read also

New research highlights rising hotel tax compliance costs in the United States

New research highlights rising hotel tax compliance costs in the United States

Gulf Attacks Raise Concerns for Tourism and Aviation

Gulf Attacks Raise Concerns for Tourism and Aviation

Indonesia tightens compliance rules for Bali short-term rentals

Indonesia tightens compliance rules for Bali short-term rentals

Ireland plans new restrictions on short-term rentals

Ireland plans new restrictions on short-term rentals

Europe Faces Growing Housing Crisis

Europe Faces Growing Housing Crisis

Budapest Joins European Crackdown on Airbnb Rentals

Budapest Joins European Crackdown on Airbnb Rentals

Вusiness / Real Estate / Investments / Analytics / Research / Albania / real estate Albania 23.09.2025

Albania Real Estate Market 2025: Hotels, Offices, Retail Growth and Investment Risks

Albania’s real estate market has entered a phase of structural transformation. The growth of new projects is accompanied by strong demand for quality space – as a result, vacancy is decreasing and rental rates are rising. International brands are entering the market, while investments are concentrated in the hotel and retail segments. The potential remains significant, but investors still face noticeable risks.

Economy and Commercial Sector

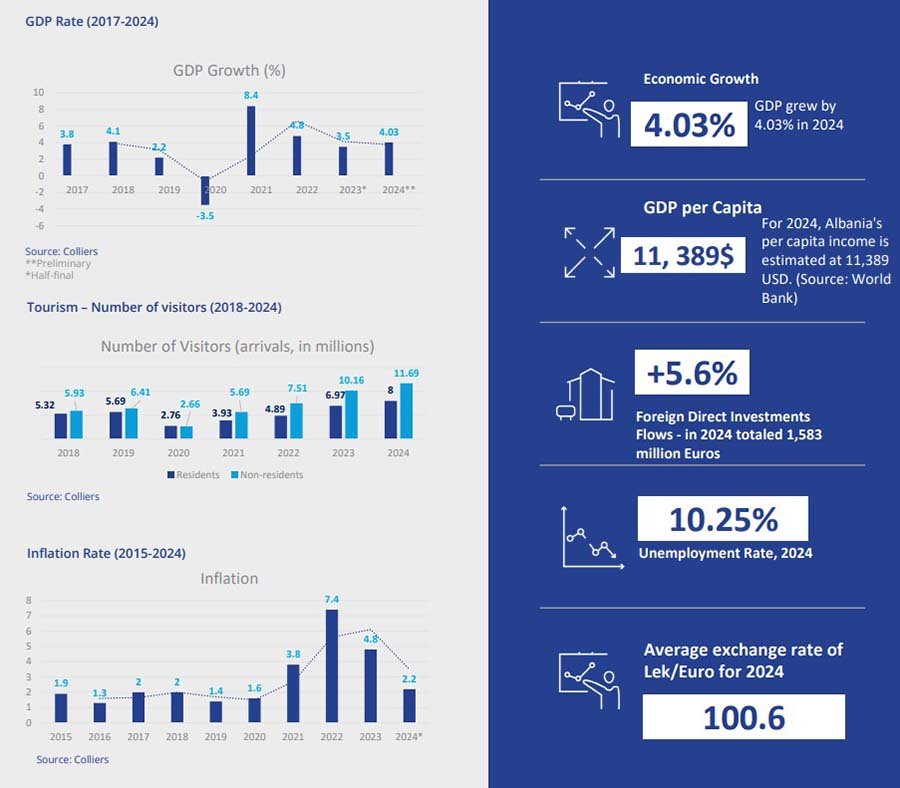

GDP. Albania’s economic performance in 2024 laid the foundation for real estate growth. GDP increased by 4.03%, inflation fell to 2.2%, and unemployment reached 8.8%. Foreign direct investment rose by 5.6% to €1.583 billion, with more than half of that amount consisting of reinvested earnings. The average salary increased by 14% to 70,530 leks, which, combined with a growing tourist flow, supported demand for hotels, offices, and retail space.

Hotels remain the main investment focus. In 2025, the first branded five-star MGallery Green Coast hotel opened on the coast, while projects by Marriott, Melia, Intercontinental, Hyatt, Mercure, and Hilton remain in the pipeline. New infrastructure, including the Vlora airport and the Llogara tunnel, improved access to southern resorts. At the same time, greater attention is being paid to environmental standards: one of the five-star projects is undergoing international certification. Colliers notes that the hotel market is highly dependent on tourist inflows, so investments in large resort complexes carry risks.

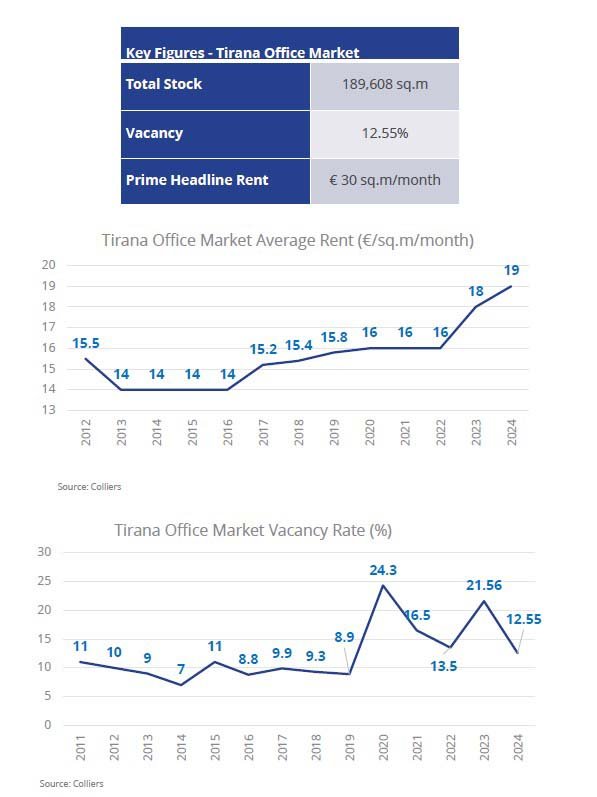

Offices. In 2024, Tirana’s office market entered a stabilization stage after rapid expansion in 2023. The total stock stood at 189,600 sq. m., holding steady. Supply continues to be dominated by B+ and A-class premises, while interest in more modern formats is increasing.

