Batumi Real Estate: 84% of Buyers Are Foreigners, Rental Yields Remain Strong

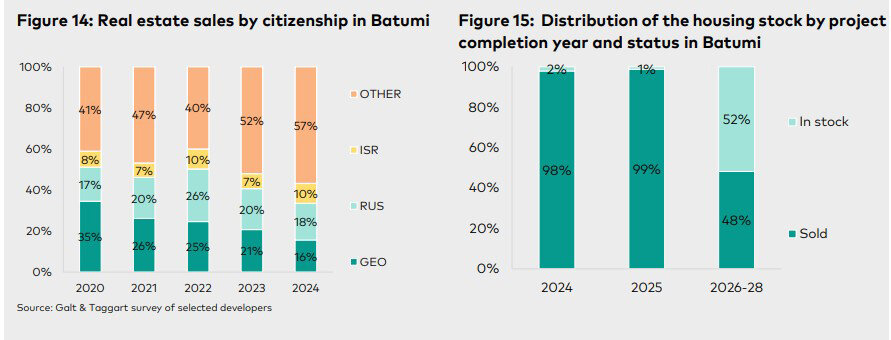

Batumi remains the flagship of Georgia’s property market when it comes to foreign buyer interest. According to Galt & Taggart, 84% of real estate transactions in 2024 involved international buyers. Experts say the combination of affordable prices, solid rental yields, and simple ownership rules continue to fuel this trend.

Leading the list of foreign nationals are Russian citizens (18%) and Israelis (10%). The remaining 57% come from various countries including Kazakhstan, Ukraine, and EU nations.

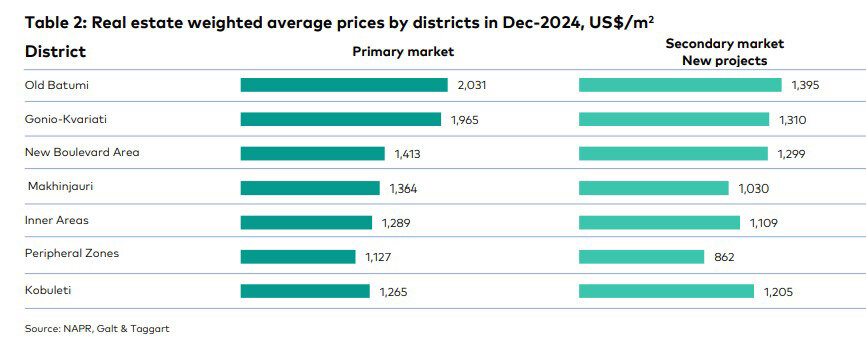

In 2024, the average price per square meter in Batumi’s primary market rose by 11.4% to $1,470. The highest prices are found in the Old Town ($2,031/sq.m) and Gonio–Kvariati ($1,965), while more affordable options are available in Mahindzhauri ($1,364) and outer districts ($1,127). Compact apartments under 50 sq.m remain the most in-demand due to their rental efficiency and easy maintenance.

Rental yields remain a strong advantage, averaging 8.8% annually—one of the highest in the region. While short-term rentals can generate more income, they also require more active management. Many developers now offer hotel management services, which allow owners to earn passive income.

Georgia’s lack of restrictions on property ownership for foreigners, combined with low property taxes and fast registration procedures, makes Batumi especially attractive for investment.

According to Colliers Georgia, the average price of new builds in February 2025 grew by 14.4% to $1,189/sq.m, while the resale market rose by 8.8% to $1,099/sq.m. In March, 1,233 transactions were registered (+5.7% YoY), with a total transaction value of $64 million (+4.9% YoY).

The strongest investment activity is still concentrated in the new-build segment, especially in tourist and coastal areas. Premium real estate continues to grow at 30% annually, driven by land scarcity and limited high-end offerings. The Old Town and Gonio–Kvariati remain the most expensive districts, home to international-level residential and hospitality projects.

More affordable yet dynamic districts like New Boulevard, Mahindzhauri, and Kobuleti attract interest for short-term rentals and apart-hotels. Developers in these areas increasingly provide hotel-style management, making the process hands-off for owners and boosting monetization.

Urban development is also supporting market growth. In 2025, Batumi is undergoing a large-scale waterfront renovation, roadworks, and tourist zone upgrades. Public transportation is expanding, and more green and public spaces are being added, making the city more livable and visitor-friendly.

Galt & Taggart forecasts price stabilization in 2025. However, record-high tourist inflows are expected to keep rental yields high, reinforcing Batumi’s position as one of the most profitable and resilient real estate investment destinations in the region.