Turkey's Real Estate Market: 2024 Overview

Housing sales in Turkey grew by 20.6% in 2024 compared to 2023, exceeding 1.4 million transactions, according to the Turkish Statistical Institute. However, sales involving foreign buyers dropped by 32%, with their share of the market declining to 1.6%, down from 5% in 2022.

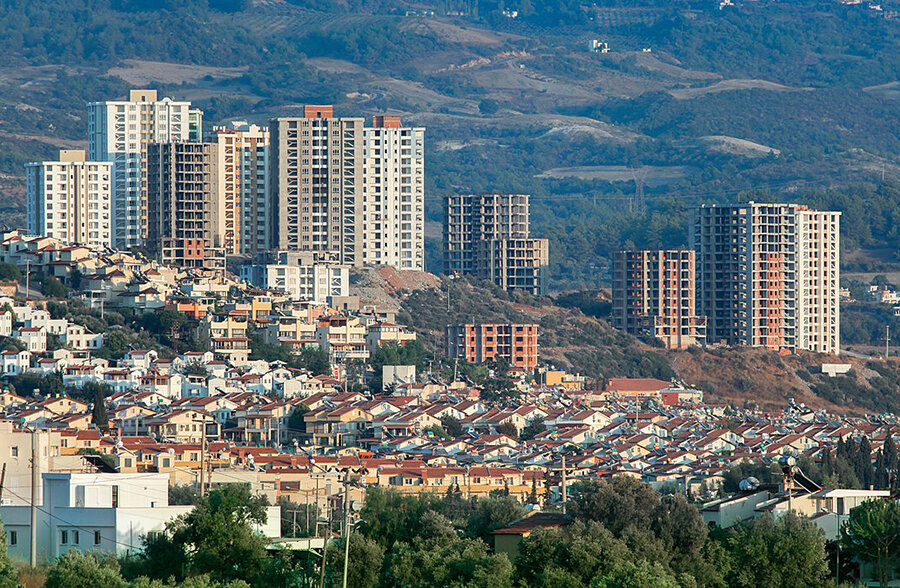

The highest number of sales occurred in Istanbul (239,213), Ankara (134,046), and Izmir (80,398). The provinces with the fewest transactions were Ardahan (755), Hakkari (958), and Bayburt (999).

December Trends

In December, 212,637 houses were sold in Turkey, a 53.4% increase compared to the same month in 2023. Mortgage-based purchases surged by 285.3% to 23,277 transactions. However, for the entire year, mortgage sales fell by 10.8% to 158,486.

The primary housing market saw a 49.5% increase in transactions in December 2024 compared to the previous year, reaching 76,629 sales. Over the year, first-time home purchases rose by 27.6% to 484,461. Secondary market transactions exceeded 136,000 (+55.7%) in December and grew by 17.4% annually, reaching 993,564.

Foreign Buyers in 2024

In December, foreign buyers purchased 2,418 homes, marking a 17.2% increase—the first growth in a long period. However, foreign transactions accounted for only 1.1% of the market. Most buyers were from Russia (438), Iran (239), and Ukraine (181).

For the entire year, sales to foreigners dropped by 32.1% compared to 2023, totaling 23,781 transactions (1.6% of the market). The majority of these purchases were in Istanbul (8,416), Antalya (8,223), and Mersin (2,112). Russians bought 4,867 properties, Iranians 2,166, and Ukrainians 631 throughout 2024.

Declining Russian Interest

Russian demand for Turkish real estate has been weakening for the second consecutive year. Experts consulted by RBC Realty cite Turkey's economic instability, inflationary pressures, and currency depreciation as key factors.

Yana Motornyuk, Head of Investments at Turkish developer Demir Holding, noted that these challenges create significant risks for short-term investments and reduce the market’s appeal to conservative buyers. However, long-term investors could benefit by purchasing assets at lower prices, anticipating value growth as the economy stabilizes. Nonetheless, such prospects remain uncertain.

Alexei Kotlov, CEO of GJA.rf, observed that many Russian buyers actively entered the Turkish market over the past two years to obtain residency or relocate. With most having already achieved their goals, market activity has declined. Complicated payment procedures and difficulties transferring funds abroad have also hindered new transactions.

Tatiana Burlakovskaya, CEO of Golden Brown Group, pointed to the weakening ruble and Turkey's rising cost of living—on average 40% higher than in Russia—as additional deterrents. Irina Mosheva, managing partner at Intermark Global, highlighted stricter residency and citizenship rules for foreigners as significant factors dampening Russian interest. Political instability and security concerns also weigh on investors.

Outlook for 2025

Some experts predict continued decline in Russian transactions, while others foresee moderate growth if inflation eases, interest rates drop, and new incentive programs are introduced. However, current price-to-rental income ratios have prompted investors to consider alternatives.

Rental Yields and Property Prices

According to the Global Property Guide, rental yields for residential properties in Istanbul average 6.63%. A one-bedroom apartment in Istanbul costs over $132,000, while a two-bedroom unit is priced at $200,000. Numbeo reports yields of 6.18% to 7.39%.

In Alanya, a one-bedroom apartment costs around $80,000, and a two-bedroom unit $125,000, with yields of 6.76% to 8.32%. In Antalya, similar properties range from $100,000 to $150,000, with yields of 6.39% to 6.73%. Nationally, yields hover around 7%.

In Georgia, rental yields are higher, averaging 9%, according to Numbeo. Batumi yields range from 9.02% to 9.16%, while in Tbilisi, they are 7.82% to 9.12%. Unlike Turkey, Georgia imposes no restrictions on foreign ownership, and its rental market regulations are more lenient, making it an increasingly attractive option for investors.