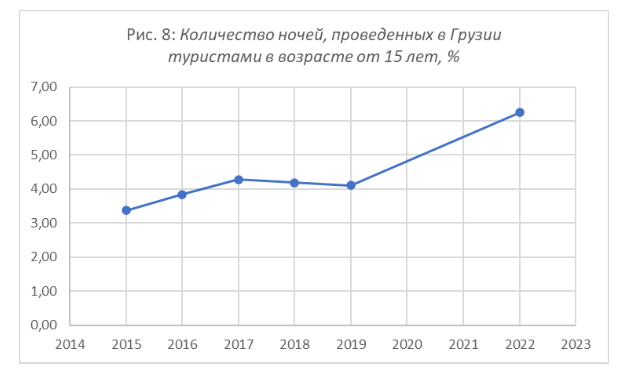

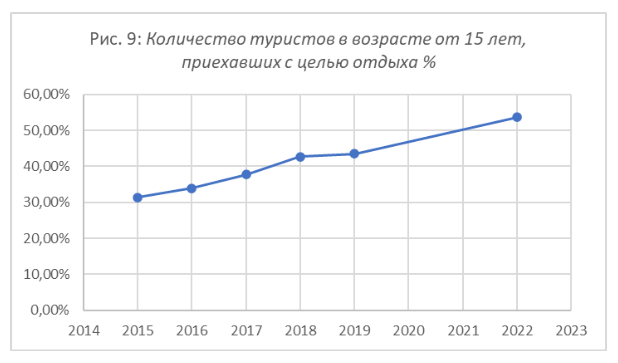

As follows from the report of the National Office of Statistics of Georgia, the amount of time spent in the country is increasing (Fig. 8). Moreover, the vast majority of respondents (more than 53%) named recreation as the purpose of their visit (Fig. 9), and this figure itself has almost doubled since 2014.

