read also

Rising Consumption and Declining Rental Rates in China’s Shopping Malls

Photo: Wikimedia

In the first quarter of 2025, China’s retail property market showed a mixed performance, according to JLL analysts. The consumer sector rebounded thanks to government support, but tenant demand remained limited, and confidence has yet to turn into sustainable recovery.

Retail sales in January–March rose by 4.6% year-on-year to RMB 124.7 trillion, with growth accelerating by 1.1 percentage points. Urban sales grew 4.5%, while rural sales increased 4.9%. Both goods and catering services expanded almost equally—4.6% and 4.7%, respectively. The strongest growth came from sports and entertainment products (+25.4%), supporting the expansion of related brands in the offline segment.

A major boost came from the “old-to-new upgrade” program: electronics sales jumped 26.9%, stationery 21.7%, home appliances 19.3%, and furniture 18.1%. Shopping malls actively embraced these categories. Online sales grew 7.9%, reaching 24% of total retail turnover. In March, retail growth accelerated to 5.9%, signaling stabilization of consumer demand.

Market Dynamics and Mall Transformations

No significant new projects entered the market in Q1: many were postponed, while developers adopted a cautious stance. Companies shifted focus from expansion to managing existing assets. In Chengdu, the “Wuhou Wanda Plaza” was converted into the “Shangpin Plaza” outlet with a new tenant mix, while another mall was rebranded as “Jinjiang Joy City.” In Nanjing, “Qiaobei MixC” ceased operations. These changes reflect intensifying competition and the need to relaunch projects to retain customers.

Vacancy rates continued to rise amid weak demand. JLL reports that in 21 major cities, vacancies reached 10.4%, up 0.2 pp from the end of 2024. In leading megacities, the rate climbed to 7.9%—a trend persisting for two consecutive quarters.

In second-tier cities, growth was moderate, while less-developed centers remained stable. Against this backdrop, rental rates kept falling. Average ground-floor rents in shopping malls dropped 3.9% year-on-year, with the pace of decline accelerating. Developers and tenants increasingly negotiate base rent reductions and risk-sharing models.

Shifting Demand and New Consumer Trends

Although under pressure, demand is shifting toward new growth drivers. Sports brands continue their expansion and open stores in major cities. A growing number of malls incorporate national culture and elements of “intangible heritage”—from crafts to cuisine and art—as tools to attract younger consumers and create unique shopping experiences.

However, fashion, jewelry, and restaurants remain constrained by declining household incomes and limited spending power.

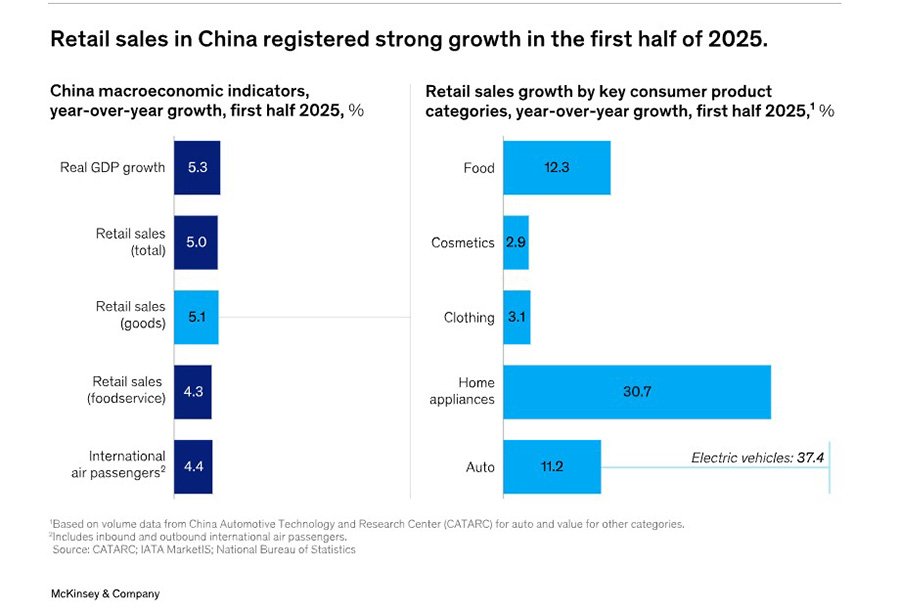

According to McKinsey, retail sales in China grew 5% in H1 2025, with May accelerating to 6.4%. Food was the standout category, up 12.3%. New distribution channels also grew: snack stores, Sam’s Club and Aldi formats, regional discounters, and new beverage categories like energy drinks and sugar-free teas. The 618 online sales festival saw GMV increase 15.2%, with the biggest gains in home appliances, sports goods, and health products.

Outlook for 2025

JLL forecasts that up to 9 million sq. m of new retail space could be added across 21 key Chinese cities in 2025, though 10–20% of projects may be delayed. Beijing and Shanghai plan to add 800,000–1,000,000 sq. m each, keeping supply highly concentrated in the largest hubs. In this environment, vacancy rates are expected to keep rising, and rents will remain under pressure.

For developers and tenants, 2025 will be a year of adaptation: competition for consumers will intensify, and new projects will need to reconsider terms and seek innovative solutions.

Подсказки: China, retail market, shopping malls, rental rates, consumption, real estate, JLL, McKinsey, Beijing, Shanghai, investment