Russia’s Economy – Stabilization or the Start of a Recession?

Photo: Unsplash

The Central Bank of Russia has cut the key interest rate and declared signs of a gradual return to balanced economic growth. Inflation is slowing down faster than expected, and the regulator claims that tight monetary policy is working. However, a deeper dive into economic data and global analytics points to growing risks and signs of stagnation.

Easing Without Acceleration

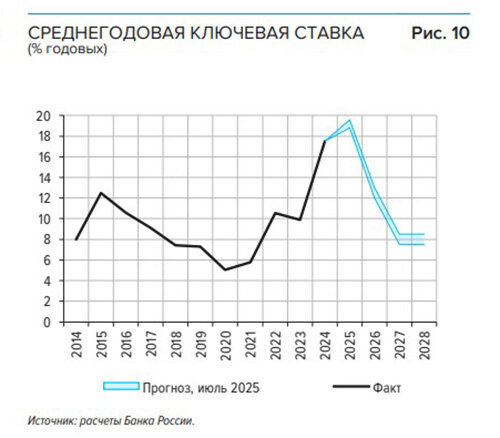

On August 6, 2025, the Bank of Russia lowered the key rate by 2 percentage points to 18% annually. The decision came amid weakening domestic demand and faster-than-expected disinflation. The regulator hinted at more adjustments in the coming months. However, the rate remains high: it is expected to average 18.8–19.6% in 2025, drop to 12–13% in 2026, and reach 7.5–8.5% by 2028, aligning with a neutral policy stance.

Money supply is projected to grow by 6–9% in 2025, down from 15% last year. In 2026, the range will be 5–10%, and in 2027–2028 – 8–11%, signaling deliberate economic cooling aimed at reducing inflation. Corporate lending remains active (9–12% growth forecast), while consumer credit is stagnating (1–4% growth). A recovery is not expected before 2026.

The current account surplus shrank to $20 billion in H1 2025, compared to $36 billion a year earlier. Export revenues are declining while imports rise. Capital outflows slowed: $13 billion was withdrawn by the private sector, half of last year’s total. The yearly surplus is expected at $44 billion in 2025, and $53 billion in 2026. International reserves stand at $593 billion mid-year and may reach $645 billion by 2028.

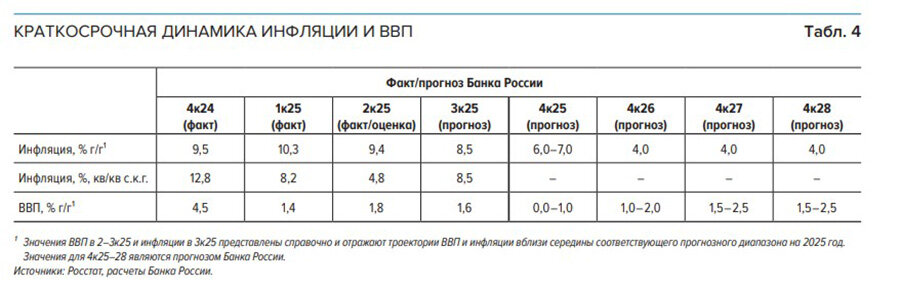

Inflation and GDP: Outlook

Annual inflation slowed to 9.4% in Q2, with seasonally adjusted rates close to 4.8%. In June, the figure neared the Central Bank’s 4% target. A temporary rise is possible in Q3 due to tariff adjustments, but year-end inflation is expected to fall to 6–7%, and return to 4% in 2026. Core inflation shows similar trends: 8.6% in Q2 2025, heading to 4% in 2026. Inflation expectations are falling but remain above target.

