Real Estate / Investments / Analytics / Research / Georgia / Real Estate Georgia / Bulgaria / Serbia / Albania 02.05.2025

Foreign Real Estate: Tbilisi Surpasses European Capitals in Affordability and Rental Yields

The growing activity of investors and shifts in migration patterns have significantly impacted the residential real estate markets of Eastern and Southeastern Europe, according to TBC Bank experts. In their study, Tbilisi was compared with Sofia, Bucharest, Belgrade, Chisinau, Skopje, and Tirana.

Prices and Investment Yields

Unlike Tbilisi, Sofia and Bucharest offer better housing affordability and more moderate sale and rental prices, thanks to higher local incomes and EU integration. These markets are more mature, with prices and rental rates balanced. However, Sofia’s lower rental yield indicates that price growth may have outpaced the population’s wealth growth.

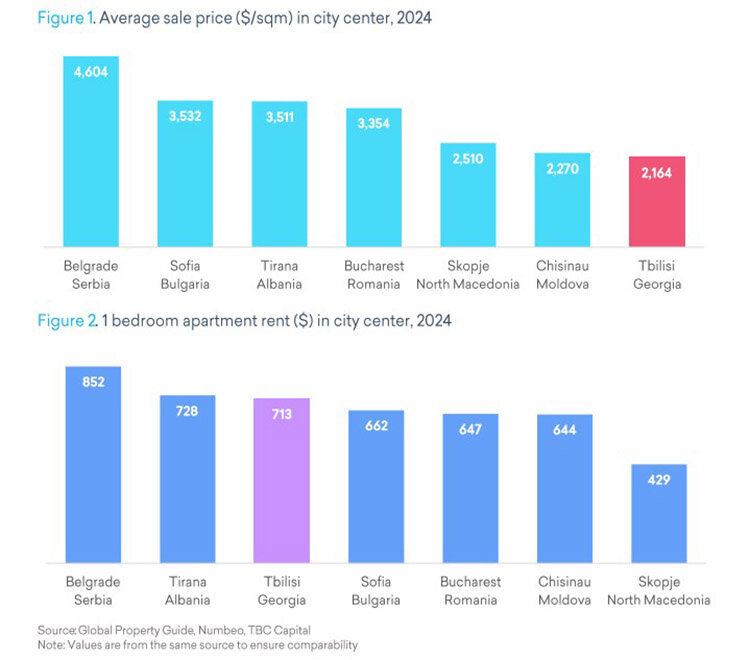

Tbilisi remains the most affordable city in the comparison, with an average property price of about $2,100. This is significantly lower than prices in EU capitals and some neighboring non-EU cities. For example, prices in Sofia and Bucharest exceed $3,300, roughly 50–60% higher than in Georgia’s capital. Belgrade ranks highest for purchase prices, with prices twice as high as in Tbilisi.

Tbilisi also shows one of the highest rental yields in the group, especially considering Georgia’s income levels. This reflects strong demand from foreign tenants—remote workers, digital nomads, and relocated professionals. A similar trend is seen in Belgrade, where rental prices have also risen due to an influx of migrants and foreign companies.

The housing affordability index (the ratio of apartment prices to average annual household income) in Tbilisi stands at 11.1. This means it takes about 11 years of household income to buy a standard apartment. This figure is lower in Sofia and Bucharest, where housing is more affordable relative to local incomes. However, Belgrade and Tirana have even higher affordability indices, indicating far less accessible housing for local residents. The difference lies in income levels: higher incomes in Sofia and Bucharest allow for lower affordability ratios despite higher prices, while lower incomes in Belgrade, Tirana, and Chisinau increase the affordability index even with moderate prices.

In cities where foreign property buyers are active, prices often exceed what local incomes would justify. This is evident in Belgrade. Foreign demand has also grown in Tbilisi, contributing to rising prices. However, with economic development and rising local incomes, the impact on housing affordability has been somewhat offset, though the index remains in double digits.

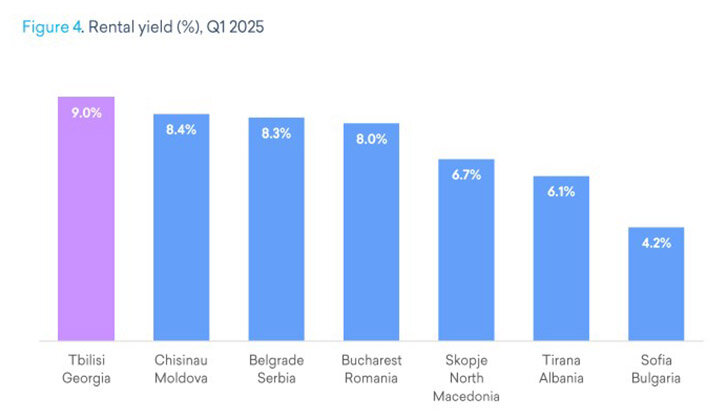

Tbilisi’s rental yield stands at about 9%, the highest among the cities analyzed and well above the European average. Chisinau, Bucharest, and Belgrade come closest, while Skopje and Tirana have moderate yields. Sofia’s yield is only around 4%—one of the lowest in the region.

