Вusiness / Real Estate / Investments / Analytics / Research / Netherlands / Real Estate Netherlands 16.06.2025

Netherlands Commercial Real Estate 2025: Logistics Leads as Investors Return Cautiously

After a period of uncertainty in 2023–2024, the Dutch commercial real estate market is showing signs of recovery. According to Cushman & Wakefield, logistics remains the top-performing sector, attracting both tenants and investors. However, the rebound comes with new risks, ranging from fiscal tightening to growing infrastructure constraints that increasingly influence site selection.

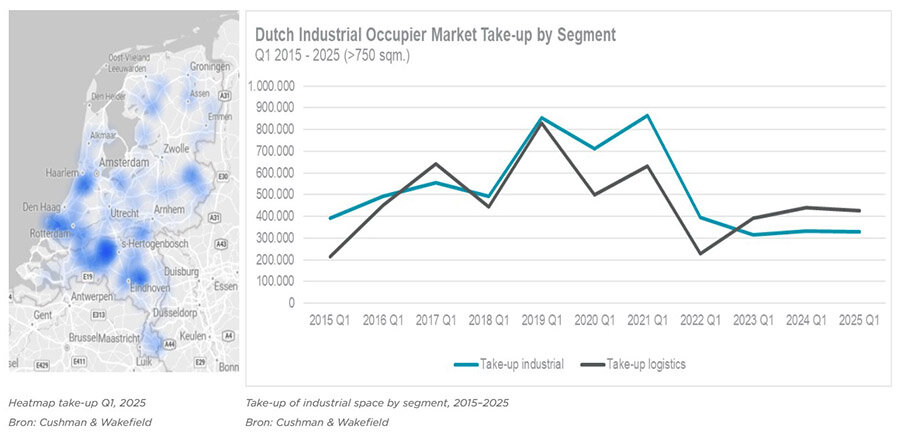

Record Start for the Industrial Sector

In Q1 2025, industrial take-up reached 753,000 sq. m, with logistics accounting for 57% (425,000 sq. m), while traditional industrial assets made up the remaining 43% (328,000 sq. m). This underscores the ongoing dominance of logistics demand.

Large transactions continue to bolster confidence. In Rotterdam, Karl Rapp leased 41,000 sq. m from Citylink; Brouwers Logistics secured 36,500 sq. m in Drunen; and Dorel Juvenile extended and expanded its lease by 10,000 sq. m.

The Netherlands maintains its position as a core European logistics hub due to its advantageous location, modern infrastructure, and digital maturity. Key regions include South Holland, North Brabant, and Limburg, while Utrecht and Friesland saw more moderate activity.

Location Gaps Widen

The divergence between prime and secondary locations has grown in 2025. In major logistics hubs — Rotterdam, Amsterdam, and Breda — rents remain high, driven by limited supply and inflation-beating price growth.

Secondary locations are drawing increased interest as landlords offer incentives like rent-free periods and discounts. According to Sander van Teijl, Head of Agency at Cushman & Wakefield Netherlands, investments in sustainability and energy efficiency could improve competitiveness in these emerging submarkets: “This is a path toward a more balanced market,” he stated.

