read also

Attack on Dubai, February 28, 2026: Timeline of Events and Impact on the Real Estate Market (Updating)

Attack on Dubai, February 28, 2026: Timeline of Events and Impact on the Real Estate Market (Updating)

Russians in Israel Join Forces to Leave: War in the Middle East

Russians in Israel Join Forces to Leave: War in the Middle East

War in the Middle East: Risks for Tourists

War in the Middle East: Risks for Tourists

Middle East Airspace Faces Flight Disruptions

Middle East Airspace Faces Flight Disruptions

Unexpected Destination Tops 2026 Travel Trends

Unexpected Destination Tops 2026 Travel Trends

Norway House Prices Hold Steady

Norway House Prices Hold Steady

The UK Housing Paradox: Strong Demand vs. Construction Failure

The UK real estate market is experiencing a paradoxical mix of trends: a steady rise in prices and stable transaction levels against a significant shortfall in new housing supply. Analysts and market participants attribute this to tax changes, high borrowing costs, a shortage of affordable housing, and financial difficulties faced by social housing providers.

Market Stability Amid Macroeconomic Challenges

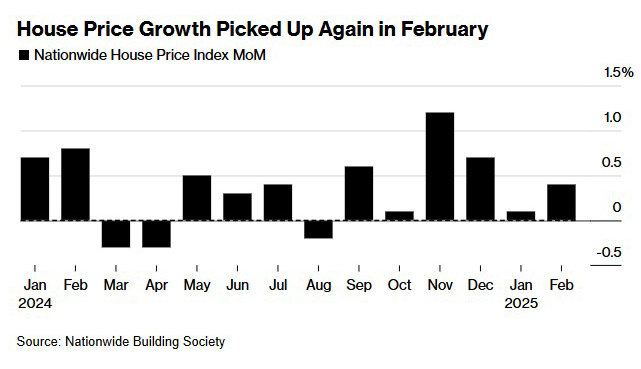

Despite economic hurdles and tighter tax policies, the UK housing market continues to recover. According to Nationwide Building Society, in February 2025, the average house price increased by 0.4% from January, reaching £270,493 ($340,290)—exceeding economists' forecasts of a 0.2% rise.

For six consecutive months, UK house prices have been on an upward trend. Although growth slowed slightly at the beginning of 2025, February data signals a return to positive momentum. This occurs despite weak economic activity and declining consumer confidence following the announcement of new tax measures set to take effect in April, including higher stamp duty rates. According to Nationwide's chief economist, Robert Gardner, this will likely lead to a short-term spike in transactions in March, followed by a slowdown.

HM Revenue & Customs reports that 95,110 residential property transactions took place in January 2025, marking a 14% increase from the same month in 2024. Sales volumes remained stable compared to December, particularly in cash buyer transactions, which exceeded pre-pandemic levels by 2%.

High Mortgage Rates Continue to Pressure Buyers

Bloomberg reports that in February 2025, the average two-year fixed mortgage rate was around 5.4%. This high cost of borrowing continues to dampen demand, particularly among first-time buyers, exerting downward pressure on the new-build sector.

Despite these challenges, Taylor Wimpey Plc, one of the UK’s largest homebuilders, predicts a modest increase in sales for 2025. The company expects to complete between 10,400 and 10,800 homes, surpassing the 9,972 homes built in 2024—though still far below pre-pandemic levels of around 14,000 homes in 2021.

“The spring selling season has begun strongly, and we are seeing good demand for our homes,” said Taylor Wimpey CEO Jennie Daly, adding that this reflects improving consumer sentiment and a market adapting to new conditions. The company also notes moderate growth in construction costs.

UK Housing Construction Falling Short of Government Targets

While major developers signal some optimism, overall housing construction remains far below government targets. According to Knight Frank, the UK [leech=https://www.bloomberg.com/news/articles/2025-02-10/uk-will-meet-only-half-its-home-target-a-third-of-builders-say]will likely build just half** of the 300,000 planned homes in 2025. This shortfall is primarily due to financial constraints on social housing providers and stricter regulations on affordable housing developments.

Housing associations, once key players in affordable housing supply, are struggling to sustain high levels of construction. Anna Ward, a senior analyst at Knight Frank, notes that without increased funding, the Labour government's ambitious housing program will face significant obstacles. RBC Capital Markets analyst Anthony Codling also highlights the ongoing financial difficulties in the social housing sector as a critical challenge.

What’s Next? A Mixed Outlook

Some analysts remain cautiously optimistic. If the current transaction levels hold, total property sales in 2025 could rise by 10%, according to RBC. A further decline in inflation and the potential for interest rate cuts by the Bank of England could provide additional support to the market.

Ultimately, the UK housing market remains a story of contradictions. While prices and sales transactions are rising, mortgage affordability issues, a severe shortage of new homes, and financial struggles in the social housing sector continue to weigh on the market. For the government's ambitious housing program to succeed, bold financial solutions and policy adjustments will be crucial.