These differences are due to the ratio of sale prices to rental prices in each city. The migration influx in 2022–2023 sharply increased rental demand in Tbilisi, driving up rental rates and yields. While the situation began stabilizing in late 2023, rental yields remain comparatively high. Georgia’s high homeownership rate also supports yields because the rental market has a limited supply of properties, allowing landlords to command higher rents relative to purchase prices.

In contrast, Sofia’s price growth outpaced rental increases. Consequently, Sofia’s 4.2% rental yield is comparable to much wealthier cities like Vienna or Stockholm. This resulted from Bulgaria’s EU accession and cheap credit availability, which fueled property price increases, while rental demand stayed limited due to an 84% homeownership rate and population decline.

Tbilisi Housing: Q1 2025 Results

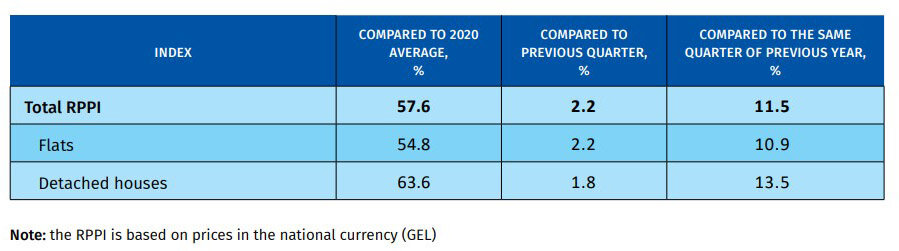

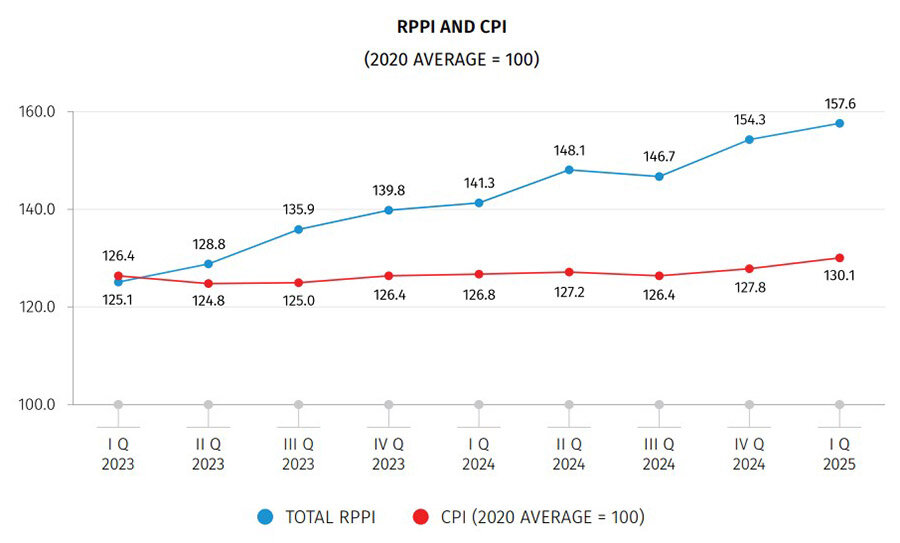

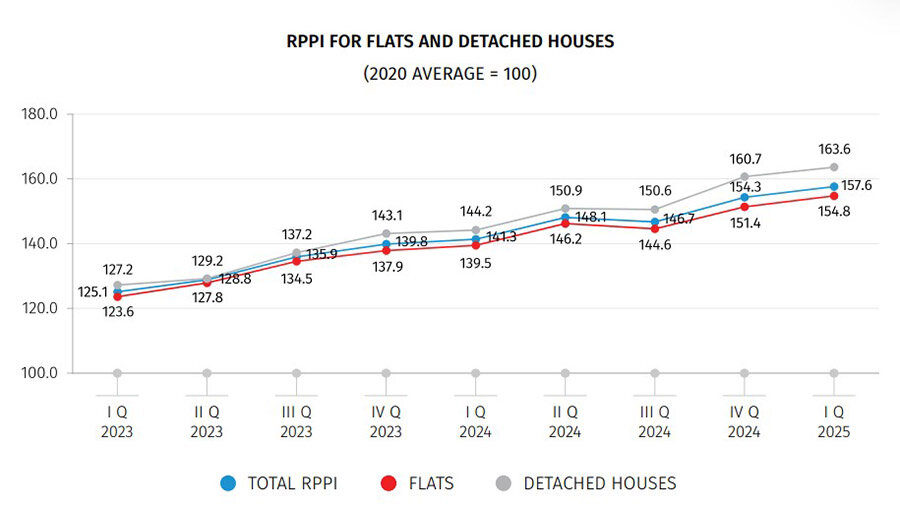

In Q1 2025, Georgia’s residential property price index (PPI) rose 11.5% year-on-year and 2.2% quarter-on-quarter, according to the National Statistics Office. Apartment prices increased 10.9% annually, while detached houses grew 13.5%. Quarterly growth was 2.2% and 1.8% respectively.

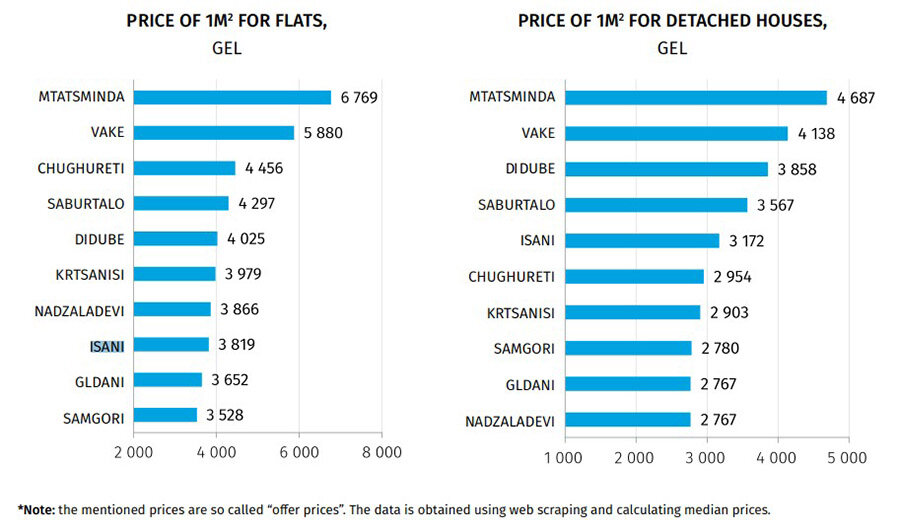

In newly built properties, the highest prices were in Mtatsminda: 6,769 GEL ($2,505) per sq. m for apartments and 4,687 GEL ($1,734) for detached houses. Next was Vake: 5,880 GEL ($2,175) per sq. m for apartments and 4,138 GEL ($1,531) for houses. Chugureti followed with 4,456 GEL ($1,649) for apartments, while Didube had 3,858 GEL ($1,428) for houses. The most affordable apartments were in Samgori—3,528 GEL ($1,306), Gldani—3,652 GEL ($1,351), and Isani—3,819 GEL ($1,413). Cheapest houses were found in Nadzaladevi and Gldani (2,767–2,780 GEL or ~$1,024–$1,029).

