read also

Denmark Set to Lead Nordic Growth Despite Novo Pressure

Denmark Set to Lead Nordic Growth Despite Novo Pressure

Sweden Urges Citizens to Hold Cash for Emergencies

Sweden Urges Citizens to Hold Cash for Emergencies

Indonesia Faces Growing Credit Rating Pressure

Indonesia Faces Growing Credit Rating Pressure

Poland Rethinks Rate Cuts as Iran War Risks Rise

Poland Rethinks Rate Cuts as Iran War Risks Rise

UAE Airport Losses Reach One Million Dollars Per Minute

UAE Airport Losses Reach One Million Dollars Per Minute

UAE Housing Market Enters Moderate Cooling Phase

UAE Housing Market Enters Moderate Cooling Phase

Foreign Buyers’ Activity in Spain’s Real Estate Market Declines

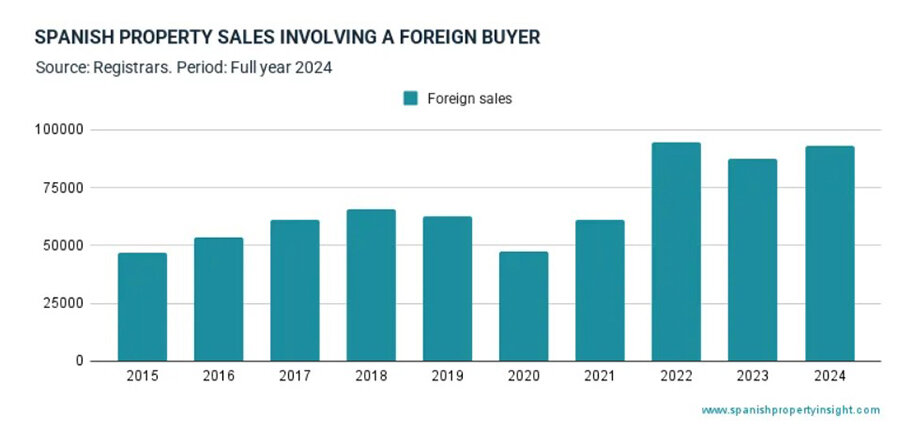

In 2024, the main foreign buyers of Spanish real estate—Britons, Germans, and French—have slowed their purchasing activity. The steepest decline was recorded among Norwegian buyers, while Russian demand also fell. However, despite these declines, the total number of foreign real estate transactions increased by 6% year-on-year, according to Spanish Property Insight, citing data from the Spanish Land Registry.

In total, 92,958 property transactions involving foreign buyers were registered in 2024, marking a 6% increase compared to 2023 and exceeding the 10-year average by 38%.

