Phuket Tourism in 2024: Growth Amid External Challenges

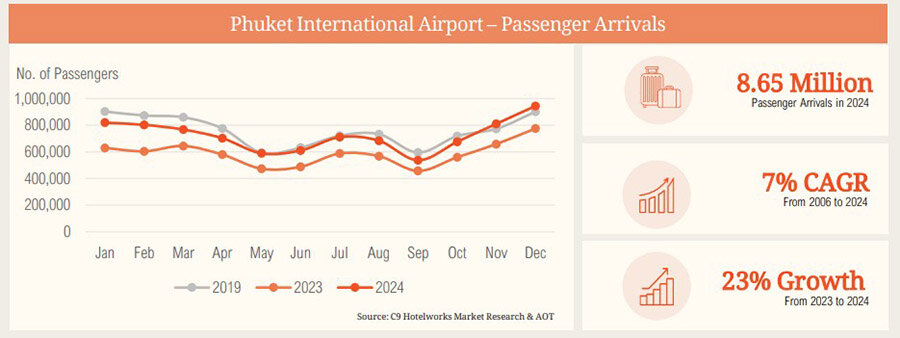

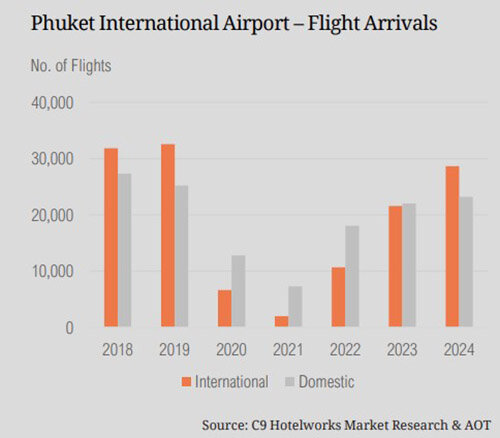

According to C9 Hotelworks, Phuket recorded 8.65 million visits in 2024, a 23% increase from 2023 and just 5% below pre-pandemic levels in 2019. Despite strong growth in arrivals, ongoing competition and external risks continue to hinder full recovery—both for the island and for Thailand as a whole.

Who’s Visiting Phuket?

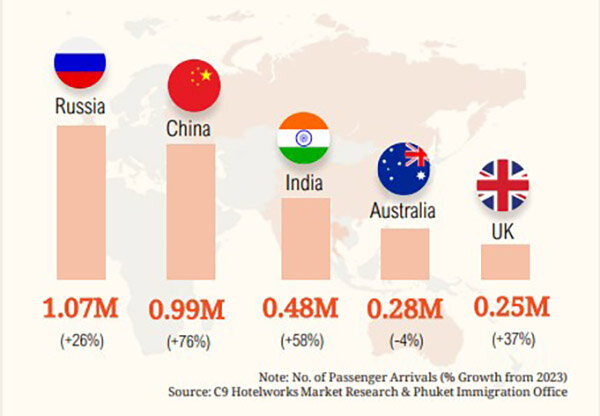

The top source markets for Phuket in 2024 were:

- Russia (1.07 million arrivals)

- India (481,000)

- China (998,000)

Together, these countries accounted for 45% of international arrivals to the island. While Chinese arrivals surged by 76% year-over-year, they remain far below the pre-pandemic peak of 3.12 million.

Luxury travelers continue to favor Bang Tao / Cherngtalay and Kamala, where premium infrastructure is booming—from private residences and luxury resorts to beach clubs and lifestyle hubs. Notable examples include the newly opened Anantara Life Center Phuket and the upcoming Mucho Amor Beach Club.

In 2024, average hotel occupancy on Phuket reached 69% (up from 64% in 2023), while the average daily rate (ADR) increased by 11%, reaching 5,241 baht ($155 USD).

The Bang Tao / Cherngtalay area stood out with an average stay length rising from 6.72 to 7.67 nights (+14%).

Tourist demographics also shifted:

58% of international arrivals were aged 18 to 44.

Average spending per visitor rose 4% to 37,440 baht ($1,103).

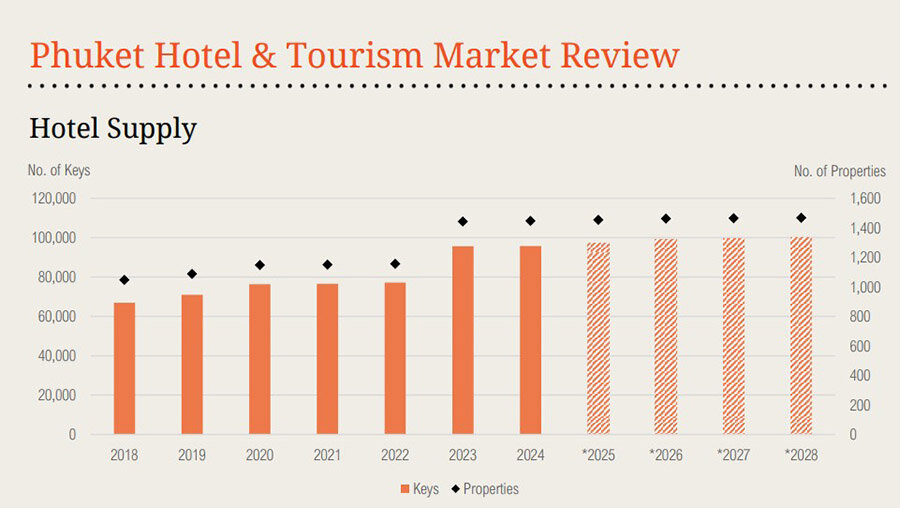

Between 2025 and 2028, 20 new hotels are expected to open, potentially increasing total room inventory on the island to over 99,000 rooms.

China Prefers Japan?

In 2024, Thailand welcomed 32.7 million foreign visitors, generating 1.5 trillion baht ($43 billion) in revenue. The leading source markets were:

- China (6.3 million)

- Malaysia (4.6 million)

- India (1.9 million)

- South Korea (1.7 million)

- Russia (1.5 million)

But Thailand’s dominance among Chinese travelers is weakening. In January 2025, Japan attracted 980,000 Chinese tourists, while Thailand saw just 711,000.

Analysts point to Japan’s weak yen, improved logistics, and perception as a safe, high-quality destination. A recent incident involving Chinese actor Wang Xin, who vanished while filming near Thailand’s Mae Sot border, further damaged the kingdom’s image—despite official statements denying Thai involvement. According to Bloomberg Intelligence, flight cancellations from China to Thailand surged 94%.

To counter this, the Thai government is investing in premium segments, halal tourism, and infrastructure. It also plans to introduce a 300 baht (~$9 USD) tourist tax per entry. While the funds are earmarked for infrastructure and emergencies, industry stakeholders worry it could discourage travelers.

Tourism experts argue for decentralizing tourism beyond Phuket and Bangkok to meet demand for diverse experiences. The Thai Hotels Association urges the promotion of lesser-known destinations tailored to different interests and budgets.

What’s Next?

Phuket remains a core pillar of Thailand’s tourism strategy. Its appeal to affluent travelers, ongoing infrastructure development, and improving key metrics offer strong growth potential.

However, without addressing rising competition, especially from Japan, and diversifying beyond Phuket, sustained success may be elusive. The Thai tourism industry stands at a crossroads—one that requires less complacency and more adaptability to meet changing global traveler expectations.