Prices by construction status increased over two years: from 2,474 to 3,236 GEL ($1,198) for “black frame,” from 2,821 to 3,582 GEL ($1,326) for “white frame,” and from 3,284 to 4,288 GEL ($1,586) for “green frame.”

According to Colliers Georgia, Tbilisi remains the country’s largest real estate market by transaction volume. In March 2025, 3,064 residential sales were registered—1.5% fewer than a year earlier, but total transaction value rose 16.7% to $243 million. Experts say this shift points to more high-budget transactions and demand moving toward pricier segments.

Investment firm Galt & Taggart earlier reported a 1% rise in sales volume in 2024 compared to 2023, while market value grew 7.1%. Average primary market prices rose 11.6% year-on-year. In projects scheduled for 2025 completion, 75% of units were already sold, mostly via internal installment plans.

In 2024, Tbilisi recorded 40,300 apartment sales overall. Most demand was in Didi Digomi, Saburtalo, and Samgori. Mid-sized apartments (51–80 sq. m) were most popular, while units under $1,000 per sq. m continued declining in share.

Conclusion

Tbilisi continues to offer an attractive real estate market thanks to steady price growth and high yields. The city provides investors excellent opportunities given its relatively low housing prices and rental rates compared to other Eastern European capitals. Foreign rental demand, including remote workers and digital nomads, keeps yields well above regional averages.

Batumi remains Georgia’s top investment destination, with 84% of 2024 buyers being foreigners. The country overall benefits from simple entry rules, transparent purchase procedures, and low property taxes. Foreigners can buy any property except agricultural land. The absence of transfer taxes and minimal ownership fees make Georgia a standout destination for investors worldwide.