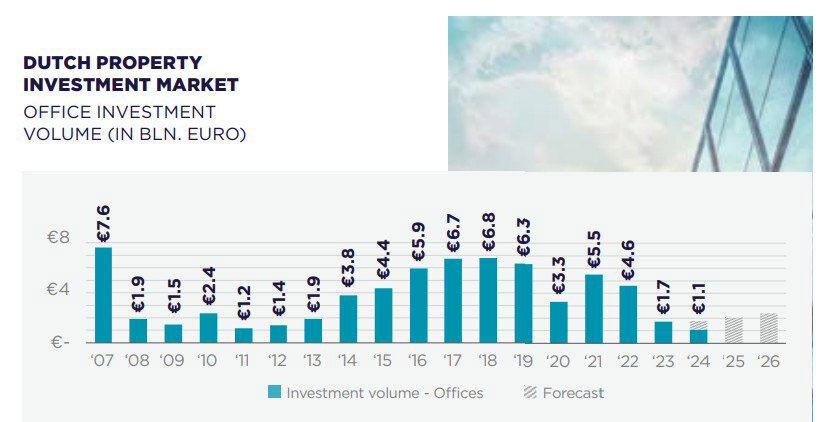

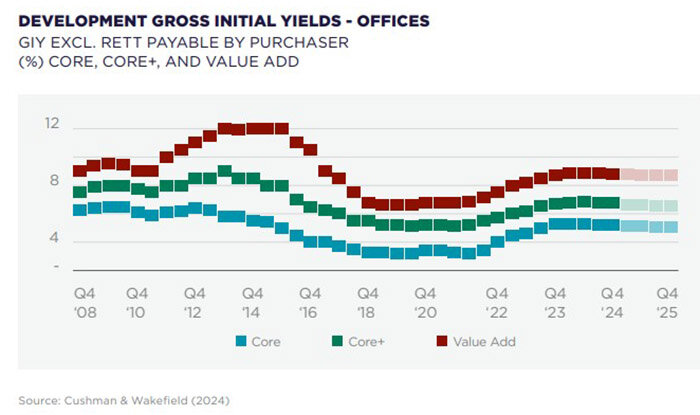

Office Sector Still Lagging

The office segment remains under pressure due to excess outdated stock and limited supply of hybrid-friendly workspaces. Tenants increasingly demand flexible layouts and high energy efficiency. Without modernization, landlords are often forced to offer concessions to retain tenants.

According to Cushman & Wakefield, this segment has yet to show signs of a turnaround. Modern buildings in major CBDs remain resilient due to their quality standards, accessibility, and ESG compliance, while peripheral locations face growing vacancy for obsolete stock.

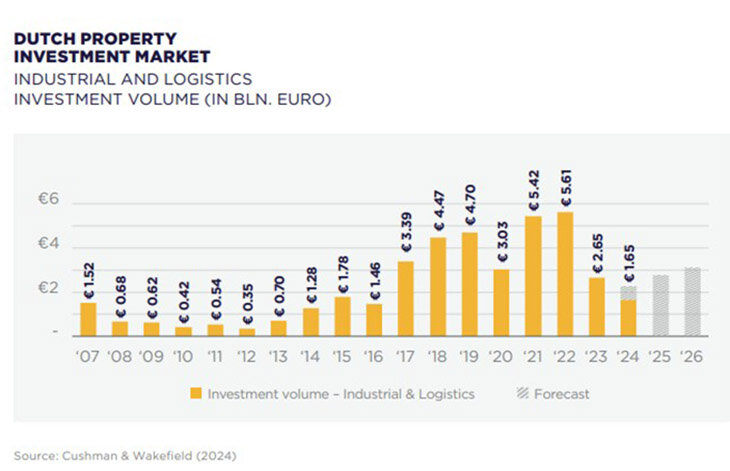

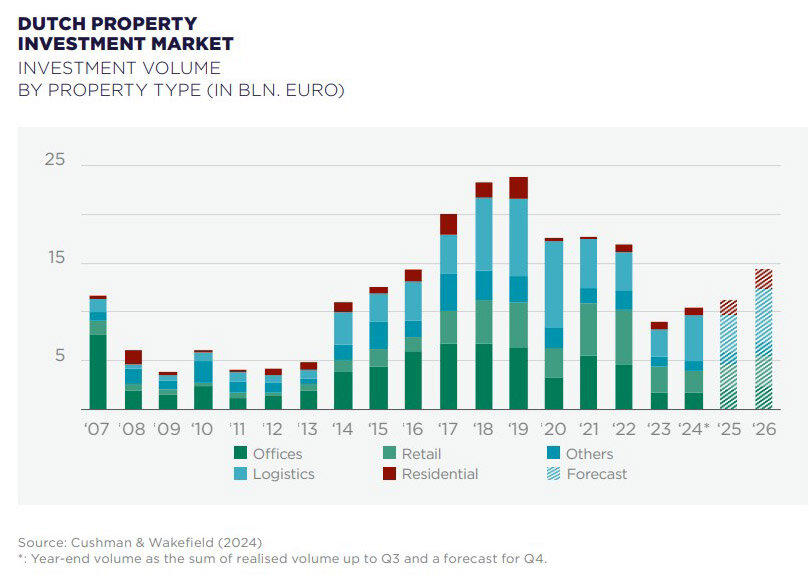

Investment Climate: Recovery With Caution

In 2025, falling interest rates and greater capital access are fueling a new investment cycle. However, optimism remains cautious. Investors are developing strategies but proceed selectively.

