Türkiye will revoke citizenship for hundreds of foreigners for investment

Photo: hurimg.com

Turkey has launched the largest investigation since the start of its “citizenship by investment” programme, reports IMI Daily. Authorities uncovered a fraudulent real-estate scheme that enabled hundreds of foreigners to obtain passports unlawfully; their citizenship will now be revoked.

Interior Minister Ali Yerlikaya specified the exact number of foreign investors at risk of losing citizenship—451. As part of the operation, 106 people were detained across 19 provinces; 1,240 apartments, 47 cars, 65 land plots and corporate assets—including a holding company and five joint-stock companies—were seized. Suspects face charges of forming a criminal organisation, illegal transport of migrants, money laundering, large-scale fraud, and document forgery.

Hürriyet Daily News reports a wider scope—nearly 2,000 people when including investors’ family members. The damage is estimated at $181 million. Figures on suspects also differ: according to the outlet, arrest warrants were issued for 131 people, including the ringleader, two organisers, 46 participants, and 82 real-estate agents.

The fraudulent network—known as BABATAK—circumvented the “citizenship by investment” rules. Foreign applicants entered sham transactions: properties were formally valued at or above the threshold, while debt arrangements guaranteed the property would be returned to the seller after citizenship was granted. As a result, hundreds of passports were issued illegally. Use of forged translations, valuation manipulation, and a large number of intermediaries enabled multimillion-dollar fraud. Authorities said all identified cases will be reviewed and illegally obtained citizenships revoked.

CIP Turkey co-founder Aran Hawker noted he was aware of similar schemes: investors would nominally deposit the required $250,000 but receive about $80,000 back in cash at registration. “Fraud should not be your first step in a new country,” he stressed, adding that legitimate professionals refuse such deals. Hawker also pointed to vulnerabilities in the previous valuation system, where much depended on bank employees. Recent reforms transferred control to the Capital Markets Board, which now assigns valuers randomly.

CIP Turkey co-founder Teymur Polding added that authorities sometimes rejected legitimate applications or left them “in limbo” for long periods due to administrative errors—frequent issues included incorrect submissions and misstatements of source of funds or SWIFT messages.

Serhan Aysever, managing partner at Beyond Global Partners, emphasised that uncovering such schemes highlights key risks potential investors should be aware of. This is not unique to Turkey; similar risks can arise in any market where citizenship or residence permits can be obtained via real-estate investment.

