read also

Inflation in Romania Slows to 9.6% but Remains Above Forecast

Inflation in Romania Slows to 9.6% but Remains Above Forecast

Riots in Mexico Disrupt Air Links to Resort Destinations

Riots in Mexico Disrupt Air Links to Resort Destinations

UK House Prices Stabilise After 2025 Slowdown

UK House Prices Stabilise After 2025 Slowdown

Israel Housing Market Eyes a Reset in 2026

Israel Housing Market Eyes a Reset in 2026

Real Estate Investment Declines in Southeast Europe in 2025

Real Estate Investment Declines in Southeast Europe in 2025

Asia Becomes the Engine of Global Aviation

Asia Becomes the Engine of Global Aviation

Rental Market in Paris: Rate Dynamics, Occupancy, and Yields

June is the peak month of the year in Paris’s rental property market, while February is the weakest; studios and one-bedroom apartments are the most in demand, noted the AirROI report. The data covers the period from November 2024 to October 2025 and illustrates demand trends, occupancy, rates, and overall yields.

Market Foundation: Structure and Audience

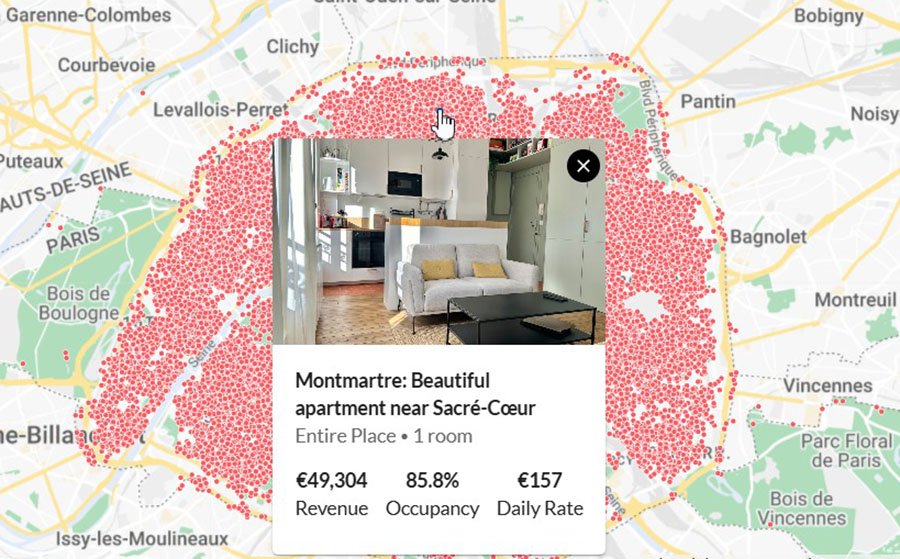

Paris has nearly 40,000 active listings. Over 91% are fully independent units, and 96% belong to the format of traditional Parisian apartments. This reflects the city’s urban layout, where standalone houses represent only a tiny share.

The structure of supply is stable: studios and one-bedroom apartments account for more than half of the market, and together with two-bedroom units, they exceed 74%. Listings with three bedrooms or more remain niche. The main audience consists of solo travelers and couples: almost half of all listings are designed for two guests, with an average capacity of around 3.2 people.

Minimum stay requirements are directly tied to regulation. Nearly half of the listings (48%) set a minimum of 30 nights to comply with city rules. However, shorter options remain available: 12% can be booked from one night, 15% from two nights, and about 10% from four to six nights.

Key Indicators

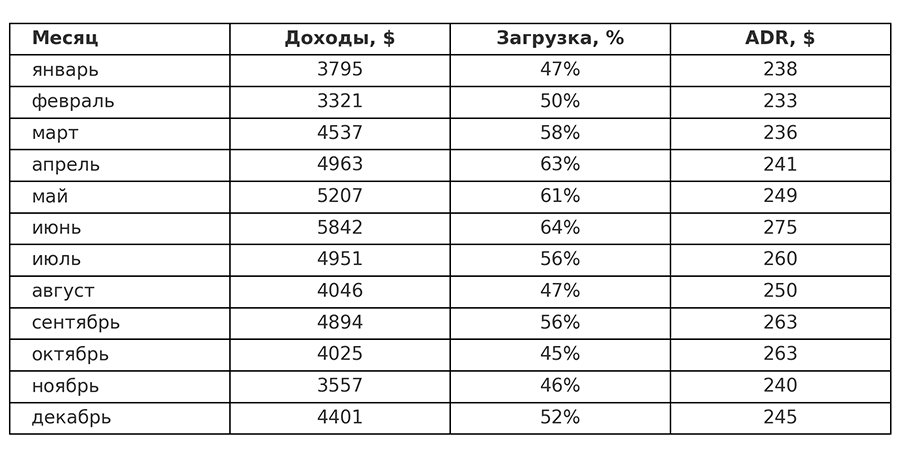

The average daily rate (ADR) in Paris reached $257, with occupancy at 50.7%. The median annual revenue per listing stands at $37,349, with results varying depending on property type and location. Revenues rose by 13.2%. February recorded the lowest figures — $3,321 at a rate of $223. At the same time, occupancy at 50% slightly exceeded August and January levels (47%). The last month of summer saw a sharp decline, yet rental rates remained above winter levels at $250, with earnings reaching $4,046.

The highest values were recorded in June — $5,842, $275, and 64%. May ranked second in revenue with $5,207, and July third with $4,951. September also showed strong results ($4,894), followed by a decline and then another rise in December.

The gap between properties is substantial. For the top 10% of apartments, monthly revenue exceeds $9,500; for the top 25%, it surpasses $5,500. The median level remains around $3,100, while the lower quartile averages roughly $1,500. Differences are shaped by location, renovation quality, pricing strategy, and hosting conditions. The most common cancellation policies are Firm and Moderate, which together cover more than 60% of the market. Guest expectations have long been standardized: fast internet, a kitchen, a workspace, and a full set of essential amenities are perceived as obligatory. Properties with modern renovations, strong interior design, or city views achieve higher conversion rates and more stable revenue.

Regulation and Actual Returns

Analysts at International Investment note that Paris remains one of the most challenging markets for investors operating in short-term rentals. On the surface, revenues look impressive — especially in peak months when income exceeds $5,800. However, profitability in percentage terms is noticeably lower due to high entry prices, significant operating costs, and strict regulation.

According to Global Property Guide, the gross rental yield in Paris amounts to just 4.63%. After accounting for taxes, city fees, maintenance, regular cleaning, interior updates, and property promotion, the actual return rises only slightly above 2% — one of the lowest among major European capitals.

Vacancy periods also affect net income. Despite steady tourist demand, such gaps are inevitable. For owners, this means that even a high ADR and strong peak months do not guarantee a tangible financial outcome. Overall, experts conclude that rental property is not the most efficient investment tool. With comparable risks, the hotel sector appears significantly more attractive — especially branded luxury properties, which offer greater reliability and more stable income.

For comparison: in the hotel complex Wyndham Grand Batumi Gonio in Georgia, guaranteed returns reach 10% per year, while potential returns go up to 19%. Against the backdrop of Paris apartment net yields just above 2%, the contrast between the formats is clear.