Foreign Buyers Breakdown

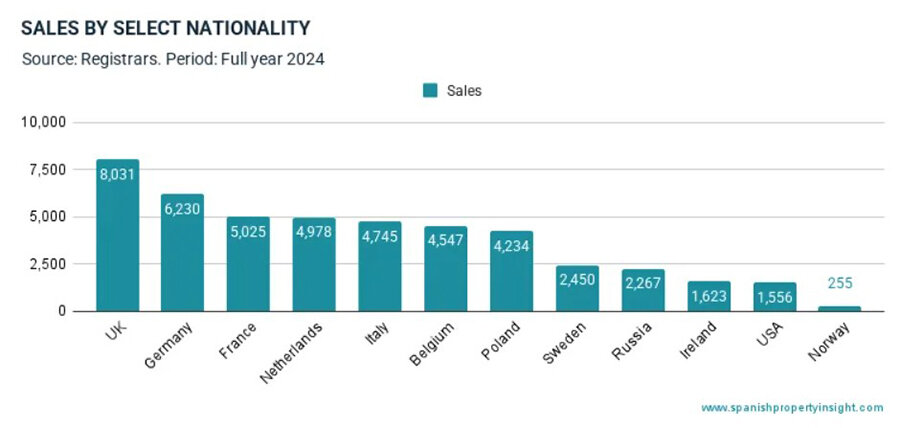

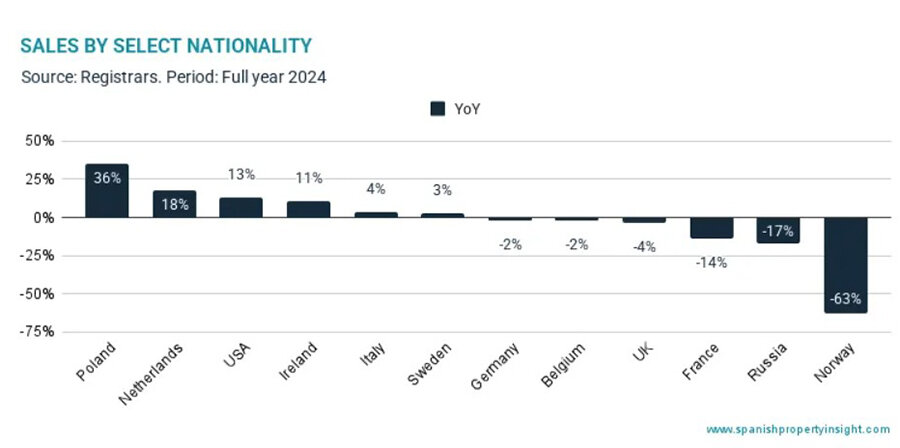

As in previous years, Britons remained the largest group of buyers, but their activity declined by 2%, with 8,728 transactions. Similarly, German buyers completed 6,230 deals, also marking a 2% decrease. Meanwhile, French purchases saw a significant drop of 14%, with only 5,025 properties acquired.

The most notable increase was among Polish buyers, who recorded a 36% surge in transactions, followed by Dutch (+18%) and American (+13%) buyers.

On the other hand, demand from Norwegian buyers plummeted by 63%, while Russian purchases dropped by 17%.

A Surge in Q4 Due to the “Golden Visa” Program Ending

In Q4 2024, 24,985 transactions involving foreign buyers were recorded, representing a 27% year-on-year increase and exceeding the 10-year average by 49%.

Analysts attribute this sharp rise to the upcoming termination of Spain’s Golden Visa program, which allowed non-EU investors to obtain residency by purchasing real estate worth at least €500,000. With the final application deadline set for April 3, 2025, many investors—especially from Mexico, Chile, Venezuela, China, the US, Russia, and Germany—have rushed to secure their eligibility before the program closes.

The announcement of the program’s closure in 2024 already triggered an increase in interest, which intensified after the official decree was published in Spain’s Official State Gazette (BOE) on January 3, 2025.

Government Measures to Address the Housing Crisis

The Spanish government has taken measures to curb foreign real estate investment, arguing that foreign demand drives up housing prices, making homes less accessible to local citizens.

Several major policy changes are under discussion:

? Regulating short-term rentals – Spain has already implemented policies to limit short-term rental profitability, reducing real estate’s investment appeal.

? VAT Increase on Tourist Rentals – Prime Minister Pedro Sánchez has proposed raising VAT on tourist rentals to 21%, up from the current 10%, arguing that landlords should be taxed as businesses.

? 100% Tax on Non-EU Buyers – The government is considering a 100% tax on property purchases made by non-EU citizens.

? Potential Ban on Foreign Purchases – There is also a proposal to ban foreign buyers who do not live in Spain permanently from purchasing property.

What’s Next for the Market?

Analysts believe that these restrictions could dampen demand, especially in the luxury segment, and may slow price growth in popular foreign investment regions such as Costa del Sol, Barcelona, and Madrid.

At the same time, these measures could negatively impact Spain’s investment appeal, particularly among foreign buyers seeking real estate as an income-generating asset.