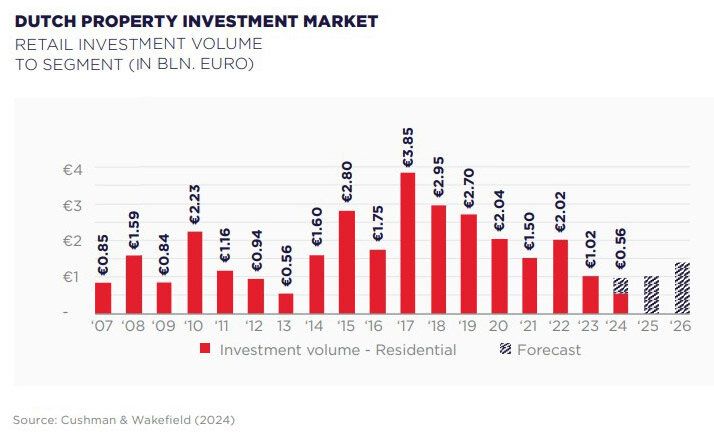

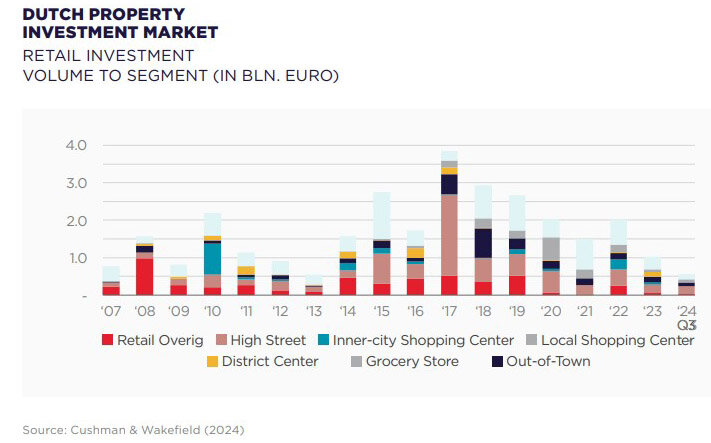

The market faces headwinds from new tax measures and regulatory burdens, which have made the Dutch market less competitive for foreign funds. Nevertheless, logistics, industrial, and select retail assets are showing early signs of recovery.

In retail, activity is returning gradually, with deals involving retail parks in North Brabant and Gelderland and rising interest in grocery-anchored supermarkets. Investors increasingly favor sustainable formats such as retail parks and long-term supermarket leases, which are expected to drive demand in upcoming quarters.

New Infrastructure & Environmental Challenges

Infrastructure and environmental compatibility are becoming key concerns. Tenants and investors now evaluate:

power grid access,

water supply,

nitrogen emissions compliance.

ESG-certified buildings enjoy stronger demand due to lower operational costs and reputational resilience, while non-compliant assets risk devaluation and prolonged vacancy.

Outlook: Growth Opportunities Amid Structural Shifts

2025 marks a transition year for Dutch commercial real estate. Logistics, industrial assets, and sustainable retail formats drive growth, while the office sector awaits structural change and functional reinvention.

Success will hinge on companies’ ability to navigate:

stricter environmental rules,

power supply limitations,

fiscal policy changes,

and capital availability.

According to Cushman & Wakefield, those who adapt flexibly and invest in quality will emerge as market leaders.

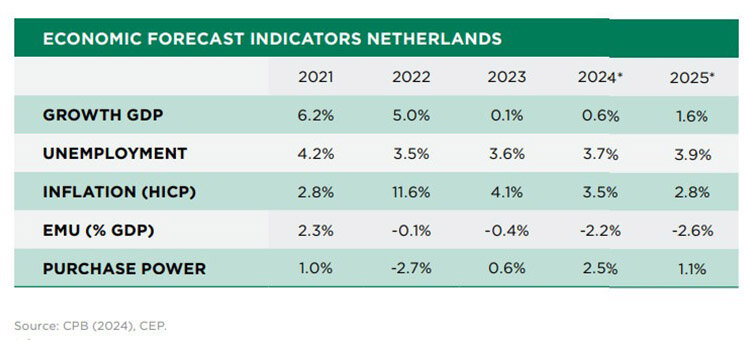

The Dutch economy itself reflects a dual nature: historically low unemployment, rising wages, and stronger purchasing power on one side, but global trade tensions, high interest rates, and persistent geopolitical risks on the other. While uncertainty remains elevated, Dutch business conditions are expected to improve in 2025, supported by rebounding global trade, stronger exports, and rising business investment as credit conditions ease — even as U.S. tariffs could weigh on external growth prospects.