Fig. 8: Number of nights spent in Georgia by tourists aged 15+, %

Fig. 8: Number of tourists aged 15 and older who came for recreation, %

Tourist activity by season

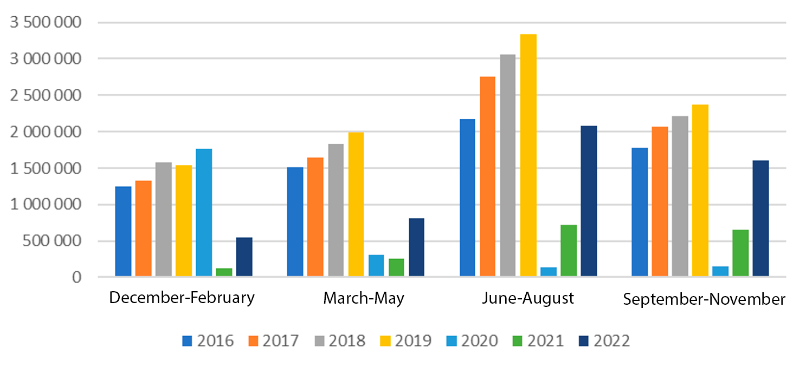

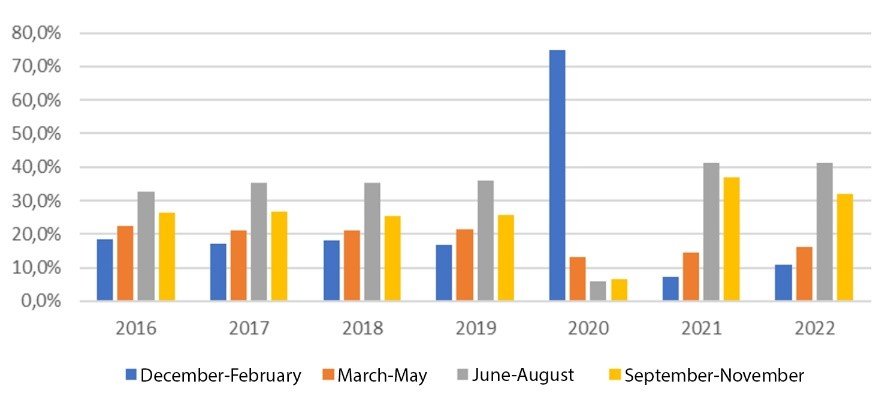

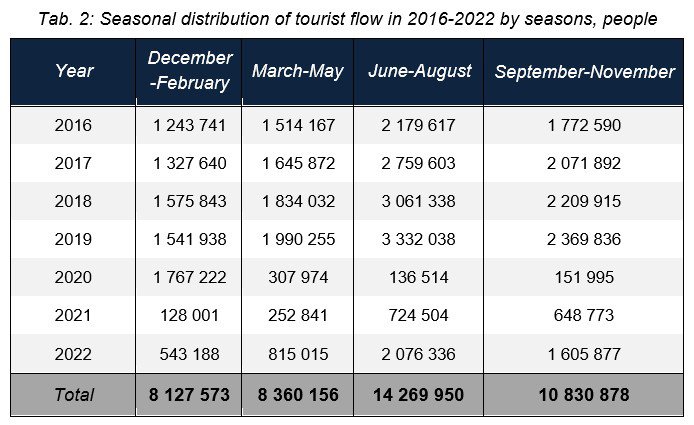

As for the distribution of the flow, for the period 2016-2022 the seasonality is pronounced. In summer (June-August) the largest number of tourists arrive (more than 37%). In autumn (September-November), the attendance rate drops slightly and is about 25%. In winter (December-February) and spring (March-May) it is about 20% (Fig. 10, Fig. 11).

Fig. 10: Distribution of the number of tourists in 2016-2022 by season, people

Distribution of the number of tourists in 2016-2022 by season, %

The only significant deviation is the period March 2020-May 2022, which was the beginning of the COVID-19 pandemic and its consequences (Table 2).

Thus, it is obvious that year-round tourism is developing in Georgia and summer seasonality begins to play an ever smaller role in the fluctuations in tourist traffic.

Despite the fact that the tourist flow in the number of visits in 2019/2022 decreased by almost 40%, Georgia's income from this direction is growing. Thus, at the peak of the season, in August 2022, the country earned 523 million USD, which is 26.6% higher than in the record year in terms of visits in 2019 (413 million USD). The main drivers of such dynamics are both the increase in the duration of the visit on average, and the demand for better service and types of accommodation.

