London’s Luxury Property Market: Downturn Deepens as Investors Exit and Tax Reforms Take Effect

Photo: Unsplash

Prices in London’s luxury housing market have fallen by more than 20% from their peak. Developers are cutting prices, deals are collapsing, and some apartments in new developments remain unsold. Bloomberg reports that the prime property market in the British capital is undergoing a prolonged slump following the abolition of tax benefits for foreign residents and the departure of wealthy buyers.

Just a decade ago, London’s luxury housing market was booming, but now high-end residential complexes often stand partially empty, and buyer interest is waning. A penthouse in Mayfair, initially listed at £100 million, is now valued by Sotheby’s at £68 million. In 2015, Chinese investors acquired a controlling stake in the 60 Curzon project, a building dubbed “Mayfair’s most exclusive address.” However, the developer went bankrupt, and half of the apartments remain unsold.

The luxury residential complex The Bryanston, located by Hyde Park, has sold only half of its 54 apartments since it came onto the market about four years ago. Paul Finch of Beauchamp Estates noted that “the glory days are long gone,” and the margin between success and loss in such projects has become razor thin. Developers are grappling with rising costs and the disappearance of previous levels of demand, as financial models from the early 2010s no longer work. The average time to sell has increased significantly. Quick deals have become the exception, especially in the ultra-luxury segment.

As of May, the number of homes priced at £5 million or more listed for sale reached a record high, rising by 22%. At the same time, demand fell by 15%. Over the first five months of the year, the number of price reductions in this segment increased by 45% compared to the same period in 2024. Experts attribute the trend to stricter tax rules. In the past year, more than 4,400 company executives officially declared relocation abroad, with the exodus accelerating in recent months.

Notably, as of April 2025, the tax relief that had existed for over two centuries and covered around 74,000 non-residents was abolished. The new package of reforms also affected the Stamp Duty Land Tax system. The tax-free threshold for first-time homebuyers was reduced from £425,000 to £300,000, and for all other buyers from £250,000 to £125,000. This has resulted in a sharp increase in tax burdens, with additional costs for first-time buyers alone running into tens of millions of pounds. The non-domicile regime, which had exempted foreign residents in the UK from taxes on overseas income and assets, has also been scrapped.

Against this backdrop, some investors are opting to rent instead of buy. Broker Charles McDowell notes that more clients prefer to “wait and see” until the tax situation becomes clearer. His agency has even launched a new division specializing in luxury rentals. Nick Gregory, Head of Research at LonRes, observes that the market is filled with motivated sellers, but listings often fail to meet buyers’ expectations, or the prices are simply not what buyers are willing to pay.

Another source of pressure on the market is the crackdown on money laundering and unexplained wealth, as well as sanctions imposed on wealthy Russians. For many years, foreign buyers were a key driver in London’s prime segment, but their share has now declined sharply. One individual named in the sanctions lists is Russian billionaire Andrey Guryev, founder of PhosAgro and owner of Witanhurst, the largest private residence in London.

Ben Sanderson, Managing Director of Real Estate at Aviva Investors, emphasizes that the previous era of free capital movement is ending: “Global capital can no longer move around the world as freely as it once did.” Camilla Dell of Black Brick reports a growing number of forced sales through receivership processes. Amid rising maintenance costs and dwindling demand, owners are losing the ability to hold onto their assets. Properties are lingering on the market: one house in West London was initially listed at £6 million but eventually sold after four months with a 15% discount for £5.2 million. In Knightsbridge, the price of one property dropped from £17 million to under £13 million.

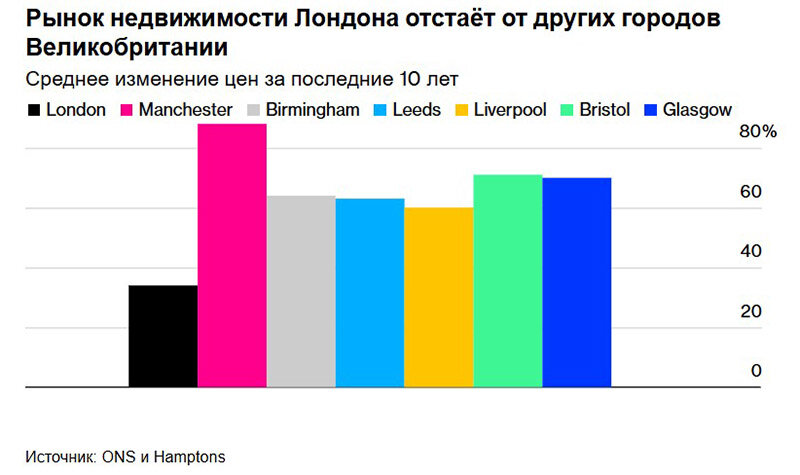

According to ONS and Hamptons, over the past decade, price growth in London has lagged significantly behind other UK regions. This trend is undermining not only the city’s reputation as an investment hub but also the confidence of local market players. Anisha Beveridge, Head of Research at Hamptons, highlights that London is no longer as attractive to buyers as it was ten years ago.

According to Savills, housing prices in London’s prime central areas have fallen by nearly 21% since 2014. The Knight Frank Prime Sales Index, a benchmark for evaluating luxury property prices in the city, peaked in August 2015 and has since declined by 19%.

Forecasts for London remain cautious. Savills expects prices in central districts to fall by another 4% by the end of the year. Black Brick predicts the decline could reach 8–10%.