Belgium Real Estate Market Analysis 2024

Experts from Colliers have analyzed Belgium's real estate market in 2024, highlighting key challenges and trends shaping 2025. The report also explores changes in sales and leasing, investment models, the growing influence of ESG principles, and technological innovations in the sector.

Despite persistent geopolitical instability, economic uncertainty, and ongoing regulatory changes in construction, a turning point occurred in June 2024 with successive interest rate cuts. Market sentiment steadily improved, supported by asset price stabilization and increasing investor confidence. Although transaction volumes remain low, rising market activity and narrowing gaps between buyer and seller expectations indicate a positive trend.

Macroeconomic Factors

In 2024, the European Central Bank (ECB) cut its main refinancing rate to 3% through four consecutive reductions. This move aimed to support economic growth, as inflation hovered around 2%, with expectations of stabilization at this level by 2025. Market forecasts suggest interest rates could drop further to 1.75% by September 2025.

Belgium's inflation rate also declined faster than expected, stabilizing at 3.2% in October and November. It is projected to fall to 1.5% in 2025. However, in Q3 2024, the Federal Planning Bureau lowered its GDP growth forecast to 1.1%, citing reduced household spending and slower international trade.

Despite these adjustments, Belgium’s economy remained resilient, with services and manufacturing driving growth. GDP is expected to rise between 1.2% and 1.8% in 2025, supported by global economic recovery and lower inflationary pressures.

? Consumer spending showed moderate growth

? Unemployment remained stable at 5.4% (expected to decline further in 2025)

? Easier credit conditions are set to boost economic stability and investments

Investment Trends

Global capital markets remain sluggish, with investors awaiting improved conditions following the ECB's rate cuts. Belgium is no exception.

Key transactions in 2024 included:

✔ The sale of Intervest’s office and logistics assets for over €1.07 billion

✔ The European Commission’s €900 million sale of 23 buildings, significantly boosting investment volumes

However, excluding these exceptional deals, the office sector struggled, with its share of investments dropping to 17%, down from 35% in 2023.

By contrast, the hospitality and industrial sectors performed strongly:

✔ Hospitality investments grew from 4% to 11%

✔ Industrial & Logistics (I&L) surged from 14% to 37%

As of early December 2024, Belgium’s total investment volume reached approximately €2.6 billion (excluding the Intervest deal), aligning with 2023 levels.

- Office investments declined

- Hospitality and logistics outperformed expectations

- Industrial & Logistics (I&L) exceeded last year’s figures by €622 million

- Hotel investments grew by €191 million

Yield Assessment

- Core assets continue to undergo revaluations

- Opportunistic assets dominate investment volumes

Buyers remain cautious, holding back purchases until prices stabilize, while sellers hesitate to lower valuations unless liquidity is urgently needed.

The office sector is particularly uncertain, awaiting bold investors willing to act.

Assessing prime asset yields remains difficult due to a lack of benchmark transactions. Investors rely on internal evaluations, sentiment analysis, and macroeconomic factors such as:

✔ Interest rates

✔ Bond maturities

✔ Overall market conditions

2024 yield forecasts remain unchanged. While economic outlooks are positive, yield spreads remain narrow relative to base rates:

✔ Prime office & industrial yields: ~5.0%

✔ Retail property yields: 4.8%

With rate hikes expected to pause, yields are likely to stabilize in the near term.

Tenant Market Overview

2024 was not a record-breaking year for real estate transactions. Tenants adopted a wait-and-see approach, leading to:

✔ Longer deal negotiations

✔ Postponed relocation decisions

✔ Cautious commitments, especially for large deals

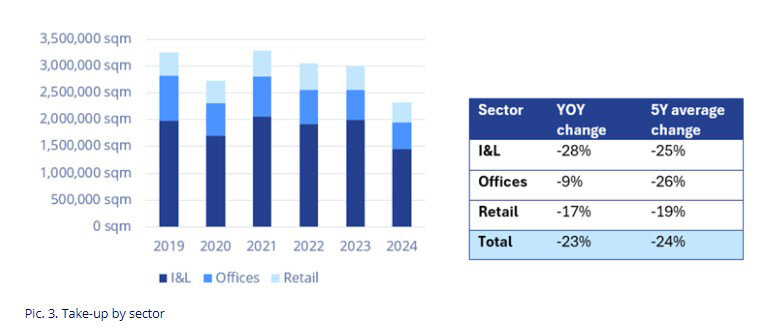

- Office sector transactions fell 9% YoY

- Industrial & Logistics (I&L) sector demand dropped 28% YoY to 1.4 million sqm

- Retail real estate activity declined by 17% YoY

Why?