Segmentation of tourist traffic to Georgia

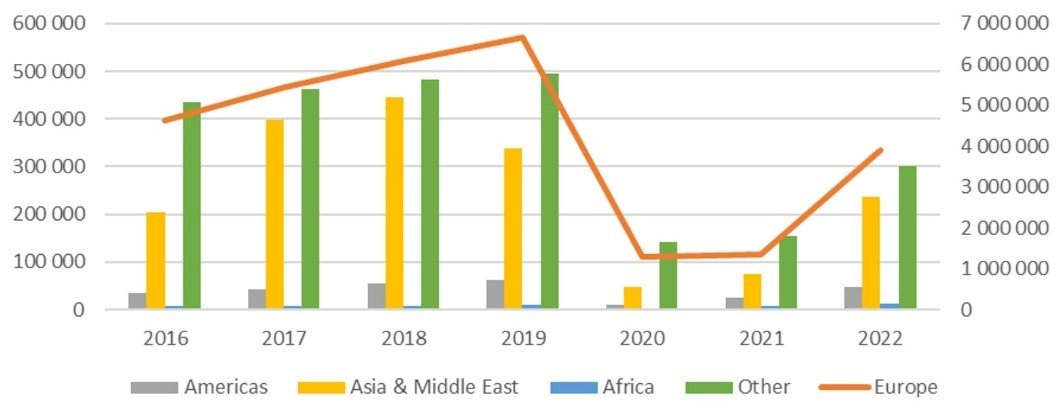

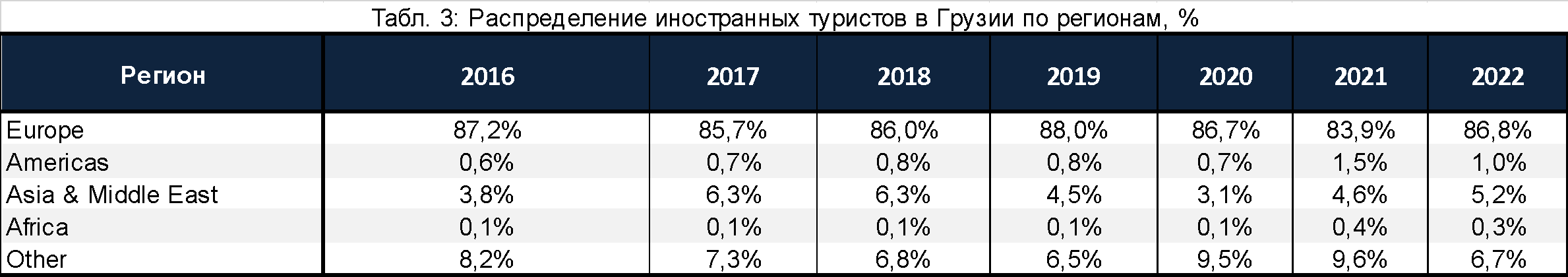

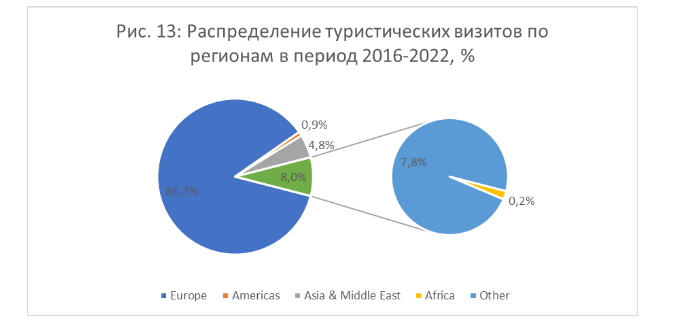

According to the data of the National Georgian Tourism Administration, the vast majority of tourists for 2016-2022 came to the country from Europe (Fig. 12). Moreover, this distribution practically did not change over time (Table 3, Fig. 13). Despite the fact that there was a drop in the indicator in 2020 in all countries of the world, already in 2021 people began to gradually return to normal life. The global growth of the tourist flow year on year amounted to 4%. In Georgia, the figure was ahead of him and exceeded 7%.

Fig. 12: Number of tourists in Georgia by region in 2016-2022, people

Tab.3: Distribution of foreign tourists in Georgia by regions, %

Fig. 13: Distribution of tourist visits by regions in 2016-2022, %

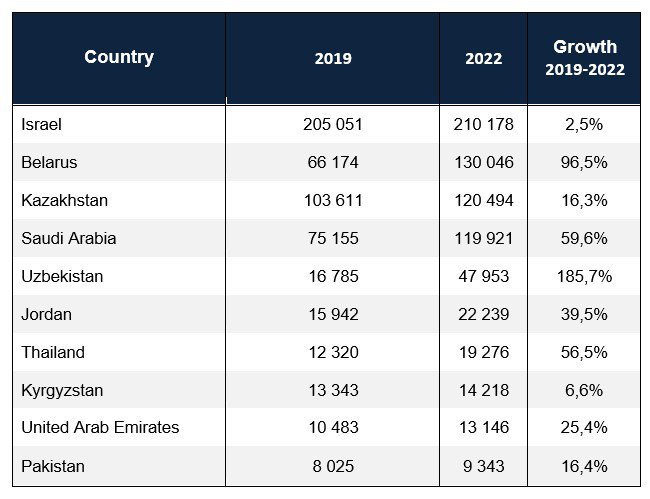

The country is still in the recovery phase after the pandemic, however, in terms of destinations, Georgia has already surpassed its record tourist flow in 2019 and 2022. In particular, travelers from the Caribbean (+48.5%), the Middle East (+33.4%) and Africa (+20.3%) began to come much more often. And the passenger traffic from 70 countries of the world has already surpassed the figures for 2019 (Table 4).

