U.S. Real Estate in 2025: Why Tariffs Pose a Greater Risk Than High Interest Rates

Spring 2025 began with growing uncertainty for the U.S. housing market. Two conflicting forces are shaping the landscape: the expectation of falling interest rates, which could revitalize mortgage activity, and the rise of new tariffs, which may cancel out any potential benefits by raising costs and weakening consumer confidence.

Tariff Pressure Hits Construction Sector

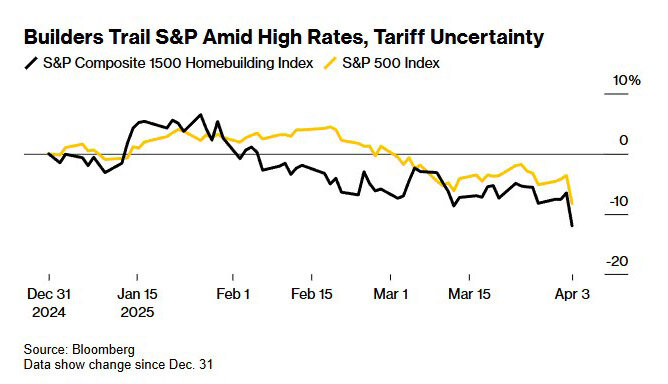

Former President Donald Trump's announcement of new import tariffs in April caused a sharp market reaction—especially in the real estate segment, Bloomberg reports. While falling bond yields might theoretically support cheaper borrowing, the panic on Wall Street overshadowed any relief from lower rates.

The response was immediate:

- Lennar Corp. lost 6% of its market cap (lowest since Nov 2023)

- D.R. Horton dropped 4.4%

- Toll Brothers fell 8%

- TopBuild Corp., an insulation supplier, dropped 9%

- Prologis, a logistics giant, saw its worst day since March 2020, down 9.6%

UBS estimates that the tariffs could increase the cost of building a single home by $6,400. According to the National Association of Home Builders, construction expenses already made up 64% of a new home’s price in 2024—the highest in decades.

Bloomberg Intelligence’s Drew Reading notes that homebuilders face both cost pressure and shrinking buyer confidence. “There’s not much room to raise prices without impacting affordability,” he says. Barclays analysts agree: the negative effects of tariffs and macro instability outweigh the potential benefits of lower rates. JPMorgan’s Michael Riho added, “We’re seeing weaker demand driven by affordability constraints and declining sentiment.”

Delayed Demand and Cautious Optimism

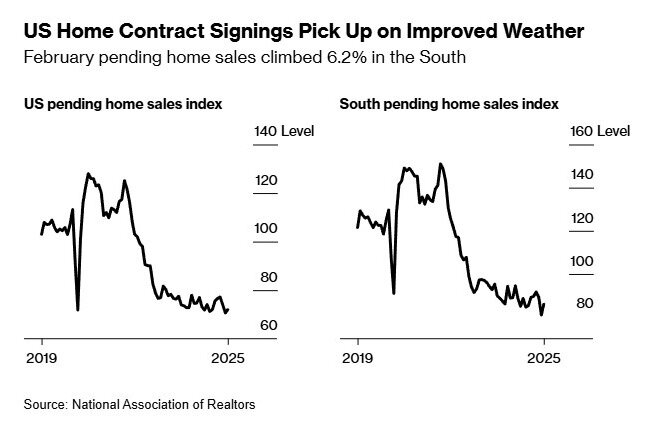

While the new home segment struggles, existing home sales have shown modest signs of life. According to the National Association of Realtors (NAR), the Pending Home Sales Index rose 2% in February, beating Bloomberg’s 1% forecast.

The South saw the biggest gain (+6.2%) after a steep decline in January. However, other regions remained sluggish. “This is more of a weather-driven rebound than a lasting recovery,” says NAR Chief Economist Lawrence Yun.

Listings rose 17% year-over-year, giving some buyers more options. Yet affordability remains a major issue:

- Mortgage rates hover around 6.71% (MBA, March 2025)

- Case-Shiller Index reports a 4.1% annual increase in home prices

JPMorgan analysts say that a significant recovery in transactions will only occur if rates fall below 5%. First-time buyers are especially impacted, as high rates collide with high home values.

MBA Economist Joel Kan summed it up: “Buyers who could qualify for a mortgage a year ago are now priced out. Sellers won’t lower prices, and higher rates shrink budgets.” In short, February’s bump in sales reflects delayed demand—not a sustained market rebound.

Подсказки: USA, real estate, housing market, construction, mortgage, interest rates, tariffs, property prices, economic policy, homebuilders