Italy’s Residential Real Estate Market in 2025

Analysts from Global Property Guide have noted signs of improvement in Italy’s housing market, driven by rising demand and a shortage of supply due to weak construction activity. The overall price index in Q4 2024 increased by 4.51% compared to the same period in 2023; adjusted for inflation, the growth was more modest at 3.21%. However, at the start of 2025, property prices began to decline.

How much does housing cost in Italy?

According to ISTAT (National Institute of Statistics), new homes increased in price by 3.99%, while resale properties rose by 3.43% (2.15% in real terms). A report by Banca D’Italia for Q4 2024 noted that upward price pressure was primarily driven by recovering demand. Estimates of potential buyers significantly improved, while supply remained limited. Previously, mortgage availability was a key reason for canceled deals, but mortgage-related rejections have been declining for five consecutive quarters.

Is Europe facing a housing bubble? The ECB warns of overvaluation

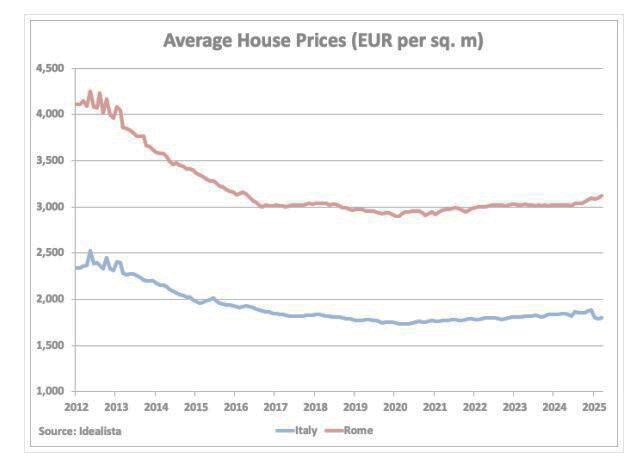

Idealista reported an average home price increase of 2.2% last year. However, in Q1 2025, this trend reversed, with prices dropping 2.6% year-on-year to an average of €1,801 per sq. meter. Adjusted for inflation, prices fell 4.6% over the same period.

Prices across all housing types declined 4.2% (-5.3% inflation-adjusted) at the start of 2025. In Rome, property averaged €3,124 per sq. meter, up 1.1% from the previous quarter and 3.4% annually. The highest prices are in Milan (€4,986), largely unchanged from last year but down 1.6% from Q4 2024. High prices were also reported in Bolzano (€4,598, down 1.8% quarterly, up 2.7% annually) and Venice (€4,562, down 0.2% quarterly, up 2.1% annually).

In Florence, prices increased 6.1% annually to €4,331. Bologna saw a 3.8% drop to €3,450, Naples fell 3.9% to €2,712, while Turin rose 1% to €1,870. Prices fell in Palermo (€1,341) and Genoa (€1,384), but increased 2.1% in Catania to €1,240.

Incentives to stimulate the market

According to ISTAT, the number of building permits for residential buildings fell 3.1% in Q4 2024 from the previous quarter. Floor area decreased 0.4% quarterly and 1.2% annually. Total new authorized residential space in 2024 increased 0.6% year-on-year to 4.73 million sq. meters.

To boost the market, Italy introduced several measures:

- From January 1, 2025, owners of resale homes have 24 months (instead of 12) to sell while retaining tax benefits.

- The 7% tax incentive for retirees moving to southern Italy (to municipalities with fewer than 20,000 residents) was extended from 5 to 9 years. Eligible regions include Sicily, Calabria, Sardinia, Campania, Basilicata, Abruzzo, Molise, and Apulia.

A superbonus tax credit (initially 110%) introduced in 2020 for energy-efficient home renovations has been reduced to 70% in 2024 and will be cut to 65% in 2025 due to budget pressures. The policy, while stimulating construction, also fueled public debt nearing 140% of GDP and saw cases of fraud. Additional restrictions were imposed on financial institutions regarding tax credit transfers.

Rental yields in Italy

Gross rental yields in Q1 2025 averaged 7.56% nationwide.

In Rome, yields ranged from 4.74% to 9.14%; in Milan, from 3.22% to 6.92%.

Florence averaged 7.35%, Turin 8.34%, Palermo 8.29%, Naples 7.41%, and Catania 6.8% to 10.08%.

Experts caution that high taxes, maintenance costs, and regulated rent increases (capped at 75% of the consumer price index) reduce net yields. Many landlords prefer long-term leases to secure future income.

Italy’s economic outlook

Italy’s economy remains sluggish. Inflation fell to 1.3% last year but rose to 1.2% in March 2025. Growth projections are modest: 1% in 2025, 1.2% in 2026 (European Commission), with IMF forecasting 0.8% and 0.7% respectively.

The Bank of Italy forecasts GDP growth of 0.6% in 2025, 0.8% in 2026, and 0.7% in 2027, citing trade policy risks but support from consumer spending. Inflation is projected at 1.5% in the next two years, rising to 2% in 2027.