Record Housing Price Growth in Australia: New Trends in 2025

Over the past five years, housing prices in Australia have surged by 39.1%, adding approximately A$230,000 (~$143,000) to the median property value, according to CoreLogic. In absolute terms, this is the largest five-year increase on record, with new highs reached in March 2025. The recent interest rate cut — the first in four years — has also boosted optimism among market watchers.

CoreLogic economist Kaytlin Ezzy explains that the long-term rise has been driven by low housing supply and sustained demand. While the pace of growth is slower than in previous booms triggered by financial deregulation, rate cuts, and government subsidies, the absolute value gain is unmatched:

+A$230,000 in the past 5 years

Compared to A$140,000 in the early 2000s

And just A$60,000 in the late 1980s

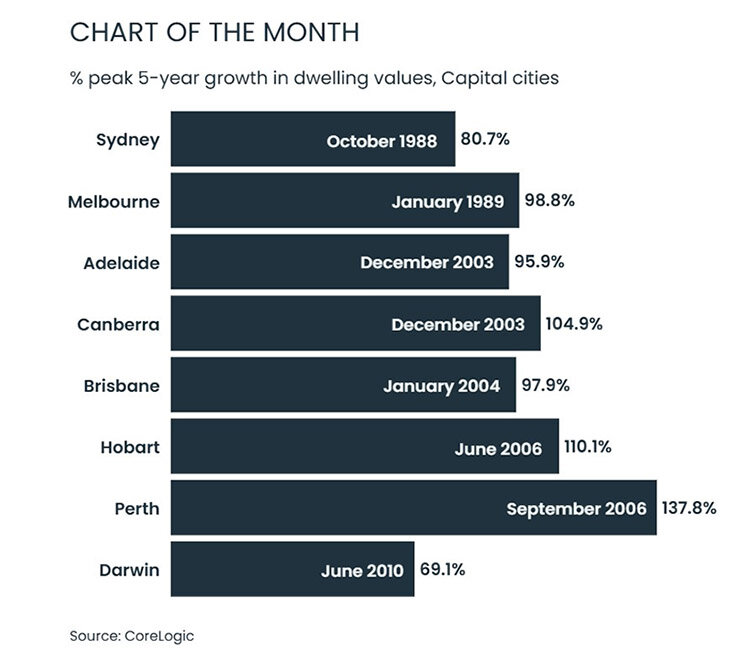

Price Trends Vary by City

Different regions saw different dynamics based on their economic and demographic appeal.

Sydney and Melbourne saw their biggest booms in the late 1980s and early 2000s (80–98%)

Perth hit a record 137.8% growth in the mid-2000s

New Peak in March, Rates Cut Supports Outlook

As Bloomberg reports, housing values rose by 0.4% in February 2025, led by Sydney and Melbourne, which now appear to be on a sustained upward trajectory. Prices rose in all major cities except Hobart. In March, national home values hit a new peak, driven in part by the first interest rate cut since 2020.

Rents Remain High, but Growth Is Slowing

Rents also stayed at record levels, rising 0.6% in March — down from 1% a year earlier.

"As migration stabilizes and household sizes increase, rental growth should moderate further," said CoreLogic research director Tim Lawless.

Construction Costs at 15-Year Low

In March 2025, construction costs rose just 0.4%, the slowest quarterly increase since March 2010. Year-over-year, costs were up by 2.9%, compared to 3.4% in December 2024. Since September 2023, annual construction cost growth has stayed at or below the pre-pandemic decade average of 4.0%.

Political Focus Ahead of May Elections

With national elections scheduled for May 3, housing affordability is a major issue.

Both the ruling Labor Party and the center-right opposition have proposed cost-of-living relief measures

Surging immigration and material shortages have fueled the price and rent spike, making housing central to party platforms

Monetary Policy and Market Outlook

On February 18, the Reserve Bank of Australia cut interest rates for the first time in over four years, but warned that further easing was unlikely in the short term. Still, improved market sentiment has supported the housing outlook.

“The rate cut seems to have triggered optimism and supported activity,” said Lawless.

Some experts believe the rate cut cycle could resume later in 2025, especially as building approvals have picked up, returning to long-term averages — a hopeful sign for developers and buyers alike.

Подсказки: Australia, housing market, property prices, CoreLogic, rent, construction, interest rates, RBA, real estate, elections 2025