Tokyo Commercial Real Estate: Retail Activity and Logistics Stability

Photo: JLL

Tokyo’s retail and logistics real estate markets show resilience despite early signs of slowdown in certain segments. According to JLL’s data for Q2 2025, demand remained strong and rental rates continued to rise, although capitalization growth has started to decelerate.

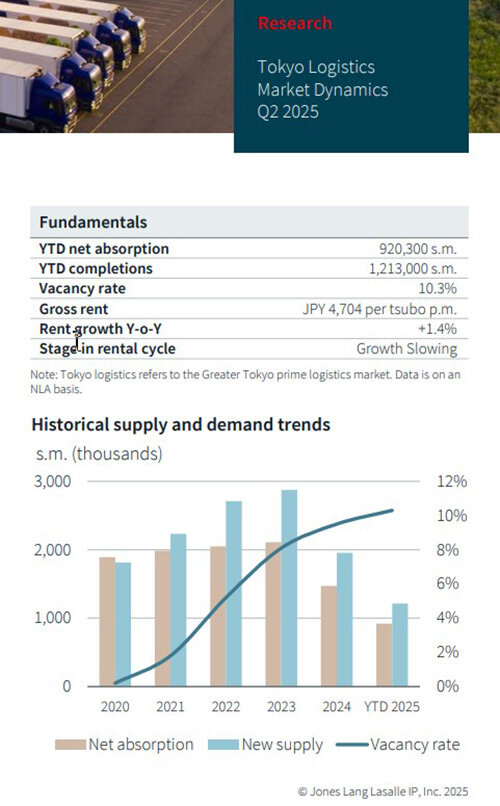

Logistics Market

In logistics, e-commerce providers and distribution operators remain the most active players【JLL†source】. Net absorption reached 332,000 sq. m—43% less than the previous quarter due to limited new supply. At the same time, 358,000 sq. m of new space entered the market, increasing total supply by 1.5%. All four new facilities are located in the Tokyo Inland area, two of them near the Ken-O Expressway.

The vacancy rate in Greater Tokyo stood at 10.3%, unchanged from Q1, but up 0.6 p.p. year-on-year. Tokyo Bay vacancy dropped by 18 bps to 8.4%, while Inland remained stable at 11%.

Average rents in the logistics segment rose to ¥4,704 per tsubo per month ($32 per 3.3 sq. m), up 0.6% QoQ and 1.4% YoY. Rising construction costs continue to push rents higher, especially in new projects. Investors remain interested in well-located assets, while remote facilities face pressure from high transport costs. Rising interest rates also weigh on investment decisions.

Capital values grew 0.4% QoQ and 1.1% YoY, supported by rent increases. Notable transactions include the sale of Fortress Investment Group’s portfolio, previously owned by GLP J-REIT. Institutional investors, including insurers, along with value-oriented investors, continue to drive demand. Yields are expected to remain stable, with capital appreciation in high-demand, prime locations.

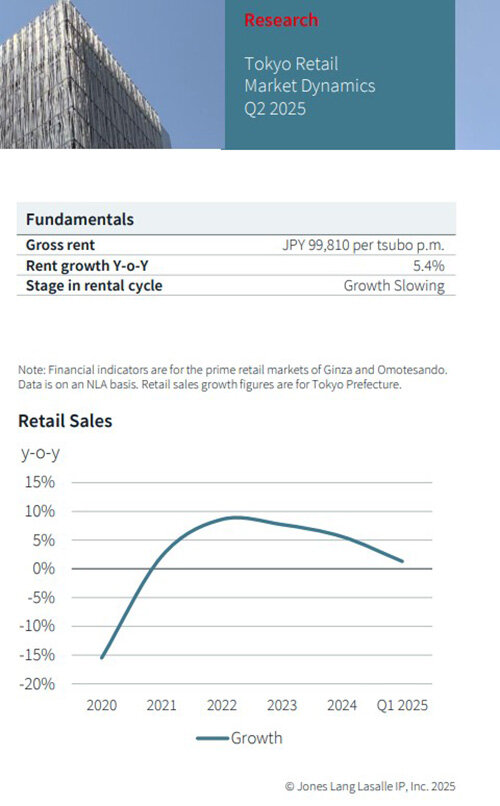

Retail Segment

In retail, consumption recovery in May was supported by rising household income and inbound tourism【JLL†source】. In Q1 2025, tourist spending grew 30% YoY. Leasing demand in prime districts remained stable, particularly from independent international brands, while major chains acted cautiously. Recent tenants include Onitsuka Tiger in Omotesando and Emporio Armani in Ginza.

Prime area rents reached ¥99,810 per tsubo per month ($677 per 3.3 sq. m), up 5.4% YoY and 0.2% QoQ. Growth was concentrated on upper floors, while ground-level rents stayed flat. This marked the 13th consecutive quarter of rental growth. Retail capitalization was stable QoQ but rose 6.2% YoY. Redevelopment opportunities are emerging, such as the acquisition of Ginza’s Marugen 31 Building.

New projects launched in Q2 include the Hulic Aoyama redevelopment in Omotesando (9,600 sq. m), scheduled for completion in May 2028, with pre-leased retail, offices, and dining spaces. In Ginza, a new 5,700 sq. m project combining two adjacent buildings is expected to open in summer 2028.

According to Oxford Economics, Japan’s private consumption will grow 0.9% in 2025 after remaining flat early in the year. Consumer activity is forecast to recover on the back of rising employment and income, though risks remain tied to consumer confidence. Leasing demand is showing moderate slowdown: interest persists, but growth rates are decelerating. Capital values are also stabilizing in line with rents.

Подсказки: Tokyo, Japan, commercial real estate, retail, logistics, investment, property market, JLL, real estate trends, 2025