read also

Japan Corporate Bankruptcies Hit 13-Year High

Japan Corporate Bankruptcies Hit 13-Year High

Japan’s New Condo Prices Reach Record High

Japan’s New Condo Prices Reach Record High

European Gas Prices Surge Amid Middle East War

European Gas Prices Surge Amid Middle East War

EU prepares new foreign investment screening rules

EU prepares new foreign investment screening rules

Collapse of Air Travel in the Middle East

Collapse of Air Travel in the Middle East

New research highlights rising hotel tax compliance costs in the United States

New research highlights rising hotel tax compliance costs in the United States

Вusiness / Analytics / Research / Bulgaria / Romania / Hungary / Croatia / Latvia / Italy / Norway / Switzerland / Spain / Austria / United Kingdom / Denmark / Sweden / France / Poland 03.12.2025

The structure of workplace costs in Europe has shifted: Colliers

Companies across Europe are facing a changing structure of workplace-related expenses. In the new Colliers report, it is noted that the cost per employee has decreased only formally: the figure does not account for lower occupancy levels or the impact of postponed repairs and workspace upgrades. At the same time, key cost categories — services, IT licences and labour — continue to rise.

Index scale

The Occupier Cost Index covers 28 European countries and includes data from almost 4,000 buildings with a combined area of over 26.3 million sq m. This scale makes it possible to assess not only average workplace costs, but also differences between countries, office types and management models. Based on this dataset, Colliers forms the current cost index and conclusions on how expense structures are shifting across Europe.

The index is calculated based on full capacity rather than actual occupancy. Average office attendance in Europe remains at 30–40%. If total expenses were calculated based on actual workplace usage, the annual cost per employee would reach €25,000–33,000.

Cost structure

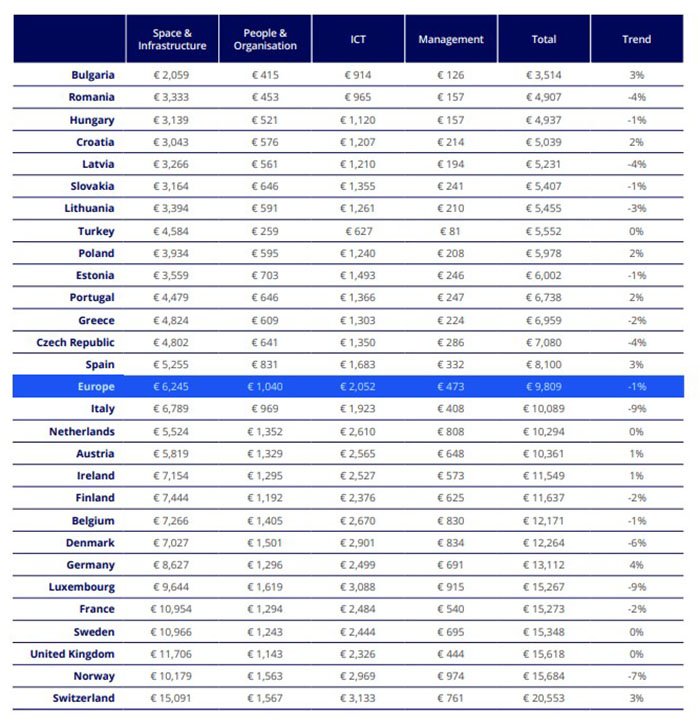

In 2024, total workplace expenses per employee in Europe decreased by 1% to €9,809. Management of office infrastructure, service support and procurement fell by 9% — from €518 to €473. Space-related costs decreased by 4% — from €6,531 to €6,245. This category includes rent, taxes, depreciation, repairs and workspace adaptation, furniture, maintenance, cleaning and energy.

Spending on workplace operations and maintaining a comfortable and safe environment increased by 8% — from €959 to €1,040. This group includes catering, reception, document management and office supplies. IT-related expenses grew by 6% — from €1,936 to €2,052. This category covers the digital resources employees need: connectivity, training, hardware and software. As a result, the overall figure appears stable, but the internal structure is shifting towards more expensive categories.

Country differences

Workplace costs vary significantly across countries and depend on local prices, rent, services and labour. The lowest costs are found in Bulgaria, Romania, Hungary, Croatia, Latvia, Slovakia and Lithuania — from €3,514 to about €5,400. The main factors are affordable space and lower labour and service costs. In Turkey and Poland, costs are higher — around €5,552 and €5,978 respectively.