✔ Post-pandemic logistics stabilization

✔ More companies subleasing surplus space

✔ Retail recovery shifting back to brick-and-mortar stores

Major 2024 Office Deals:

- European Commission (24,211 sqm & 14,262 sqm)

- Engie/Tractebel (31,500 sqm)

- IHECS (19,800 sqm)

ESG-compliant offices now dominate leasing decisions:

✔ Brussels: 54% of office deals were for green-certified buildings

✔ Antwerp: 43% ESG-compliant office deals

Many ESG-focused projects are fully leased before completion.

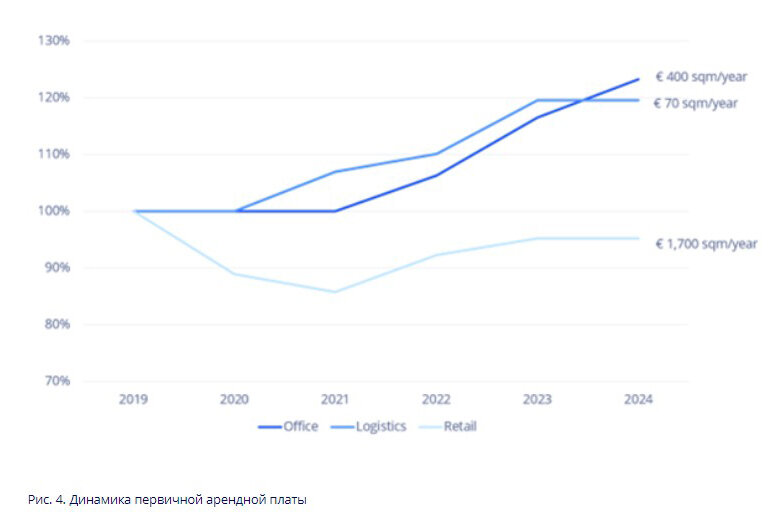

Brussels Prime Office Rents Hit New Records:

✔ Leopold District: €400/sqm/year

✔ Louise District: €356/sqm/year

✔ Periphery: €200/sqm/year

Other regions saw notable rent increases:

✔ Antwerp: €195/sqm/year

✔ Ghent: €185/sqm/year

✔ Leuven: €195/sqm/year

✔ Hasselt: €175/sqm/year

Retail Rents Stabilizing:

✔ Rue Neuve, Brussels: €1,650/sqm/year

✔ Meir, Antwerp: €1,700/sqm/year

Further retail rent hikes in H1 2025 are unlikely.

Growing Importance of ESG

ESG principles have become a cornerstone of investment and leasing decisions.

Regulations such as:

✔ Corporate Sustainability Reporting Directive (CSRD)

✔ Corporate Sustainability Due Diligence Directive (CSDDD)

… are reshaping the market, driving sustainable investment.

Companies that adapt early will gain competitive advantages, as demand for green-certified office spaces continues to grow.

Artificial Intelligence & Technology in Real Estate

According to ULI’s Emerging Trends in Real Estate Europe 2025, AI and technology are transforming the sector:

AI applications in real estate:

✔ Predicting tenant behavior

✔ Optimizing energy consumption

✔ Enhancing leasing strategies

However, cybersecurity risks are a growing concern:

- 50% of respondents worry about financial and operational disruptions.

Europe lags behind the US and Asia in PropTech adoption, facing:

✔ Regulatory hurdles

✔ Financial barriers

AI is revolutionizing logistics, especially last-mile delivery, by predicting consumer demand.

While some investors remain cautious, AI’s impact on real estate development, planning, and construction is expected to grow over the next five years.