Mortgage Payments in Sydney Exceed 57% of Household Income: Rising Housing Stress Across Australia

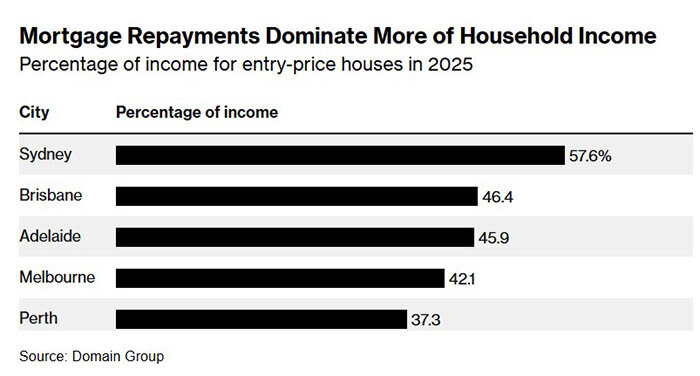

Australia is facing a surge in mortgage stress — a term used when repayments exceed 30% of household income. According to Bloomberg, citing Domain Holdings Australia, families in Sydney now allocate 57.6% of their income to mortgage payments. In other major cities, the average is above 47%.

In 2019, only Sydney and Melbourne experienced such levels of stress. By 2025, the issue now affects all major cities except remote Darwin — with Brisbane and Adelaide crossing the threshold as well.

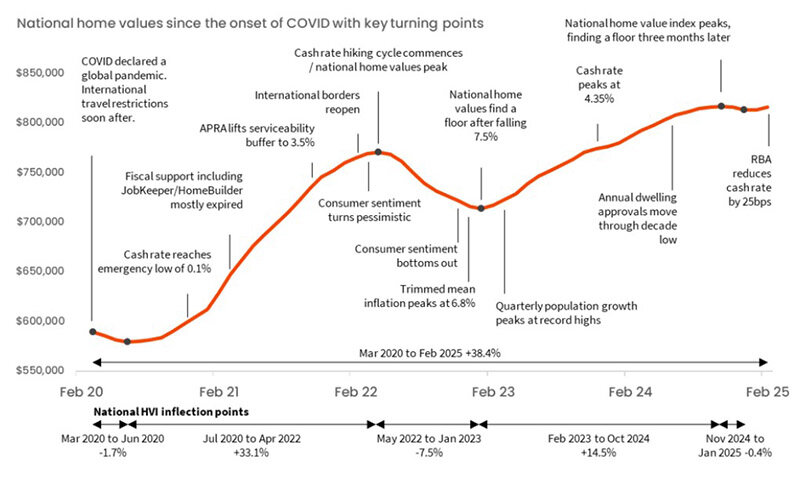

Domain’s Chief of Research and Economics Nicola Powell notes that rising property prices and interest rates have deepened the crisis. A critical shortage of housing exacerbates the situation. The aggressive monetary tightening in 2022–2023 “severely impaired mortgage serviceability,” though recent price declines and the first interest rate cut in four years “signal gradual improvement.”

In February, the Reserve Bank of Australia lowered the cash rate to 4.1%, but warned against further easing. Meanwhile, housing has become a central issue in the upcoming May 17 federal election, with affordability ranking among voters’ top concerns.

Vacancy rates are below 1%, and rental prices are skyrocketing. The growing population in Greater Sydney is worsening the shortage.

According to CoreLogic, home values in Australia rose by 38.4% since the COVID year of 2020 — far higher than the 20.6% increase in the prior five years, and 14.7% before that.

Recent figures show that prices are stabilizing. The national housing price index dropped by 0.4% between November 2024 and January 2025, followed by a 0.3% increase in February. Analysts see this as a sign of market adjustment in response to population normalization, access issues, and anticipated rate cuts.

Market forecasts for 2025 suggest a brief slowdown followed by recovery due to improving fundamentals — including rising real incomes, easing inflation, and expanded lending options. Although rental growth is expected to moderate, Firstlinks warns that access to affordable housing will remain challenging across both rental and sales segments.

Structural issues in housing supply also persist. The government aims to build 1.2 million new homes over the next five years, but labour shortages and cost pressures may delay delivery and drive up construction costs — further skewing the supply-demand balance.

Additionally, tax reforms are under discussion. Adjustments to stamp duty and rental regulation are anticipated, potentially discouraging investors. Many have already been deterred by government interventions.

Подсказки: Australia, Sydney, real estate, mortgage, housing stress, property market, interest rates, investment, affordability, inflation, stamp duty, 2025