About 82% of the office stock is concentrated in the central business district and adjacent areas, while only 18% is located on the periphery. A shortage of large units in the center stimulates demand for standalone multifunctional buildings for headquarters along the Durres highway and in Farka. The vacancy rate fell to 12.55% from 21.56% a year earlier, indicating an improved demand-supply balance. Rental rates continued to grow: in prime central properties they reached €30 per sq. m. per month, while the city average was €19.

The market is gradually moving to an international level: Park Avenue received BREEAM Excellent certification, while Downtown One obtained preliminary LEED Gold status. Banks and international companies remain the key tenants, shifting away from converted premises in favor of high-class specialized buildings.

In the coming years, supply is expected to grow: about 192,000 sq. m. of new office space has been announced in projects such as Book Building, Tirana’s Rock, Tirana Boulevard, Lake Park Central, Eyes of Tirana, and others. Among them are skyscrapers of up to 100 floors. According to Colliers, intensified competition and limited central supply may lead to further rental growth.

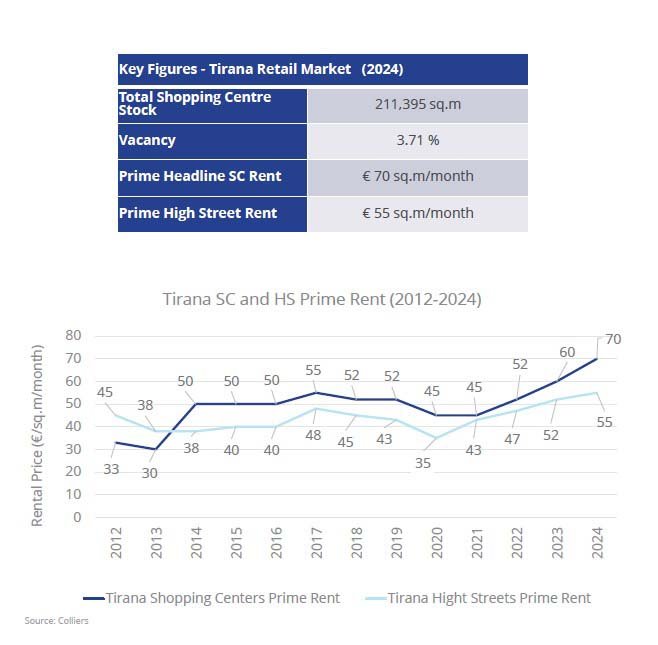

Retail. In 2024, Albania’s total retail stock reached 211,400 sq. m. compared to 203,400 sq. m. a year earlier. Vacancy stood at only 3.71%, reflecting limited supply. Large shopping centers in Tirana are operating at near-full capacity, with waiting lists emerging in some cases.

Rental rates kept rising: in shopping centers they reached €70 per sq. m. per month, and €55 on prime streets. In multifunctional complexes, sales of space remain the priority, limiting rental flexibility. Retail sales were supported by stable household spending and slowing inflation, but online retail is increasingly pressuring small shops and local chains.

In 2025, the 5,000 sq. m. Fashion Gallery Tirana will open next to TEG Shopping Center, and expansions of Eyes of Tirana and Tirana Boulevard will add another 7,898 sq. m. The sector is also undergoing structural change: the SPAR Albania chain came under the control of Viva Fresh, while Lidl is building a logistics center near Durres to expand operations. Colliers notes that demand will remain, but a shortage of quality space and the rise of e-commerce may constrain further growth of traditional retail.

Risks of Investing in Albanian Real Estate

The development of the commercial market does not eliminate existing threats. Some risks are related to land ownership. Many properties, especially on the coast, lack proper documentation: cases of double sales and inheritance disputes occur. Property registration can take up to a year, and cadastral maps in some regions are outdated.

According to Balkan Insight, a major issue remains the high level of illegal construction. Houses are built without permits or utility connections, raising the risk of demolitions and financial losses. Research by D. Liça points out that bureaucracy and corruption in obtaining permits and utility connections make hotel and commercial projects particularly difficult to implement.

According to the IMF, the market’s vulnerability is exacerbated by currency risks. Many projects are financed in euros, while revenues are in leks. When exchange rates shift, debt service burdens increase. Another limitation is the lack of mortgage access for foreigners, and capital gains tax upon resale varies by municipality, reducing transaction predictability.

Experts also highlight weak liquidity in the secondary market: properties may take years to sell, especially outside tourist zones. In prestigious areas, prices are inflated by 10–25% due to developer and agency fees. Brevitas draws attention to permitting delays and the likelihood of price corrections. Another risk remains poor construction oversight – from cheap finishes to fire safety violations.

Resort property yields largely depend on seasonal factors. Many assets remain vacant for up to eight months a year, and declines in tourist flows due to external crises, rising energy prices, or geopolitical instability lead to sharp revenue drops in the sector.

Подсказки: Albania, real estate, property market, hotels, offices, retail, investments, Colliers, Tirana, IMF, risks