read also

Global Wealth Map: The U.S. Maintains Leadership, Asia Strengthens Its Position

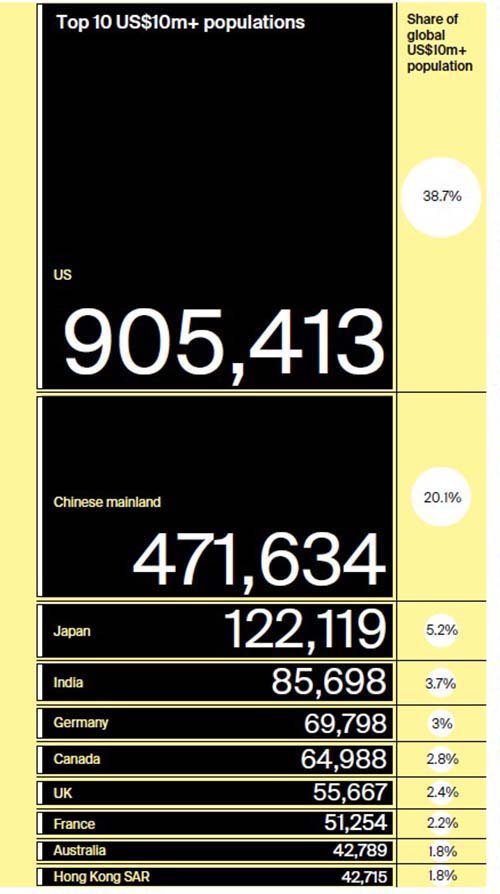

In 2024, almost 39% of the world’s dollar multimillionaires lived in the U.S., exceeding the combined figures of China and Japan, noted in the Knight Frank study. India rose to fourth place for the first time by the number of wealthy individuals, Africa showed one of the fastest growth rates, while Europe, on the contrary, was on the verge of stagnation.

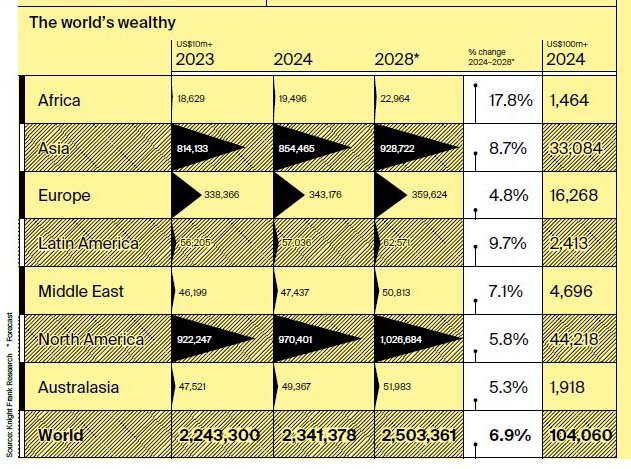

The number of people with wealth above $10 million increased from 2.24 million in 2023 to 2.34 million in 2024 (+4.4%). The category of the ultra-wealthy – those with more than $100 million – includes 104,000 individuals.

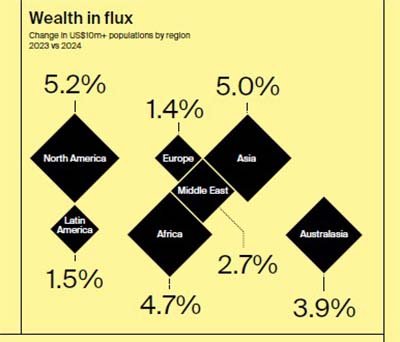

North America remains the world’s largest wealth hub. The number of multimillionaires in the region grew by 5.2% to reach 970,400, of whom 44,200 belong to the ultra-wealthy category ($100 million+). The U.S. leads with 905,400 such individuals – nearly 39% of the global total. That is twice as many as in China and four times more than in Japan.

In 2024, the number of wealthy Americans increased further (+5.2%), supported by stock market growth, a cryptocurrency boom, and the success of leading artificial intelligence companies. “Rate cuts played a key role in sustaining asset price growth,” said HSBC’s chief economist Samuel Pomiero. Canada added 65,000 multimillionaires, securing its place among the top ten wealth-concentrated economies.

Asia moved into second place globally with 854,500 dollar multimillionaires (+5%). China remained the main driver: 471,600 people with wealth above $10 million and a uniquely high share of HNWIs (over 5%). Japan ranked third in the world (122,100), while India rose to fourth for the first time – 85,700, surpassing Germany. A new generation of entrepreneurs is emerging here: “A start-up culture is developing in Asia, especially in India and the Philippines. These companies can scale internationally much faster than before,” emphasized Pomiero. The region counted 33,000 ultra-wealthy ($100 million+), and Asia is becoming the platform for a new technological elite. Hong Kong added another 42,700 multimillionaires, remaining one of the world’s largest financial centers.

Europe showed minimal growth – only 1.4%. The number of dollar multimillionaires reached 343,200, of whom 16,300 were ultra-wealthy. Germany remained the region’s largest economy (69,800 multimillionaires), followed by the U.K. (55,700) and France (51,200).

Experts pointed to structural barriers: low productivity, overloaded social systems, and demographic decline. In 2024, the EU population decreased by 120,000, while the U.S. population grew by 5.5 million. “The scale of the differences is striking: Italy is losing population, while Singapore and other pro-business countries attract those who want to earn more and manage their investments more effectively,” said Jefferies economist Hat Smith.

The Middle East increased its number of multimillionaires by 2.7%, reaching 47,400. Almost 10% of them belonged to the $100 million+ category, a record share among all regions. This structure reflected accumulated “old wealth” formed during the oil and gas era. However, many of the region’s largest economies, primarily Saudi Arabia, were actively investing in tourism, hospitality, technology, biotech, and renewable energy. The coming years will show how successful this diversification proves to be.

Africa became one of the leaders in growth rates (+4.7%), though the base remained small: 19,500 multimillionaires, of whom 1,500 were ultra-wealthy. By 2028, the number of wealthy individuals is projected to rise to 23,000. “Africa is poised to outperform all regions in wealth creation, if not in absolute numbers, then in relative terms,” the report noted. A young population, infrastructure projects, and abundant natural resources provided incentives, while the expanding middle class opened new niches for entrepreneurs.

Latin America added 1.5%, with multimillionaires reaching 57,100, and a 2028 forecast of 62,600. Australasia reported a total of 49,400 (+3.9%) and 1,900 ultra-wealthy. By 2028, the figure is expected to rise to 52,000.

Knight Frank forecasts show that by 2028 the number of dollar multimillionaires will exceed 2.5 million, with an average annual growth rate of 7%. The U.S. and China will maintain unchallenged leadership, but Asia and Africa will shape new centers of wealth thanks to demographic and entrepreneurial potential. Europe, on the other hand, risks being locked in stagnation unless it overcomes demographic decline and structural constraints. The global wealth map in the coming years promises not only growth in absolute numbers but also a redistribution of emphasis in favor of young and dynamic economies.

Подсказки: Global Wealth Map, Knight Frank, global wealth, multimillionaires, USA, China, Europe, Africa, Middle East