read also

Expensive Property in Britain Set to Drop 5% Due to the ‘Mansion Tax’: Hamptons Forecast

Photo: Сonvert-construction.com

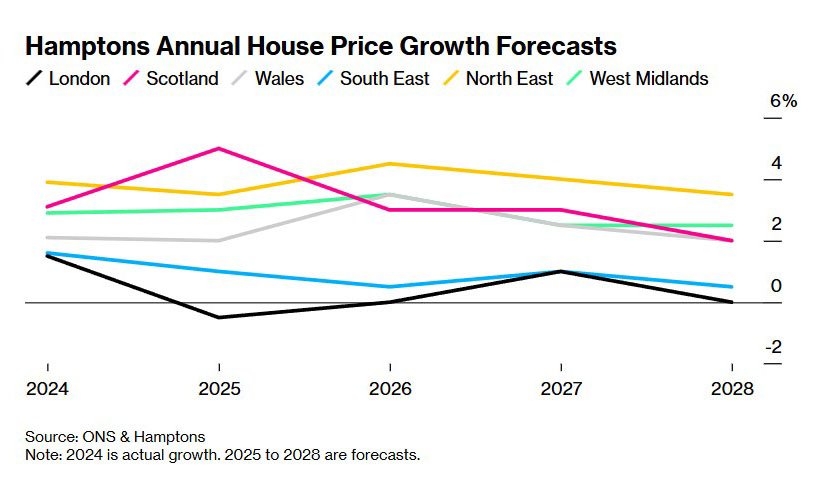

The high-end property market in the UK may face a 5% price drop in 2026, Bloomberg reports, citing a forecast by Hamptons. The correction is linked to preparations for introducing the “mansion tax,” which will increase annual ownership costs for such properties. The strongest pressure will fall on London, where price dynamics are already weaker than in other regions of the country.

Chancellor of the Exchequer Rachel Reeves previously explained that the new levy will apply to homes valued above £2 million ($2.7 million) starting April 2028. The annual surcharge will range from £2,500 to £7,500 ($3,400–10,200) depending on the property’s value. Analysts believe the market will factor in the upcoming changes in advance: the price adjustment in this segment is expected to be a one-off and occur in 2026.

The new “mansion tax” will affect less than 1% of all property in England, but London is expected to feel its impact the most. The majority of homes worth more than £2 million are concentrated in the capital, and agencies already warn that the additional burden may increase turbulence in the local market. In 2025, prices there are expected to fall by 0.5%, while other regions may see growth of up to 5%.

Aneisha Beveridge, Head of Research at Hamptons, notes that the market is under growing pressure from taxes and political uncertainty. London is being slowed by higher stamp duty and concerns about new fiscal measures, reducing seller activity and making buyers more cautious.

Additional instability has also come from earlier changes in the tax regime, including the abolition of the non-dom status, which had allowed wealthy foreign residents to avoid taxes on overseas income. These measures hit London hardest, where the share of foreign buyers has traditionally been higher, further weakening activity in the capital’s segment. Against this backdrop, any new tax decision is perceived particularly sharply by market participants.

According to Knight Frank, between January and August 2025 average prices for prime property in central London have already fallen by 3.2% — the steepest drop since March 2021. Current values are around 20% below the peak reached ten years ago. Experts attribute the trend to changes in the tax regime for foreign owners and weakening external demand. The correction has affected key luxury districts — Kensington and Chelsea, Westminster and part of Islington — where foreign-owned properties are traditionally concentrated.

Hamptons expects London’s weak price dynamics to continue for at least the next two years. The capital will be the only region where no price growth is anticipated next year, while all other parts of the country are forecast to show positive trends. The gap in growth rates may widen to 16 percentage points between 2024 and 2028.

Further easing of monetary policy is also expected. The base rate may continue to decline and stabilise around 3.25% by the end of 2026. This increases the likelihood that mortgage rates will fall below 4%, which should support demand. London is no longer leading in price growth: since the market recovery after the 2008 crisis, the Midlands has shown stronger performance.

Economists note that the “mansion tax” may be only the first step toward a broader reform. In the UK, even small and temporary fiscal measures tend to evolve into permanent revenue sources — as happened with the stamp duty introduced in the 17th century, which now brings the budget more than £10 billion a year.

Minouche Shafik, the Prime Minister’s chief adviser, who led the Resolution Foundation study, supported the shift to a proportional property tax (PPT). Under such a model, owners of expensive homes would pay significantly more: for a £5 million property, the annual tax would reach £25,000 instead of £7,500 under the current system.

The emerging administrative infrastructure for the new tax and the upcoming large-scale property revaluation make further expansion almost inevitable. International experience — France, Switzerland, Norway — shows that property taxes tend to intensify over time, so the current format is unlikely to remain final.

Analysts at International Investment note that conditions for investors have become less favourable. Sharp changes in tax policy slow down decision-making and force investors to revise their strategies. As a result, many wealthy buyers turn to markets with more stable rules and lower ownership costs, increasing competition for London and other UK locations in the premium segment.