Вusiness / Real Estate / Investments / Analytics / Reviews / News / Georgia / Real Estate Georgia 05.09.2025

Rental Housing in Georgia: Yields and the Most Profitable Areas

Photo: Bm.ge

Private individuals in Georgia earned more than 340 million GEL from renting out real estate in January–July 2025, up 12% compared to the same period in 2024, reports Bm.ge, citing the Revenue Service. Renting remains one of the most popular ways of generating income.

In January 2025, rental revenues reached 44 million GEL, and in July, at the peak of the season, they rose to 52.1 million GEL. On average, the market generated about 49 million GEL per month over seven months, reflecting both seasonal fluctuations and overall growth. The number of individuals renting out property also increased: from 23,900 in January to 28,300 in July, about 2,000 more than a year earlier. The Revenue Service notes that growth is driven not only by rising demand but also by more landlords registering rentals officially and being included in tax statistics.

The average monthly income per landlord in January–July was 1,835 GEL, or around $680. These figures cover both residential and commercial real estate, and official registration of contracts helps reflect profitability levels more accurately in statistics.

According to Galt & Taggart, rental prices in Tbilisi continue to decline. In June 2025, the average price stood at $9.4 per sq. m, down from $9.9 a year earlier and $11.4 in 2023. Despite this, overall market revenues are growing thanks to more landlords and official registrations.

Experts from Global Property Guide estimate the average rental yield in Georgia at 7.53% in Q1 2025 and 7.90% in Q3.

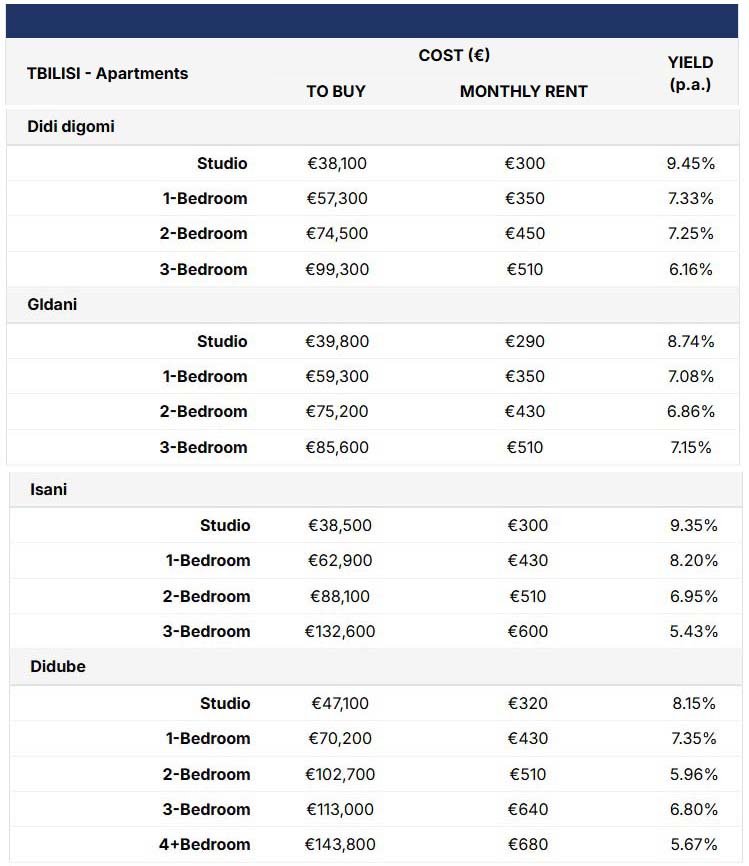

In Tbilisi, yields averaged 7.68%. The most profitable investments are small studios:

Didi Digomi: studio for €38,100 brings 9.45% annual yield with €300 monthly rent.

Isani: studio for €38,500 yields 9.35%.

Gldani: studio for €39,800 rented for €290 generates 8.74%.

Didube: studio for €47,100 with €320 rent provides 8.15%.

On average, Tbilisi studios yield 8.93%. In central and prestigious districts such as Saburtalo and Vake, profitability is lower—6–7% depending on property size. By contrast, more affordable areas like Varketili and Nadzaladevi show higher yields.

In Batumi, average yields reached 8.11%.

Bagrationi Street leads with a studio for €38,500 yielding 10.6% at €340 rent.

Near the airport, a studio for €42,800 rented at €340 provides 9.53%.

A one-bedroom apartment for €60,800 rented at €470 yields 9.28%.

On Khimshiashvili Street, a studio for €44,300 rented at €340 achieves 9.21%.

Average studio yield in Batumi is 8.81%, while one-bedroom apartments average 8.79%. The lowest returns are in Old Batumi and Rustaveli Avenue, rarely exceeding 6–7%. For example, a three-bedroom apartment for €176,300 rented at €770 yields just 5.24%. By contrast, on Agmashenebeli Avenue, a two-bedroom apartment priced at €71,000 and rented at €510 yields 8.62%.

Overall, Georgia’s rental property market continues to grow and attract both local and foreign investors. Batumi’s new-build sector shows the fastest growth, but the highest returns are seen in the hotel sector.

Подсказки: Georgia, real estate, rental market, rental yields, Tbilisi, Batumi, property investment, apartments, studios, returns, tourism