read also

Evacuation from the Middle East: How Countries Are Bringing Their Citizens Home

Evacuation from the Middle East: How Countries Are Bringing Their Citizens Home

Japan Corporate Bankruptcies Hit 13-Year High

Japan Corporate Bankruptcies Hit 13-Year High

Japan’s New Condo Prices Reach Record High

Japan’s New Condo Prices Reach Record High

European Gas Prices Surge Amid Middle East War

European Gas Prices Surge Amid Middle East War

EU prepares new foreign investment screening rules

EU prepares new foreign investment screening rules

Collapse of Air Travel in the Middle East

Collapse of Air Travel in the Middle East

How investors assess Egypt’s real estate potential: Knight Frank

Residential properties, offices and branded residences are the most frequent areas of investor interest in Egypt, as noted in Knight Frank’s research. The review is based on a survey of investment priorities among wealthy buyers from Europe, the US and the Gulf region. At the same time, Experts emphasize the risks that continue to hold back the development of the country’s real estate market.

During the survey, the leading segments were residential real estate (61%), offices (49%), and branded residences (45%).. These segments remain the most in-demand among investors. Additional categories include industrial and logistics facilities, hotels, and projects in education and healthcare.

Investment priorities vary depending on country of origin. For respondents from Saudi Arabia, key factors are affordable prices (33%), developed infrastructure (33%) and a family-friendly environment (31%). Buyers from the UAE are attracted to coastal locations (32%), want to work with reliable developers (26%), and value a high standard of living (24%). Investors from the UK and the US pay close attention to pricing and infrastructure, while German respondents highlight Egypt’s cultural and historical heritage (24%) and proximity to the sea.

The main decisive factors include property quality and finishing, and the ability to use it year-round. Infrastructure, maintenance, concierge services and security play a major role. Investors are also attracted by the possibility of using the property as a holiday home or second residence, high income potential, on-site restaurants, the reputation of the hospitality brand and loyalty program benefits.

Internationally, Egypt is perceived as a mix of heritage, warm climate and diverse recreational opportunities. The key advantages named by respondents were rich history and culture (72%), summer beach destinations (35%) and a mild climate (33%). Affordable entertainment and shopping (27%), a family-friendly atmosphere (25%) and the country’s business potential (16%) were also highlighted.

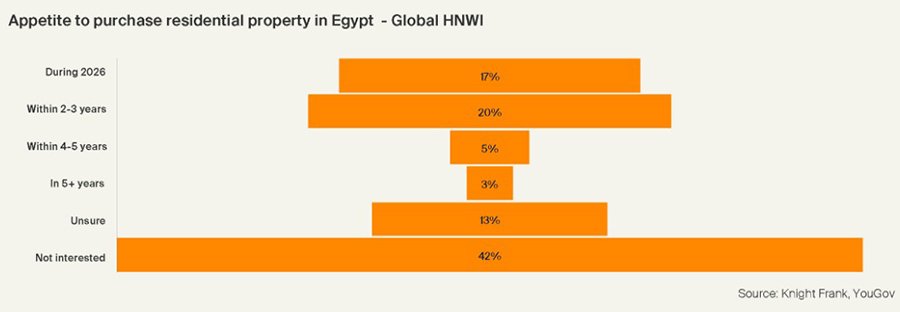

The survey showed that 17% of investors plan to purchase a property in Egypt as early as 2026, and 20% intend to do so within the next two to three years. A smaller group is considering a longer horizon: 5% within four to five years and another 3% even later. Meanwhile, 13% remain undecided and 42% show no interest in buying for now.

More than half of respondents (51%) are considering buying a second home or holiday residence, 20% aim to purchase a primary residence, and 13% are looking at properties for resale. A smaller share (8%) is focused on buy-to-let opportunities, 3% on retirement homes and another 3% on purchases for family members.

World Bank analysts note that Egypt’s economy continues to recover after the currency crisis and import restrictions. GDP growth in fiscal year 2025/26 is expected to reach around 4.3%, and 4.8% in 2026/27. Key drivers include exports, renewed foreign investment and large-scale infrastructure projects, including those in the Suez Canal zone and the country’s new administrative capital.

The International Monetary Fund also improved its outlook for Egypt in October, projecting GDP growth of 4.5% in the 2025/26 fiscal year. According to the IMF report, progress on structural reforms and support from international partners are helping strengthen macroeconomic stability. Annual inflation has fallen from nearly 40% in 2023 to 11.7% in September 2025, partly thanks to $8 billion of IMF assistance.

Egypt’s real estate market continues to face pressure from macroeconomic and geopolitical factors. Rising energy prices and supply disruptions of construction materials following the summer escalation of conflict in the Middle East have increased project costs and timelines. The situation is further complicated by the depreciation of the Egyptian pound, which reduces yield predictability and complicates long-term planning.

Additional uncertainty stems from transparency issues and overlapping government regulations. The market remains vulnerable to fraud schemes, and delivery deadlines are often missed. This creates high transaction costs and a reliance on informal agreements, undermining foreign investor confidence. The sharp 20–30% rise in housing prices in the first half of 2025 is largely speculative. Experts warn that overheating, especially on the North Coast, could result in a temporary market correction and a cooling of demand in 2026.

Knight Frank partner Faisal Durrani noted that inflows of foreign direct investment are crucial for Egypt, where authorities are working to stabilize the economy, curb inflation and ensure sustainable growth. The shortage of completed homes remains a major constraint on market expansion. Most investors prefer finished properties priced from $2 million and are unwilling to buy off-plan. Durrani emphasized that developers must prove the market’s resilience by delivering projects capable of competing with leading regional destinations. He also warned that a possible global recession could temporarily slow buyer activity.

Подсказки: Egypt, real estate, investment, Knight Frank, property market, housing prices, branded residences