Global Real Estate Market 2024: Price Trends and Forecast from Knight Frank

Knight Frank published its Q4 2024 report, analyzing housing price dynamics in 55 countries. The average annual growth reached just 2.6%, well below the long-term trend of 4.8%. Analysts believe the market will only recover if interest rates continue to fall.

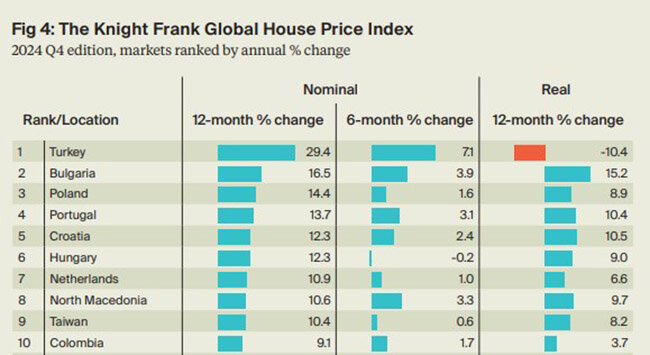

Leaders and Laggards

Turkey topped the nominal growth chart with housing prices rising by 29.4% in a year. However, due to high inflation, real prices dropped by 10.4%, making it the worst-performing market in real terms among the 55 countries tracked. This highlights the importance of analyzing real price dynamics: nominal growth may mask declining purchasing power and investment appeal.

Other strong performers included Bulgaria (+16.5%), Poland (+14.4%), Portugal (+13.7%), Croatia and Hungary (both +12.3%). These countries show strong domestic demand and moderate inflation. However, Hungary showed a slight decline in the second half of the year, potentially signaling market volatility. The Netherlands recovered with a +10.9% increase, alongside North Macedonia (+10.6%) and Taiwan (+10.4%).

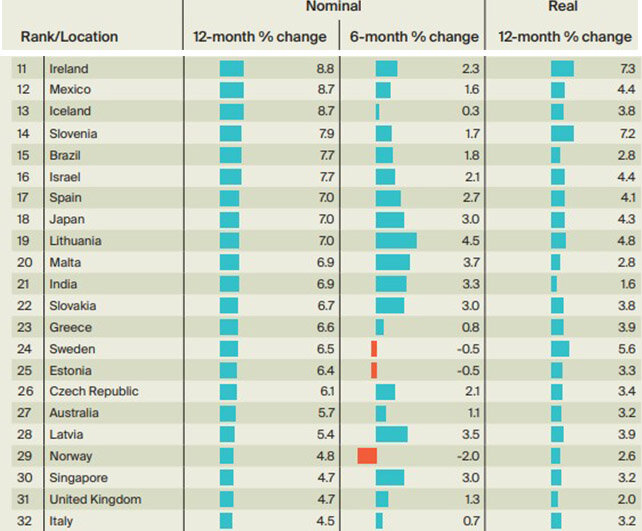

Markets with moderate growth of 5–9% include Ireland, Lithuania, Japan, Slovenia, Israel, Spain, Mexico, and Iceland. Lithuania posted a 4.5% increase in just six months, indicating trend resilience. These regions reflect cautious demand recovery amid stable macroeconomic conditions.

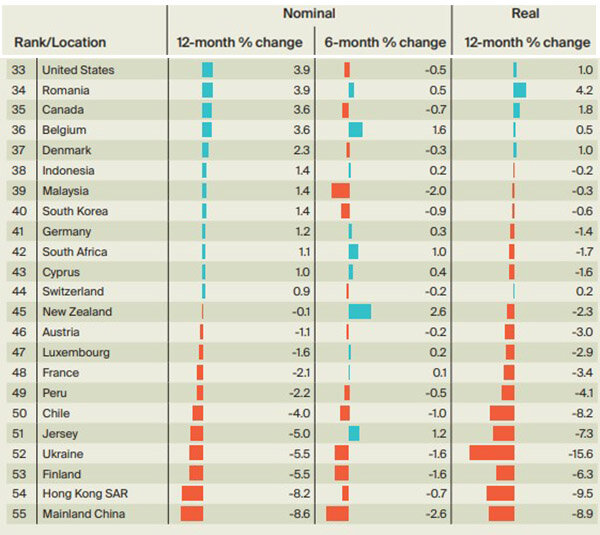

The weakest performers were China (-8.6%), Hong Kong (-8.2%), Finland, and Ukraine (both -5.5%). Other markets in decline included Chile, France, Vienna, and New York, impacted by high rates, falling investor confidence, and weakening demand. In France, housing prices dropped 2.1% amid mortgage inaccessibility and stagnant incomes.

In real terms, global housing prices peaked in Q1 2022 and declined by 3.6% over two years — the steepest drop since the global financial crisis. The decline was driven by high interest rates and surging inflation, especially in Europe and North America. While 80% of countries posted nominal growth, only a few recorded real value gains.

Despite modest Q4 growth, the global housing market remains sluggish. Knight Frank expects further rate cuts in 2025 may support renewed growth — if inflation in developed economies slows down. Liam Bailey, Global Head of Research, notes:

“House prices are rising moderately worldwide. The impact of 2023’s rate cuts is fading, and further easing is needed for sustained growth.”

Prime Real Estate Segment

The Prime Global Cities Index Q4 2024 tracks luxury housing prices in 44 major cities. In 2024, annual price growth in the prime segment reached 3.2% — above mid-year levels, but still below the 20-year average of 5.3%. Two-thirds of cities saw gains, while less than 20% posted declines.

Seoul led with 18.4% growth. Manila rose 17.9% year-on-year despite a 7.6% drop in Q4. Dubai rose 16.9%, Tokyo gained 12.7% yearly and 10.6% quarterly. Other top performers included Nairobi (+8.3%), Delhi (+6.7%), Mumbai (+6.1%), and Madrid (+5.5%). European cities like Lisbon (+5.3%), Zurich (+4%), and Dublin (+3.9%) posted stable growth.

London (-1%), Beijing (-4.2%), Vienna (-2.6%), and Hong Kong (-2.8%) saw price declines, driven by local policy impacts and global investor caution. U.S. cities like New York, San Francisco, and Los Angeles also showed stagnant or negative trends.

Bailey noted that the path to interest rate cuts has become harder as inflation slows less than expected. However, most analysts agree that upcoming rate reductions in 2025 are critical for market recovery.