read also

Georgia’s Real Estate Market: Tbilisi and Batumi Show Growth in 2025

Photo: Unsplash

In the first half of 2025, Georgia’s residential real estate market recorded steady growth in both the number of transactions and price levels. The fastest pace was observed in Batumi, while Tbilisi also maintained a positive trend, according to Colliers Georgia.

Tbilisi

Monthly and Half-Year Dynamics.

In June 2025, 3,363 apartment transactions were registered in the Georgian capital — an 11% increase compared to June 2024. Market volume grew by 21.5% to reach $253 million. The primary market saw an 8.8% increase in deals, while the secondary market surged by 16.6%. The average price per square meter rose by 10.6% in suburban areas and by 9.8% in central districts.

For the first six months of 2025, Tbilisi recorded 19,205 transactions — 0.6% fewer than the previous year. However, total market value rose by 11% to $1.4 billion. New build sales increased by 4.8%, while transactions in the secondary market declined by 14.8%. Price-wise, the most significant increase for new housing was in the city center — 20.6%, partially due to bulk registration of large projects in 2024. Adjusted for that effect, real growth would be 8.8%. In the suburbs, prices grew by 10.5%.

In the secondary market, prices grew by 7.8% in the city center and 9.8% in the suburbs. Overall, despite a minor drop in transaction volume, housing prices continue to rise in both new and old stock.

Foreign Buyers and January–May Activity.

According to Galt & Taggart, there is consistent foreign interest in Tbilisi real estate. From January to May 2025, Israeli citizens accounted for 11% of transactions by major developers, Russians for 2%, and another 10% came from buyers of other nationalities.

During the first five months, 15,865 transactions worth $1.2 billion were recorded in the capital. May sales exceeded the January–April monthly average by 6.4% in the primary and 11.8% in the secondary market.

Developers reported 3,179 apartment sales — nearly unchanged year-over-year. In May, sales jumped 48.1% annually. For projects completing in 2025, 81% of units have already been sold — mostly via installment plans.

Prices on the primary market varied significantly — from $2,467/m² in Vake to $1,019 in Vashlijvari. In some districts, prices ranged over 100% between affordable and premium properties. Average rental yield reached 8.4%, with an average rent of $9.3/m² in May.

Batumi

Monthly and Half-Year Dynamics.

In June 2025, Batumi recorded 1,357 deals — a 25.1% increase YoY. Market value reached $76 million, up 41.5%. New builds saw a 26.7% rise in deals, and the secondary market grew by 11.4%.

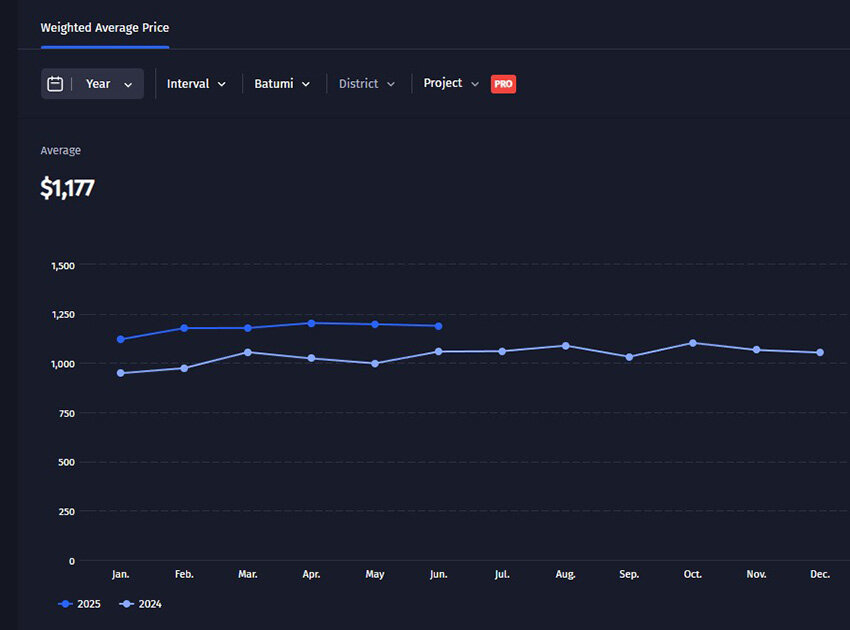

The average price per square meter in new developments rose by 11.8% to $1,185. In the primary segment, prices grew by 9.4%; in the secondary — by 10.3%. Some delayed registrations may slightly distort the perception of growth rates.

For H1 2025, Batumi saw 7,129 transactions, 4.8% higher than the same period in 2024. Market volume grew by 16.1% to $397 million. New home prices rose by 16.1% to $1,184, while old housing surged by 20% to $1,169.

Priority Area.

Experts highlight Gonio district in Batumi as a key investment hotspot. Authorities plan to develop a new resort city with a financial center and SEZ. A master plan by the Ministry of Finance and Economy of Adjara, Colliers International, and HOK envisions beachfront hotels, a crystal lagoon, aquaparks, sports facilities, and 30% green space.

International Brands.

Major hospitality brands are actively investing in Gonio. Projects include Radisson Blu Resort & Residences Batumi Gonio, Wyndham Grand Residences, Pontus Rotana Resort & Spa Gonio, and others — underscoring strong investor confidence.

One of the most notable is Gonio Marina by Eagle Hills (UAE) — the largest private investment in Georgia’s history, covering 260 hectares and set to anchor the region’s future resort cluster.

Record Price Growth.

According to Galt & Taggart, Gonio saw the highest annual price growth in Adjara — 45%, while transaction volume rose 11%. Demand from foreign buyers (UAE, Israel, Europe) is rising. Gonio’s clean sea, mild climate, and mountain-sea landscapes remain key advantages.

Conclusion

Tbilisi and Batumi continue to attract buyers due to price growth, active construction, and strong rental returns. Simplified transactions, developer installment options, and rising international interest, especially in resort areas, reinforce Georgia’s position as a leading real estate destination in the region.