Tab. 4: Top 10 growing destinations for incoming tourist traffic to Georgia in 2022, people

Overview of the hotel business in Batumi

The hotel business in Georgia is currently one of the most dynamically developing sectors of the country's economy. With its unique combination of mountain scenery, seaside, rich cultural heritage and famous Georgian hospitality, the country has become a popular destination for tourists from all over the world, attracting the attention of many hospitality investors. Many of the largest international chains (Wyndham Hotels & Resorts, Inc., Marriott Hotels & Resorts, , Hilton Hotels & Resorts, Radisson Hotels, IHG and others) are actively using the opportunities offered by the region.

The trend among the world's leading hotel chains is the construction of new hotels on the coast under hotel brands owned by the chains. In such hotels, everything is regulated, from strict requirements for general parameters (for example, buildings, unit layouts, common areas, etc.) down to small details of the arrangement (switches, sockets, panel length under the sink, etc.). ), based on the rich and long experience of these companies in the global market. Such hotels or hotel residences can be managed either by the hotel chain itself or by an international management company accredited by it. Only by this condition can the brand ensure that high standards of guest service are observed.

Non-branded or non-branded apartments do not have such strict standards, may be built from lower quality materials, and the local management company will not be able to provide a world-class quality of services provided. The consequence of all of the above is a lower occupancy rate, lack of infrastructure and low cost of renting a room (apartment).

The leadership of the Black Sea region of Adjara, one of the most promising in terms of investment in Georgia, cooperates most actively with foreign hotel brands. And this is not surprising - already now the occupancy of branded hotels at the peak of the season (June-September) is more than 90%, and the average annual occupancy rate is above 68%. The demand for high quality hotel service is growing in Georgia every year.

According to Booking, there are more than 2,400 guest accommodation options in Batumi, of which 174 are hotels and only 7 hotels are from major global chains.

