read also

Attack on Dubai, February 28, 2026: Timeline of Events and Impact on the Real Estate Market (Updating)

Attack on Dubai, February 28, 2026: Timeline of Events and Impact on the Real Estate Market (Updating)

Russians in Israel Join Forces to Leave: War in the Middle East

Russians in Israel Join Forces to Leave: War in the Middle East

War in the Middle East: Risks for Tourists

War in the Middle East: Risks for Tourists

Middle East Airspace Faces Flight Disruptions

Middle East Airspace Faces Flight Disruptions

Unexpected Destination Tops 2026 Travel Trends

Unexpected Destination Tops 2026 Travel Trends

Norway House Prices Hold Steady

Norway House Prices Hold Steady

Albanian Real Estate Market Study 2025: Prices, Yields, Risks

In 2024, the Albanian real estate market showed stable and, in many segments, accelerating price growth. This was especially noticeable in the capital and along the Ionian Sea coast. The main growth drivers were strong demand from foreign investors, limited new housing supply in cities, increased tourist activity, and overall economic growth.

In 2024, the average housing price in Albania, according to Albanian Daily News, increased by 8% — the highest growth rate in the past five years. New developments in Tirana are offered at €2300 to €2700 per square meter. On the secondary market, apartments around 10 years old are selling from €1500 per sq.m.

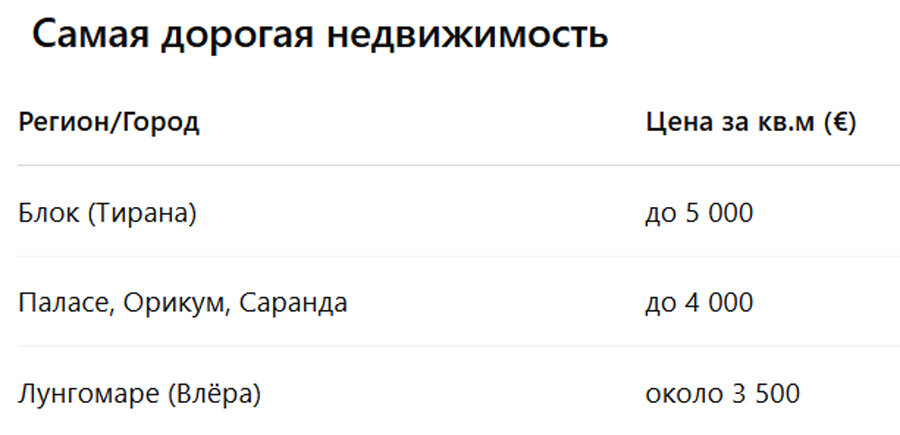

Most expensive real estate

1. Blloku district in Tirana – up to €5000 per sq.m. This is the city’s business and cultural center, home to luxury residences, offices, and embassies.

2. Palasë, Orikum, Saranda – up to €4000 per sq.m. These are resort areas overlooking the Ionian Sea, aimed at premium tourism demand.

3. Lungomare (Vlorë) – around €3500 per sq.m. A new waterfront district with beaches, hotels, and restaurants.

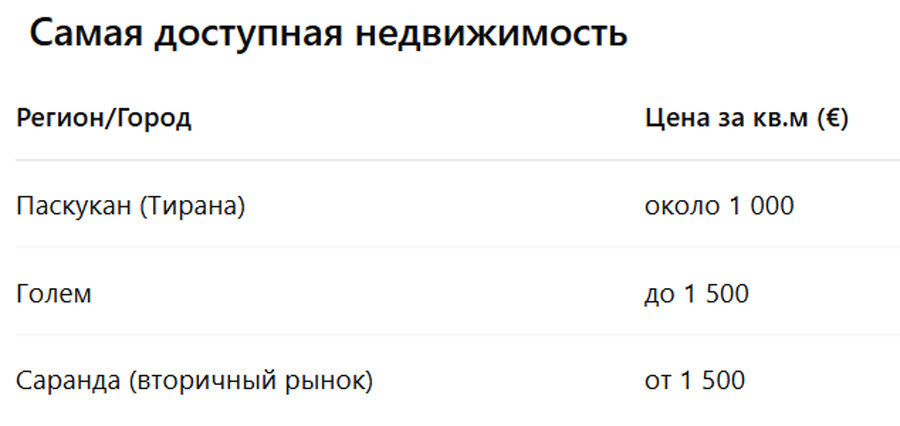

Least expensive real estate

1. Paskuqan (Tirana) – around €1000 per sq.m. A residential suburb of the capital, a developing area without tourist traffic.