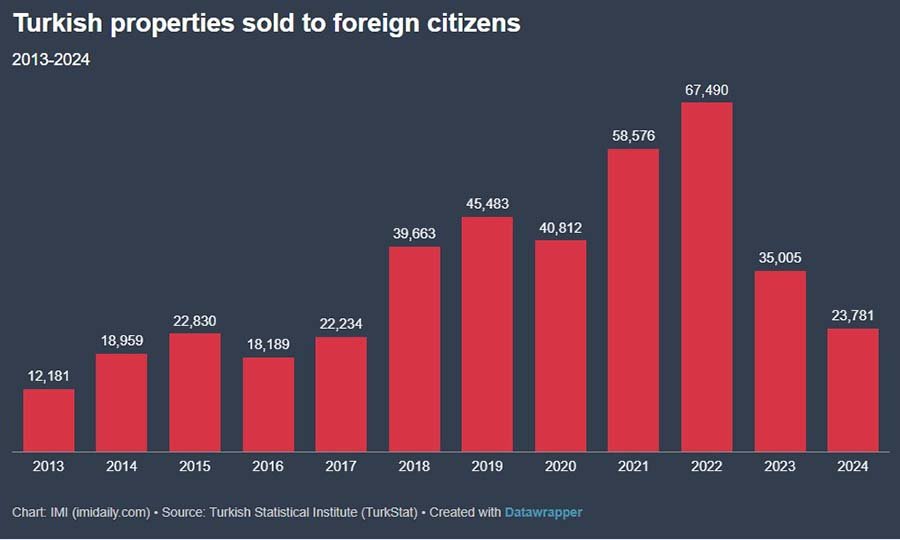

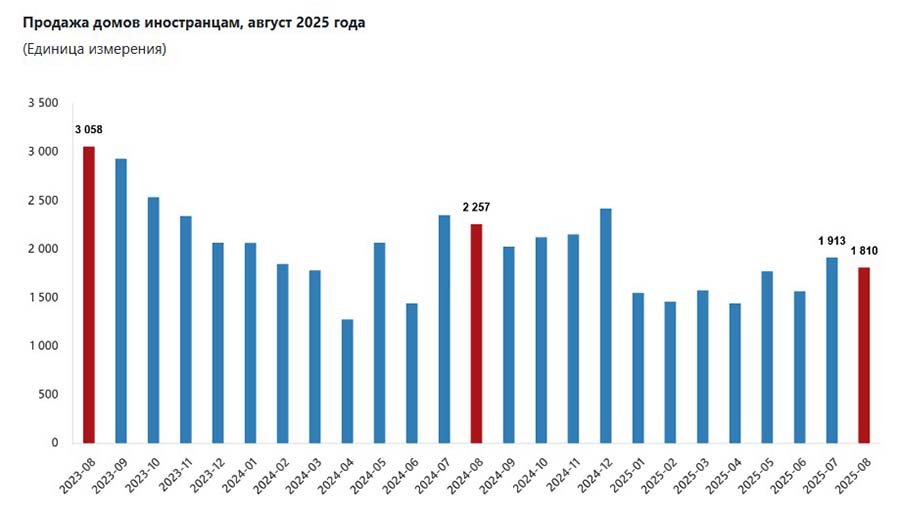

The scandal coincides with a sharp decline in foreign interest in Turkish property. Statistics show a record 67,490 units sold in 2022, dropping to 35,005 in 2023 and 23,781 in 2024. From January to August 2025, foreigners purchased 8,945 homes in Turkey—down 47.2% year-on-year.

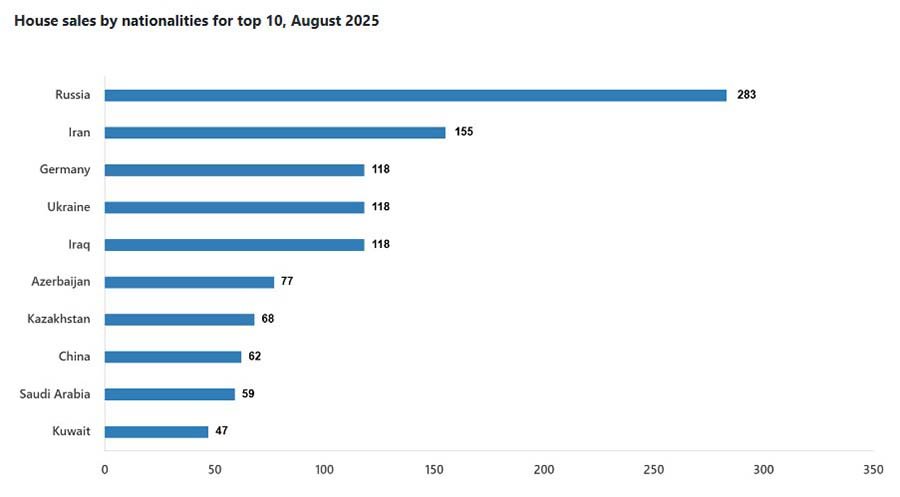

In August, 1,123 properties were sold to foreigners versus 1,987 a year earlier—a 43.5% decline. Leading cities were Antalya (332 deals), Istanbul (310), and Mersin (145). Foreign buyers’ share of the overall market was 1.1%. By nationality, most purchases were made by citizens of Russia (283), Iran (155), and Germany (118)—with steep declines across all countries.

Analysts note the downturn stems from tighter rules for foreigners, higher financial thresholds for residence and citizenship, and weaker returns. The earthquakes of winter 2023—which killed more than 50,000 people—also had a significant negative impact. Experts add that the country remains in a high seismic-risk zone, including Istanbul and popular resorts.

Подсказки: Turkey, citizenship by investment, CBI, real estate, fraud, denaturalisation, foreign buyers, TUİK, Antalya, Istanbul, Mersin, seismic risk, investment policy