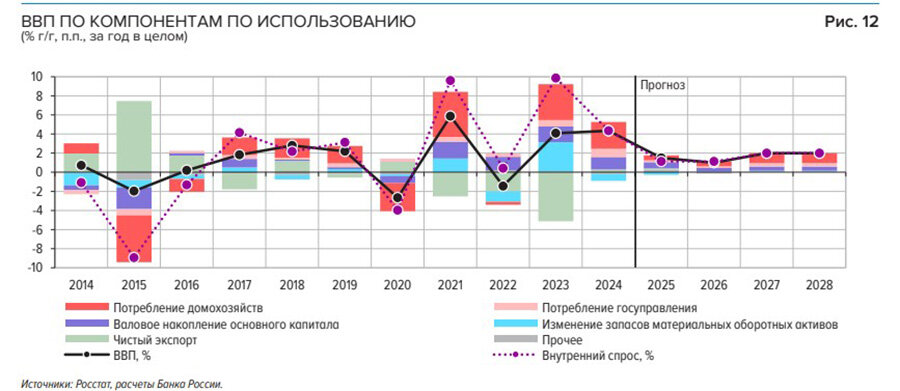

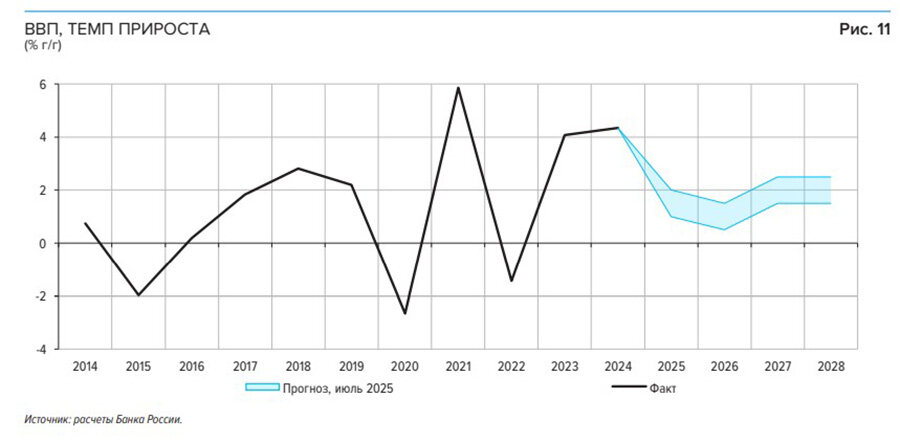

Russia's GDP grew 1.4% YoY in Q1 2025 — below the 2% forecast. Q2 growth hit 1.8%, close to projections. The main drag was weaker domestic demand. Household spending rose by just 3%, and government spending by 1.4%. Investment drove growth: fixed capital investment grew by 8.5%. But companies cut inventories sharply — the steepest drop since 2009 — and net exports contributed negatively.

Q3 growth is projected at 1.6% YoY; Q4 may slow to 0–1% due to a high base effect. Full-year GDP growth is expected between 1–2%. Depending on demand and global trends, growth could range from 0.5% to 2.5%. In 2026, GDP is expected to rise 0.5–1.5%; in 2027–2028, 1.5–2.5%.

Alternative Views

Alexander Kolyandr (CEPA) called the “balanced growth trajectory” a euphemism for economic anemia, warning of long-term recession risks. S&P Global reported the sharpest three-year drop in Russia’s manufacturing PMI in July, driven by weak demand and client solvency issues. Business confidence is at a post-2022 low.

Business Insider notes that despite falling inflation (from 8.2% in Q1 to 4.8% in Q2), GDP is losing momentum. The IMF projects only 0.9% growth in 2025. High interest rates curb inflation but also reduce loan availability, harming consumption and investment. Confidence remains low, with limited foreign capital inflows.

Bloomberg writes that Russia’s $2 trillion economy is showing cracks: “The fractures are becoming visible.” Even Economy Minister Maxim Reshetnikov admitted that recession risks are mounting.

“There’s growing evidence that many sectors are facing serious trouble,” says Alex Kokcharov of Bloomberg Economics. War consequences, sanctions, labor shortages, falling oil prices, a stronger ruble, and high interest rates are taking their toll.

Demand is falling in steel and construction. Severstal’s CEO forecasts a 10% domestic steel demand drop. Auto sales in June declined by 30% YoY. The coal sector is struggling with sanctions, equipment shortages, and long logistics delays.

Banks are concerned about credit quality. According to Bloomberg, major banks may seek state aid if defaults rise. Internal borrower assessments are far worse than official data. Sberbank CEO Herman Gref acknowledged rising corporate loan restructuring.

Sofia Donets, chief economist at T-Investments, said only defense-related sectors are growing. Civilian sectors are declining, and risks will continue to build.

Подсказки: Russia, economy, recession, inflation, interest rates, GDP, Central Bank, monetary policy, investment, economic forecast