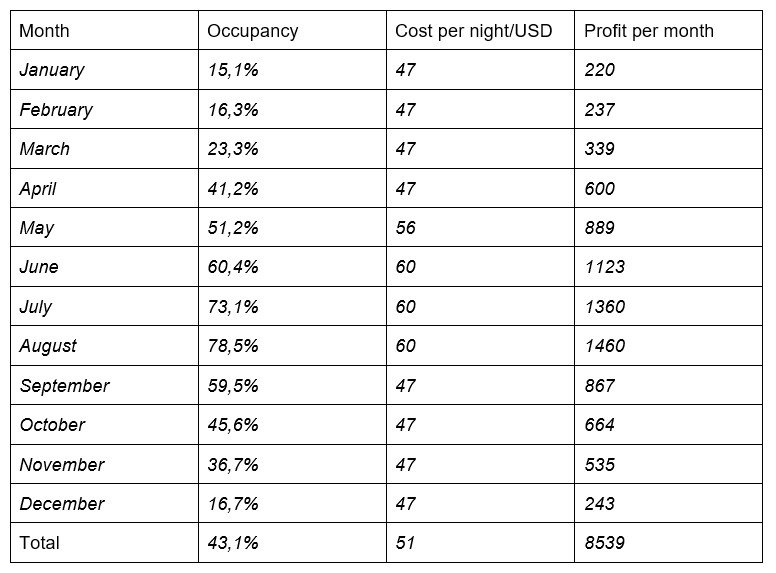

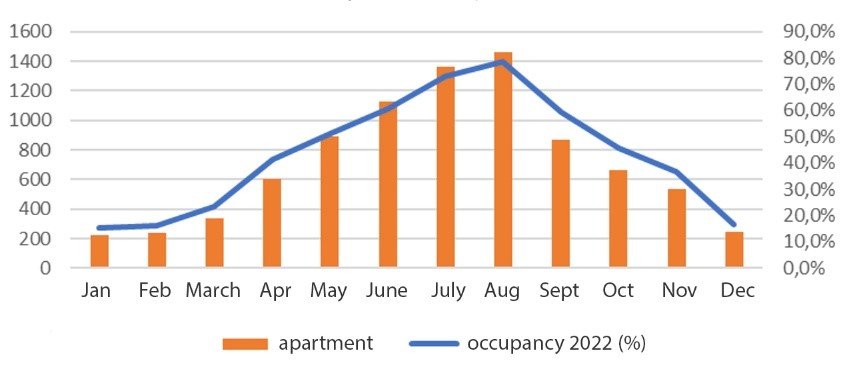

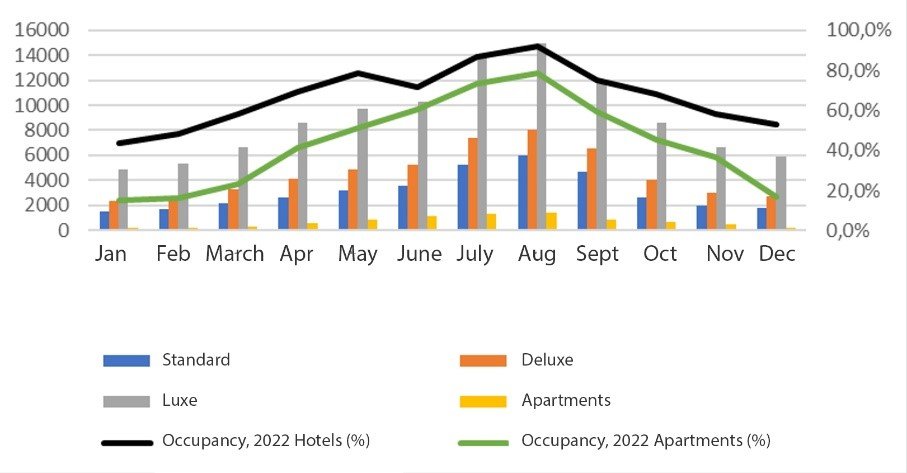

The cost of placement in non-brand complexes is much lower and amounts to 51 USD in average annual terms (Table 5), and the demand for such offers is less active than for offers from global chains - a little more than 43% of occupancy by year (Fig. 14).

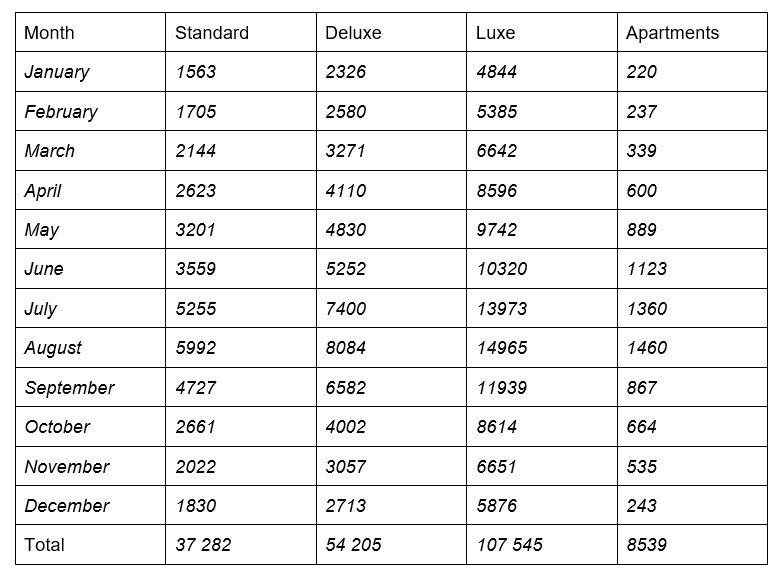

Tab.5: Profitability of branded apartments in Batumi 2022 (USD)