In the Czech Republic, Estonia, Portugal and Greece, the figures range from €6,002 to €6,959. Spain is slightly above the European average due to higher space and infrastructure expenses — about €8,100 per employee. Italy, the Netherlands, Austria, Ireland, Finland and Belgium spend even more — from €10,089 to €12,171. Here, key drivers are rent, security, services and IT infrastructure. The highest expenses are recorded in Denmark, Germany, Luxembourg, France, Sweden, the United Kingdom, Norway and Switzerland — from €13,112 to over €20,553 per employee.

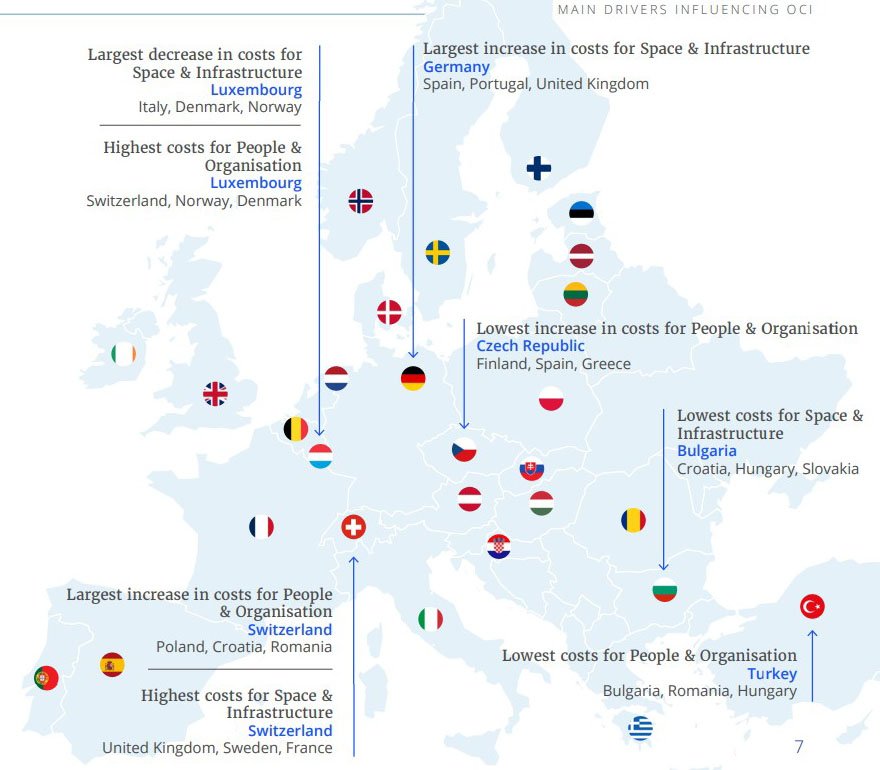

Trends also differ: Italy and Norway show a decrease of 9% and 8%, while Estonia, Slovakia, the Czech Republic, Finland, France and Sweden demonstrate moderate declines. Germany, Spain, Austria and Switzerland show increases of up to 3%, reflecting rising service and infrastructure costs.

Macroeconomic factors

Differences in workplace costs are closely linked to macroeconomic dynamics. Average consumer inflation in Europe reached 2.6% in 2024. The lowest rates — around 1% — were recorded in Lithuania, Finland, Italy and Switzerland. Croatia, Belgium and Romania exceeded 4%. Labour costs rose on average by 5%, but in Romania, Bulgaria, Croatia and Poland increases exceeded 14%.

Energy costs dropped significantly. Electricity prices decreased by an average of 7%, with some countries seeing reductions of over 20%. Heating costs fell by 15% across Europe, with Latvia, Lithuania, Hungary and Luxembourg showing declines of more than 30%.

Office space usage also changed: average area per employee fell by 4%. Rent showed moderate growth — around 2%, with higher increases in central business districts.

The highest increases in space and infrastructure costs were recorded in Germany, Spain, Portugal and the United Kingdom, while the largest decreases occurred in Luxembourg, Italy, Denmark and Norway. Currency fluctuations also played a role: the Polish, British and Swiss currencies strengthened, while those in Central and Eastern Europe weakened. Nordic currencies remained close to the euro.

Need for acceleration

The shift toward more flexible facility management models remains slow, even though companies are already requesting services based on actual space usage. Technologies are applied fragmentarily: tools for monitoring occupancy and workspace utilisation operate separately and have not yet evolved into a unified adaptive system. Colliers analysts emphasise that adoption must accelerate, as the technological base is already available and allows services to be aligned with real demand, reducing costs without compromising quality.

The industry remains in a transitional phase: changes are limited to isolated initiatives, while key processes rely on traditional schemes. As the gap between projected and actual occupancy widens, the speed of adopting adaptive models becomes critical. According to Colliers, the sustainability of corporate cost structures in the coming years will depend directly on how quickly the market can transition to management based on real office usage.