read also

Japan Corporate Bankruptcies Hit 13-Year High

Japan Corporate Bankruptcies Hit 13-Year High

Japan’s New Condo Prices Reach Record High

Japan’s New Condo Prices Reach Record High

European Gas Prices Surge Amid Middle East War

European Gas Prices Surge Amid Middle East War

EU prepares new foreign investment screening rules

EU prepares new foreign investment screening rules

Collapse of Air Travel in the Middle East

Collapse of Air Travel in the Middle East

New research highlights rising hotel tax compliance costs in the United States

New research highlights rising hotel tax compliance costs in the United States

Investments in APAC real estate jumped by 130%: key trends and the 2026 outlook

For several years, the American and European markets remained the primary destinations for global capital, but interest is shifting notably toward the Asia-Pacific region, as noted in the Colliers report. The amount raised for APAC strategies increased by more than 130% in the first three quarters of 2025 compared with the same period in 2024, while the region’s share in global fundraising rose from 6% to 11%.

Joanne Henderson, National Director of Research at Colliers Australia, says: “The renewed interest in the Asia-Pacific region is a positive signal, especially for Japan and Australia, the region’s core markets. We are also seeing investors who previously did not consider India now viewing it as a major destination for capital allocation over the coming years.”

Offices: focus on mature markets and portfolio upgrades

The Global Investor Outlook 2026 report highlights steady demand for offices in Seoul, Tokyo and Sydney. Capital flows from the US and Japan into Australia are increasing, while the Japanese market attracts additional attention due to low vacancy and stable rental growth.

High construction costs are redirecting investor interest toward existing income-producing buildings. At the same time, more projects are emerging to repurpose lower-grade offices in peripheral locations. Demand for assets in secondary business hubs is growing especially fast, adding 18 percentage points in a year. More favourable pricing has made these assets one of the key investment targets.

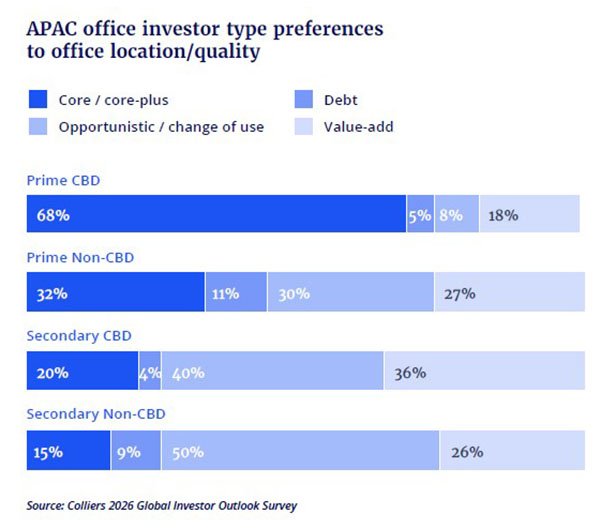

According to the Colliers survey, 68% of investors plan to focus on premium office assets in central business districts (CBD) in 2026. For assets outside CBDs, the preference is 32%.

Retail and logistics

Retail. Interest is shifting toward high-quality retail properties viewed as more reliable than some alternative formats. Lower cap rates indicate declining market risk. 31% of investors plan to allocate capital to neighbourhood shopping centres, and 27% to high-street assets.

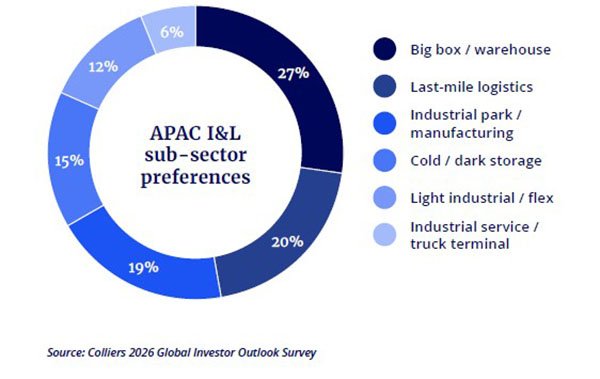

Logistics. Transaction activity in logistics has grown significantly in Australia, while demand continues to rise in India and Japan, driven by e-commerce expansion. Investor preferences lean toward Australia, New Zealand, Japan and South Korea. Some markets show growing caution, as rising vacancy forces more careful asset selection. Large-scale warehouse complexes attract 27% of investors, while cold-storage facilities have increased their share to 15%. Other preferences include industrial parks, light manufacturing assets and freight-related facilities.

Data centres and housing

Data centres. This segment is most popular in Singapore and Australia, while India attracts interest due to its vast technology sector. In Japan, limited energy capacity constrains growth and creates additional barriers. For 2026, 11% of investors plan to allocate capital to data centres — only slightly below the US figure of 14%.

Housing. In residential real estate, interest is concentrated in the region’s largest cities: 87% of respondents choose these locations. Japan is particularly active, with migration to major urban areas and limited new supply driving sustained momentum. Growth is also strong in India.

The highest activity in student housing is seen in supply-constrained markets such as Hong Kong, where underutilised hotels are being considered for conversion. Foreign investors are expanding their presence in India, capitalising on the gap between demand and the availability of quality assets.

Outlook and risks

In 2026, the number of office-upgrade projects will continue to rise across both central and peripheral districts. Strong potential remains in last-mile logistics, distribution hubs and technology infrastructure — particularly data centres, where demand is growing faster than network expansion.

At the same time, the market faces ongoing pressure from macroeconomic uncertainty, geopolitical risks, persistent inflation and the possibility of further rate hikes. High construction costs limit new development and increase interest in refurbishments. In Japan and Hong Kong, labour shortages complicate operations and reduce margins, particularly in the hospitality sector.

Export-oriented economies in the region remain sensitive to tariffs and inflationary pressure, although certain agreements — such as the tariff deal between Japan and the US — may partially mitigate risks. Differences in regulatory frameworks for multifamily housing and data centres also complicate long-term planning.

Подсказки: APAC, real estate, investment, property market, Colliers, Asia-Pacific, offices, logistics, retail, data centres, residential, 2026 trends