Fig. 14: Room yield by months, apartments, USD

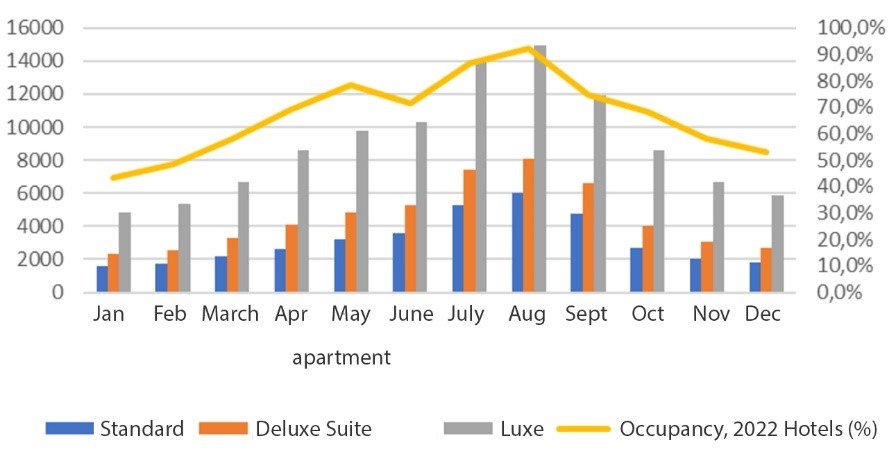

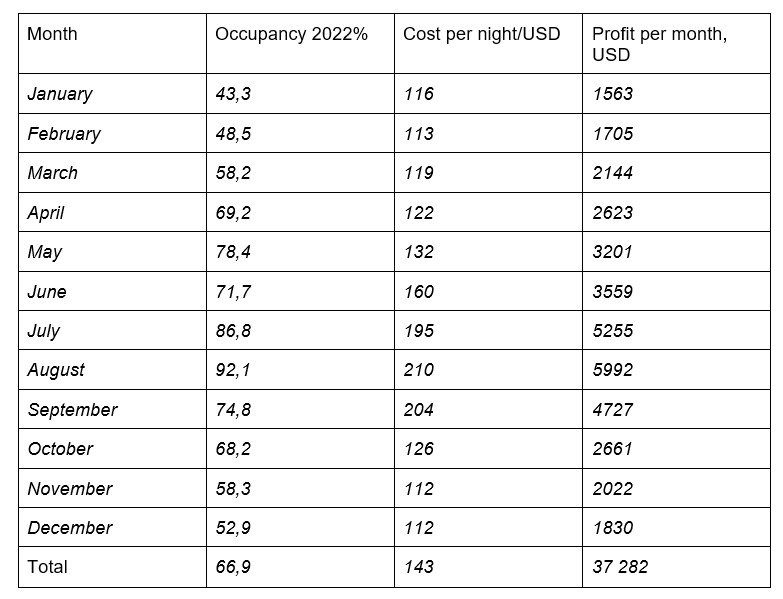

In 2022, the average annual occupancy of branded hotels in the largest city of the Adjara Region, Batumi, is more than 60% (Fig. 15). The average cost of a Standard room is 143 USD per night (Table 6).

Fig. 15: Room profitability by months, branded hotels

Tab.6: Room profitability in branded hotels in Batumi 2022 (USD)

Comparison of the above data (Table 7) gives a clearer picture. In terms of sold square meters, non-branded apartments are ahead of the premium segment, but they have a much more modest investment potential, and therefore, in the long term, less liquidity in the secondary market (Fig. 16).

Tab. 7: Comparison of profitability of non-branded apartments and branded hotels in Batumi in 2022 (USD)

Fig. 16: Сomparative profitability of rooms by months, hotels and apartments, USD

Conclusion

Georgia is one of the most promising post-Soviet regions in terms of developing international tourism in the coming years. This is facilitated both by the ecology of the region, the support of the country's leadership, the focus of the citizens themselves on attracting more guests with a growing quality of service on the one hand, and the interest of foreign investors in an actively developing region. The flagship of this growth is the segment of world branded hotels, where tourists choose to stay more and more every year against the backdrop of an acute shortage of service. A new level of service standards fill in deficit niches, allowing customers to focus, in addition to other similar offers, also on package tour formats, which significantly increase hotel occupancy, ensuring an even distribution of tourists throughout the year. An additional factor is the loyalty programs of global hotel chains, which include hundreds of millions of people around the world.

The country's economy is quite dependent on tourism, so the state is doing everything possible to strengthen and develop this direction. Political neutrality and support for the tourism sector attracts the attention of travelers from Arab countries, Israel, the USA, Europe, citizens from the territory of the former USSR, etc. With a 4% global post-COVID growth in tourism in terms of overnight stays, Georgia in the 2019/2022 ratio was able to achieve a 52% rise in tourism, exceeding the global average by 13 times.

Despite the fact that the consequences of the largest pandemic in the last century could not but affect the country's economy, the recovery trends in all areas are encouraging both private investors and large international holdings that are increasing the import of finance, technology, standards and competencies into the country, which gives more than justified grounds for optimism, especially in the tourism sector.