Luxembourg's Housing Market Recovers Unevenly

In the third quarter of 2024, sales of existing apartments in Luxembourg increased by 6%, while detached house sales rose by 16% compared to April–June. However, the number of new construction transactions fell by 6%, indicating an uneven recovery across all sectors, according to the Delano portal.

Sales

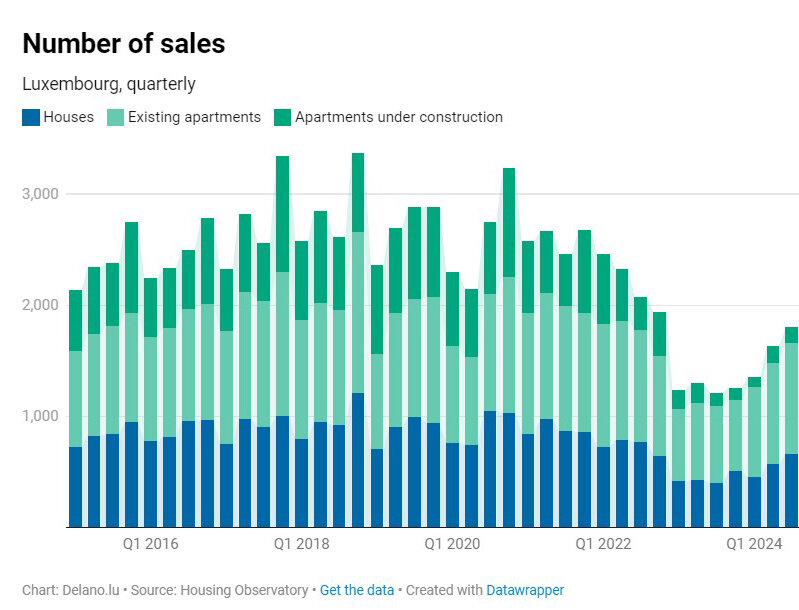

Between July and September 2024, a total of 664 houses and 1,139 apartments were sold, exceeding the previous quarter’s figures (570 houses and 1,065 apartments). However, only 144 transactions were registered for newly built apartments, reflecting a decline compared to the second quarter, when 154 contracts were signed.

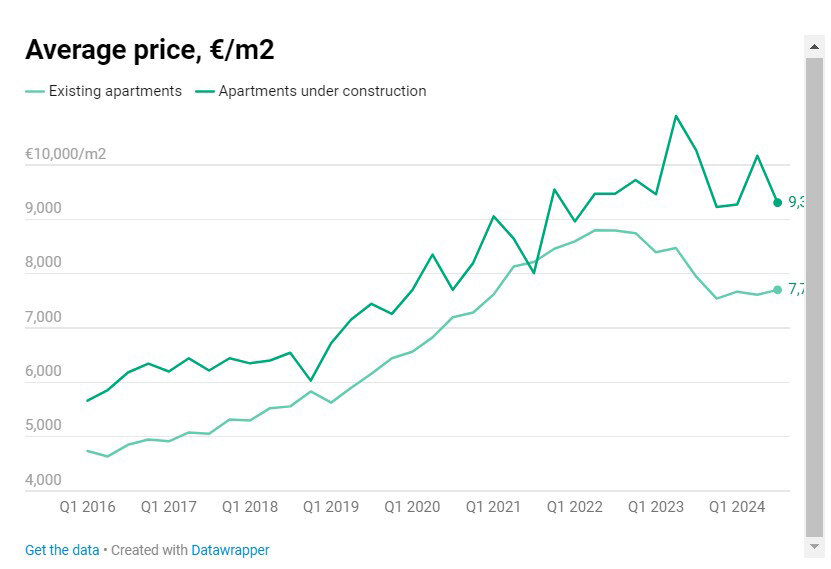

One possible explanation for this trend is the significant price gap between new and existing apartments. In Q3 2024, the average price per square meter of a newly built apartment reached €9,309, nearly 21% higher than the average price in the secondary market (€7,703). This is a significant increase compared to the 7.7% price difference observed in 2022.

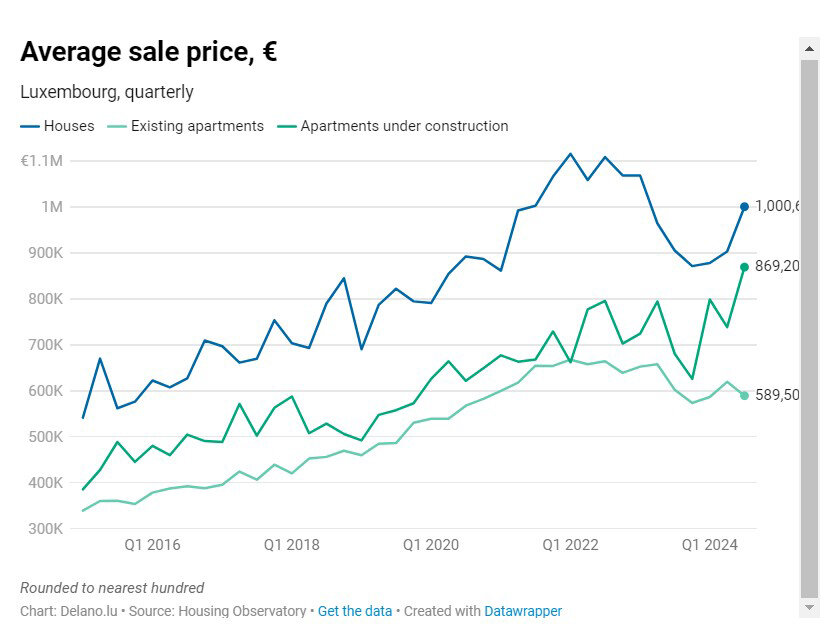

Data from the Luxembourg Land Registry, Real Estate, and VAT Authority (AED) highlight a striking contrast in the country’s real estate market in Q3 2024. The average sale price of a newly built apartment reached €869,200, which is 47% more than the price of a comparable property in the secondary market (€589,500). This substantial price gap makes move-in-ready apartments increasingly attractive to buyers. Meanwhile, demand for detached houses has grown significantly, with the average sale price rising to €1 million—an 11% increase compared to Q2 2024.