2. Golem – up to €1500 per sq.m. A moderately popular tourist destination, mainly for domestic demand.

3. Saranda (secondary market) – from €1500 per sq.m. Older housing at moderate prices in a prestigious area.

Regions with the fastest price growth, according to experts at Investropa:

1. Tirana (center) – up to 23.5% growth in 2024.

2. Resort areas (Palasë, Lalzi) – up to 25% annually.

3. Saranda (new builds) – around 20% increase.

Rental yield for residential real estate in Tirana, according to Global Property Guide, stands at 4.5–6% annually. In resort towns, short-term rentals can yield 8–9% annually, especially during the summer months.

Is it profitable to invest in Albanian real estate in 2025?

As of early 2025, Albania’s real estate market continues to show high activity. Experts from Euriskon highlight the following advantages for investors:

- Ongoing price growth.

- High returns from short-term rentals in resort areas.

- Relatively low entry threshold compared to Southern Europe.

- Growing interest from foreign investors and tourists.

- Simplified property purchase procedures for citizens of most countries.

Legal risks, according to Balkan Insight:

1. Lack of transparency in property rights

- Many properties, especially on the coast, have unclear land status. Proper ownership documentation is often missing.

- Following nationalization (1940s–1980s) and privatization (1990s), many land plots remain under dispute between the state and individuals.

- Double sales and inheritance disputes are common.

2. Complications with registration

- Registering property in the cadastral registry may take several months to a year.

- In some regions (especially the southern coast), cadastral maps are outdated or do not reflect the actual situation on the ground.

- Some buildings are constructed without government approval or full permits.

Urban planning and infrastructure risks

3. Unauthorized construction

- Albania has a high level of illegal construction, especially along the coast and in rural areas.

- Buildings are often erected in violation of standards, without licenses or utility connections.

- The state periodically demolishes such structures, posing a risk of loss.

4. Poor infrastructure quality

- Outside of Tirana, Durrës, and Vlorë, road, utility, and communication infrastructure is underdeveloped.

- Central water supply, sewage, stable electricity, and internet are often lacking.

- Connecting new homes to the power grid can take months.

Financial and macroeconomic risks

5. Lack of mortgage financing for foreigners

- Foreign buyers have little access to mortgage loans from Albanian banks.

- Transactions are usually in euros, but Albania is outside the eurozone and exposed to exchange rate fluctuations.

6. High capital gains tax on resale

- Capital gains tax rates and calculations vary by municipality and may lack transparency.

Market-related risks

7. Limited secondary market

- Properties can stay on the market for years — liquidity is much lower than in EU countries.

- Reselling is especially difficult in overheated or low-tourism areas.

- No unified sales database or transparent agent system exists.

8. Overvaluation risks

- Speculative price growth is observed in areas like Blloku, Lalzi, Palasë, not always backed by actual demand.

- Prices may include "internal commissions" for developers and agents, inflating costs by 10–25%.

Construction and operational risks

9. Delays in project completion

- Most developments miss announced deadlines.

- Even projects close to completion may be delayed due to material shortages or administrative issues.

10. Poor construction quality oversight

- Technical supervision during construction is underdeveloped.

- Cheap finishes, lack of soundproofing, and fire safety violations are common.

See also: Albania to Monitor Cash Transactions

Political and legal risks

11. Dependency on political will

- Land, construction, and investment matters are politicized.

- Sudden changes in permitting or taxation policies are possible.

- Although Albania aims to join the EU, its legal framework remains fragmented and vulnerable to corruption.

Tourism and seasonality risks

12. Strong income seasonality

- In coastal and resort towns, rental demand drops sharply outside the summer season.

- Short-term rentals may remain vacant for 6–8 months a year without competent management.

13. Dependence on foreign tourism

- A decline in tourist flows due to external crises or regional instability can drastically reduce income.

An investor considering property in Albania must understand that the market remains poorly structured and high-risk. To minimize potential losses, it is crucial to:

- Verify legal clarity through local lawyers.

- Work only with reputable developers.

- Avoid “too good to be true” offers without clear documentation.

- Plan for potential difficulties with resale, rentals, and utility connections.

See also: EU Opens Accession Talks with Albania

Investment projects

Several key investment projects are underway in Albania, expected to be completed in 2025–2026:

1. Downtown One Tirana

A multifunctional skyscraper (residential apartments, offices). Height: 150 m, 40 floors. Completion: 2025.

2. InterContinental Hotel Tirana

A 5-star hotel with 300 rooms. Height: 133.5 m, 33 floors. Completion: 2025. First InterContinental brand hotel in Albania.

6. White Rocks Residences (Dhërmi)

Premium two-story villas. Area: 115 m². Prices from €750,000.

In 2025, the Albanian property market offers various investment opportunities:

- Tirana: strong potential for price and rental growth due to infrastructure development and flagship projects.

- Coastal areas: high demand for resort properties, especially near the sea and in areas with developed tourist infrastructure.

- Premium segment: limited supply of villas and luxury apartments makes them attractive for long-term investment.