Luxury Housing Demand Slumps in Singapore in 2025

Photo: Bloomberg

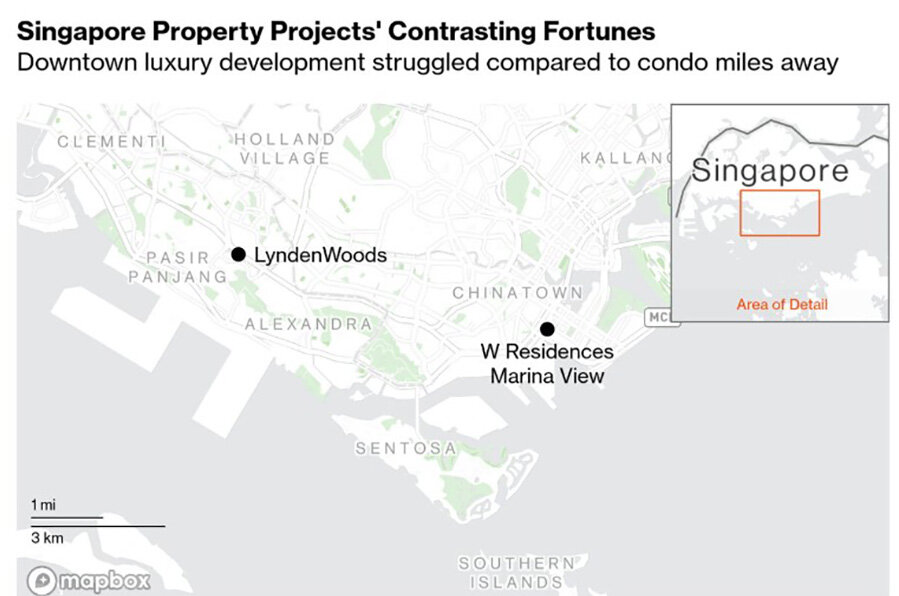

Interest in high-end housing in Singapore is waning. At the sales launch of W Residences Marina View, only two out of 683 units were booked, Bloomberg reports. Key factors include steep taxes for foreign buyers, market saturation, and growing demand for more affordable homes.

Located in Singapore’s central business district, the Marriott-managed luxury complex opened sales with unexpectedly weak results. The starting price was SGD 1.8 million (~USD 1.32 million) for a one-bedroom unit, with per-square-foot pricing from SGD 3,200 (USD 2,500). Five-bedroom penthouses start from SGD 11.6 million (over USD 9 million).

IOI Properties insists that interest remains in W Residences Marina View — private viewings were conducted, and “in the current wave of new launches, buyer caution is natural”. However, since the project is still under construction, early buyers can back out with a penalty, reducing urgency.

The same trend is observed at Skywaters Residences, backed by Alibaba Group and Perennial Holdings. One year after its launch, only two of 190 units have sold. A 721 m² apartment fetched SGD 47.3 million, another sold for SGD 30.9 million. These prices appeal to very few. Developer City Developments Ltd. has yet to announce the launch date for Newport Residences, a 246-unit luxury project with serviced apartments.

According to Savills, in Q1 2025, average prices for premium non-landed homes reached SGD 2,612 per sq. ft. (USD 2,038), up just 0.6% from Q4 2024 and 0.7% year-over-year. Price growth remains flat, reflecting weak top-tier demand.

CBRE reports that the number of new launches in central districts fell 78.7% in Q1 2025 compared to late 2024 — the steepest drop across all regions. Analysts cite oversupply and buyers’ reluctance to invest in unbuilt luxury properties.

Knight Frank shows similar patterns: prices in central districts rose just 0.6% quarterly and 1.7% year-on-year in Q1 2025. Meanwhile, prices in suburban areas grew more significantly. Buyers are shifting to outer districts, drawn by better infrastructure, comfort, and value.

Ultra-luxury sales still exist — albeit in a narrow niche. According to The Straits Times, at least four units priced over SGD 10 million were sold in June 2025. These rare deals highlight a consistent pool of ultra-high-net-worth buyers undeterred by broader market trends.

Mass-market projects show stronger results. LyndenWoods, located 9 km from the city center, sold over 94% of its 343 units in a single day, with an average price of SGD 2,450 per square foot. Over the past five years, private property prices in Singapore rose by 40% — but only 19% in central upscale areas.

Experts point to tax policy as a key pressure on the premium segment. In 2023, the government doubled stamp duties for foreign buyers from 30% to 60%, sharply narrowing the pool of potential investors. Still, developers refuse to cut prices, relying instead on affluent locals and PR-holding expats — both taxed at lower rates. Mogul.sg’s Head of Research Nicholas Mak says developers will remain cautious about land purchases in the CBD and seek to avoid a price war at all costs.

Read also:

Housing Prices in Singapore Continue to Rise Despite Cooling Measures and Weak Demand

Ultra-wealthy Population Set to Grow: Demand for Luxury Property to Intensify

Global Real Estate Trends and Changing Ultra-Rich Behavior: Wealth Report 2025

IMF Ranking: Global Public Debt in 2025

Quality of Life in 2025: CEOWORLD’s Global Leaders and Laggards

Подсказки: Singapore, real estate, luxury property, housing market, foreign buyers, taxes, CBD, W Residences, Marina View, Knight Frank, CBRE, Savills