Loans

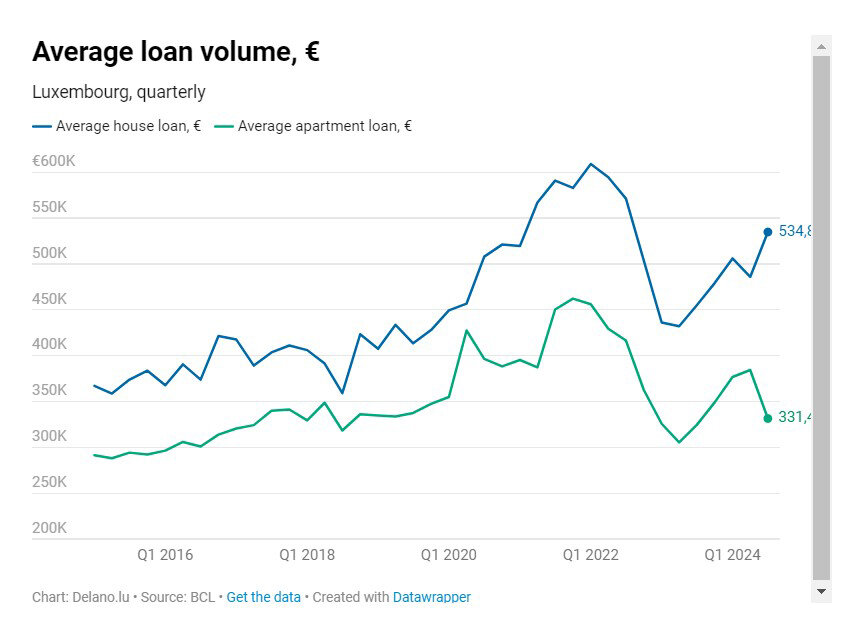

While transaction volumes continued to rise, the total value of housing loans issued for residential property purchases in Luxembourg slightly declined—from €1.252 billion in Q2 to €1.219 billion in Q3, marking a 1% drop, according to the Bank of Luxembourg (BCL). This decrease suggests that financial institutions are becoming more cautious, carefully assessing potential buyers’ ability to meet mortgage obligations and minimizing the risk of defaults. As a result, the average loan amounts have also shifted: the typical mortgage for an apartment decreased by nearly 14% to €331,400, while the average home loan amount increased by 10% to €534,800.

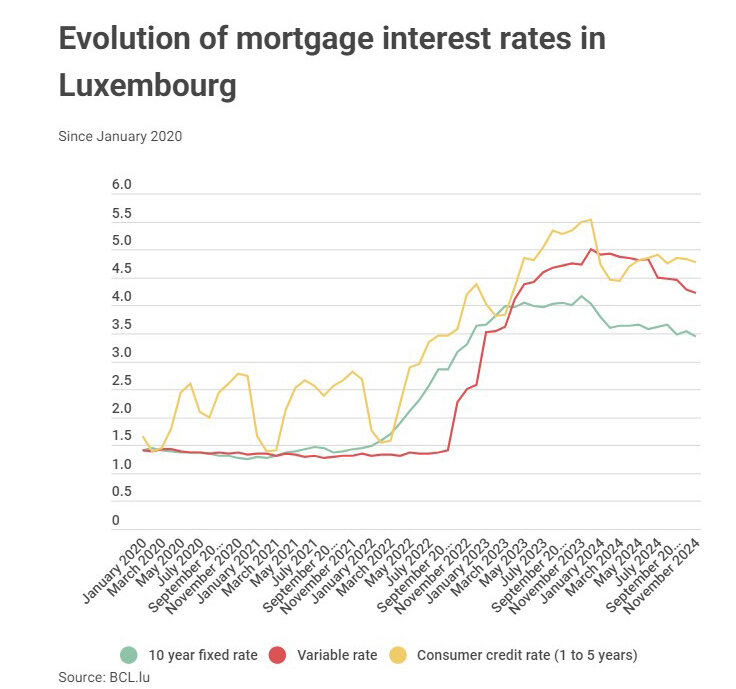

At the same time, RTL Today notes a steady decline in interest rates on loans in Luxembourg, sparking hopes for a real estate market revival. A fixed-rate mortgage for over ten years can now be obtained at 3.44%—the lowest rate in 2024. For comparison, in November 2023, the fixed rate stood at 4.16%. Floating mortgage rates also dropped to an average of 4.22%, down from 4.73% a year earlier. For short-term financing, such as consumer loans under five years, the average rate in November 2024 was 4.77%.

Construction

The number of building permits issued increased slightly compared to Q2, but remains below historical averages, indicating that a large volume of new projects may not emerge in the coming months. This suggests that the construction sector faces challenges related to uncertain future pricing trends and potentially low demand for new housing.

Minister of Housing Claude Meisch stated that developers need to take action. "The government can provide temporary support through tax measures, but there also needs to be an adjustment on the supply side. Developers must lower prices," he said.

Previously, authorities announced that they would not extend property tax incentives or allow increased deductions in 2025. Meisch emphasized that as Luxembourg enters 2025, the market must find a "new equilibrium" without relying on state support. Nevertheless, the government remains committed to "building more and building faster", making every effort to support future development.