Georgia Sees Tourism Boom in 2025: Visitor Numbers, Hotel Occupancy and Revenues on the Rise

As of July 2025, Georgia’s tourism industry continues its upward trend, recording notable increases in international arrivals, hotel occupancy rates, and tourism-related revenues. Investments in infrastructure—especially in the premium hotel sector—are gaining momentum, and global hospitality brands are expanding their presence.

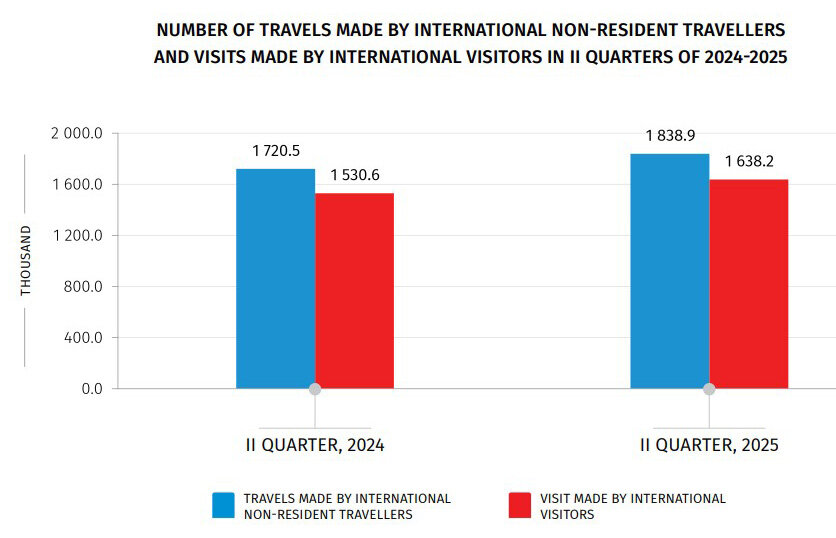

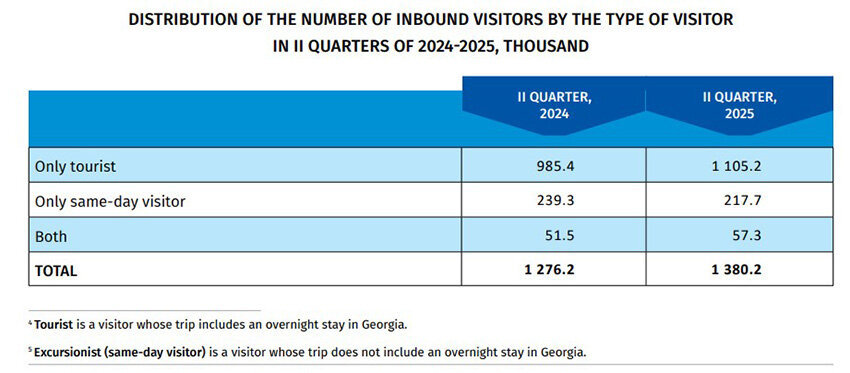

According to Georgia’s National Statistics Office, 1.8 million international visits were registered in Q2 2025, a 6.9% increase year-on-year【source】.

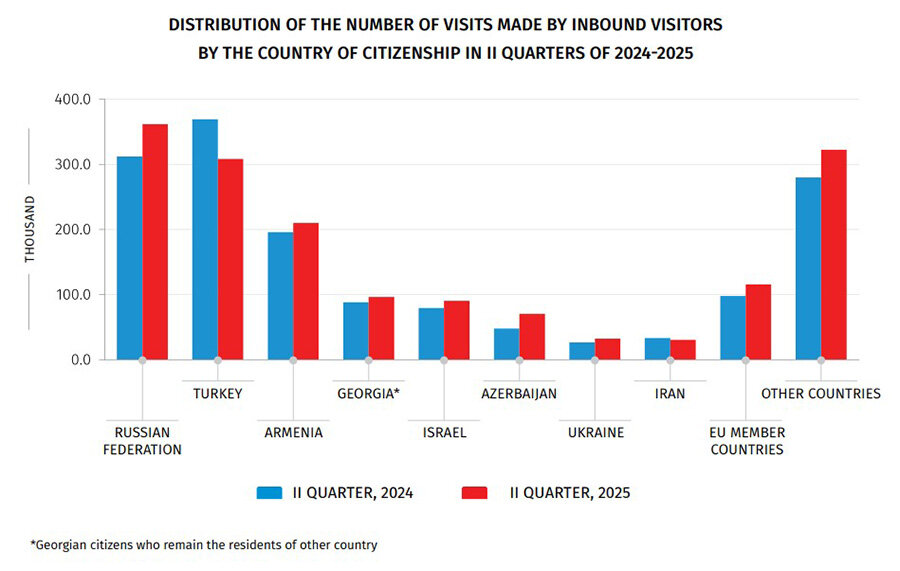

Top source markets remain unchanged:

Russia: 361,800 visits

Turkey: 308,300

Armenia: 210,000

Visitor numbers from Israel and Azerbaijan also rose significantly.

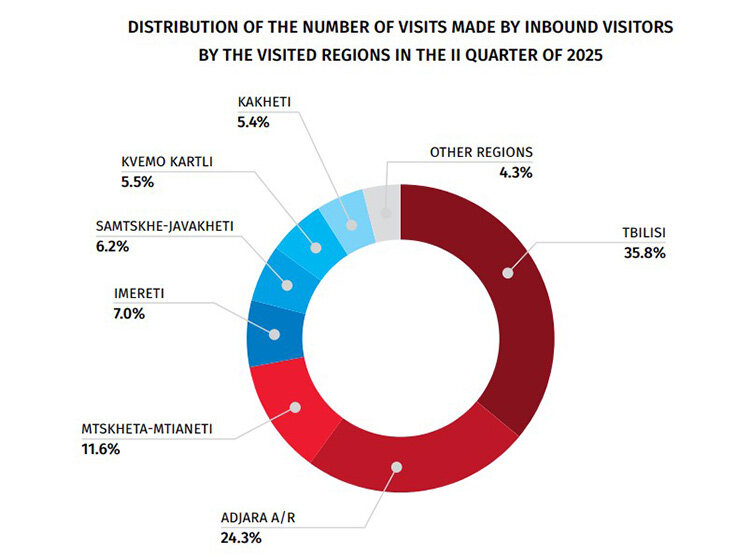

The majority of travelers visited Tbilisi (928,300) and Adjara (629,800). Mtskheta-Mtianeti and Imereti also reported high inflows.

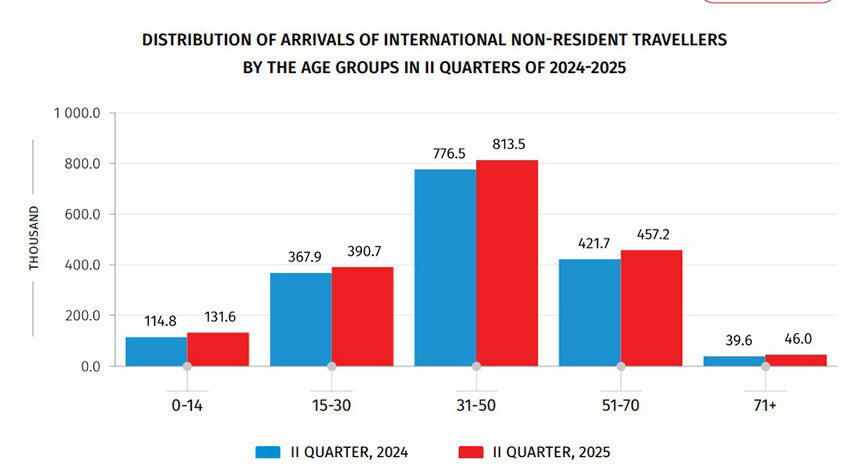

In Q2, visitors aged 31–50 made up 46.5% of total arrivals. Youth travelers (15–30) accounted for 24.7%, while 28.8% were aged 51+. Female travelers made up 41.8%.

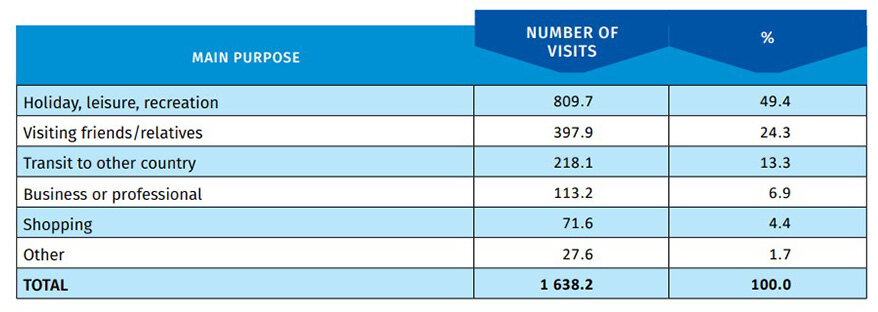

Average trip duration rose by 4.7% to 5.30 nights. Repeat visits accounted for 78.1% of trips. According to surveys, 49.4% came for leisure, 24.3% to visit friends and relatives. Other reasons:

Transit: 13.3%

Business: 6.9%

Shopping: 4.4%

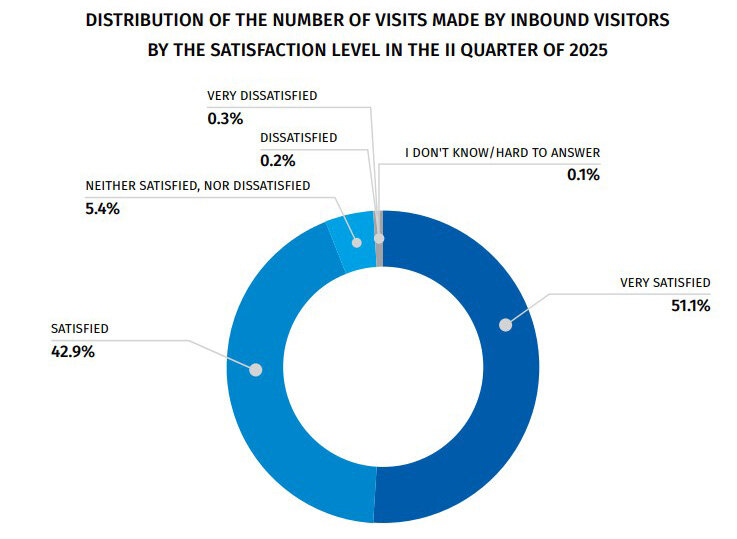

Satisfaction remained high: 81.3% rated their experience positively.

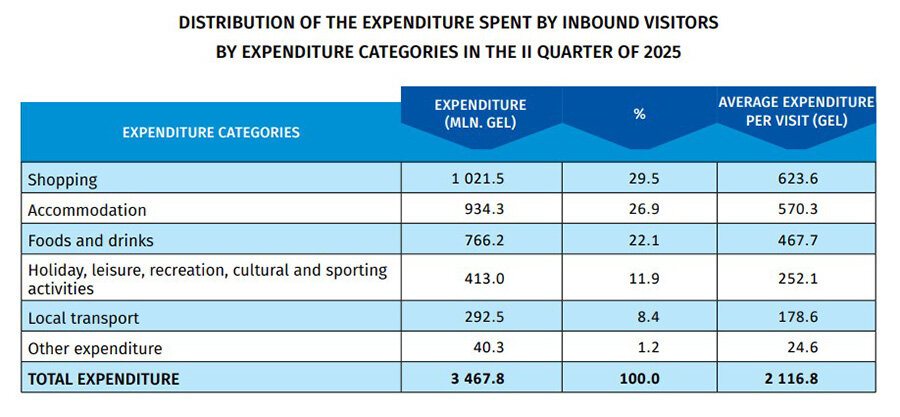

Tourism revenue trends:

Total international tourist spending grew by 0.6% to 3.47 billion GEL

Average spend per trip dropped 6% to 2,116.8 GEL

Top spending categories:

Shopping: 1.02 billion GEL

Accommodation: 934 million GEL

Dining: 766 million GEL

Entertainment: 413 million GEL

Transport: 292 million GEL

According to TBC Capital, the first half of 2025 saw 2.81 million international visits (+4.6% YoY).

Israel and Azerbaijan: +36%

India: +31%

Russia, EU, UK: +10%

Total international tourism income reached $1.97 billion, up 3.8% compared to H1 2024.

Top source markets by revenue:

Russia: $308 million

EU & UK: $277 million

Israel: $242 million

Hospitality sector highlights:

Premium hotel occupancy reached 54% in H1 2025, +4% YoY

Average Daily Rate (ADR): $126

International hotel brands are actively expanding

Batumi suburbs, especially Gonio, are emerging as investment hotspots【source】

In Gonio, supported by a national development plan and private capital, real estate prices surged 45% and sales rose 11%. EU, Israeli and Gulf investors are showing growing interest.