New Zealand investor visa: new opportunities to buy residential property

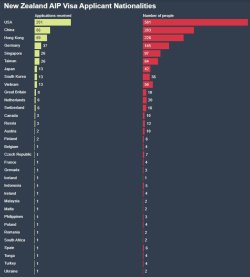

The United States, China, and Hong Kong lead in Active Investor Plus applications

New Zealand updated its Active Investor Plus investment migration program in April 2025. Following the reform, interest from high-net-worth foreigners increased significantly. Over nine months, 532 applications were submitted, covering 1,709 individuals including family members, according to Investment Migration Insider, citing Immigration New Zealand. The total minimum volume of potential investment reached NZ$ 3.16 billion (US$ 1.8 billion). Further growth is expected from March, when foreigners will be allowed to purchase luxury residential property.

Investor visa applications

Which countries participate in the Active Investor Plus program

The United States ranks first in the number of applications, with 201 submissions. Including family members, more than 580 Americans are participating in the program, accounting for about 38% of all applications. China ranks second with 86 applications covering 283 individuals, followed by Hong Kong with 69 applications representing 226 individuals.

Germany is also among the largest source markets, with 37 applications covering 145 individuals, followed by Singapore with 26 applications covering 97 individuals and Taiwan with 26 applications covering 84 individuals. In total, applications have been submitted from 33 countries, including Austria, Belgium, Finland, and Iceland. This confirms the broad geographic reach of the program and its appeal to global investors.

Investment volume under the investor visa

In January 2026, the total declared investment volume increased by NZ$ 155 million to NZ$ 926.2 million (US$ 532 million). Authorities are currently reviewing an additional 134 applications, which could bring approximately NZ$ 774 million (US$ 445 million) in further investment.

Of the 532 applications, 482 were submitted after the program reform, while 50 investors transitioned from the previous visa framework.

Investment formats preferred by applicants

Most applicants choose the Growth category, which requires investment of at least NZ$ 5 million (US$ 2.9 million) over three years in higher-risk but potentially higher-return assets. These include managed investment funds and direct business investments. A total of 432 applications were submitted under this category.

The Balanced category requires investment of at least NZ$ 10 million (US$ 5.8 million) over five years across diversified asset classes. This option attracted 100 applicants, reflecting a more conservative investment approach among some investors.

Immigration New Zealand approved an additional 30 resident visa applications, bringing the total number of approvals to 159. In addition, 392 applications received approval in principle, allowing investors to proceed with capital deployment. The average processing time is approximately 33 working days.

Investment in New Zealand luxury residential property

In December 2025, Parliament passed amendments allowing Active Investor Plus visa holders to purchase residential property valued at NZ$ 5 million (US$ 2.9 million) or more, according to OneRoof. The law will come into force on March 6, 2026.

The minimum threshold includes the combined value of the house and land. According to the government, the changes will affect less than 1% of the country’s housing stock. Currently, around 10,000 properties are valued at NZ$ 5 million or more, with approximately 7,000 being ready-to-live-in homes. Most are located in Auckland and the Queenstown-Lakes region, the country’s key luxury property markets.

The NZ$ 5 million-plus segment remains extremely limited. In 2024, such transactions accounted for just 0.2% of total housing sales. Even at peak market activity, the figure did not exceed 0.4%. Immigration Minister Erica Stanford emphasized that the program plays an important role in attracting capital and supporting the national economy.

Investor requirements

Eligibility and due diligence

Foreign investors must meet Active Investor Plus visa requirements and pass due diligence checks. Applicants must verify the legal origin of funds, provide criminal record certificates, and undergo medical examinations. Visa processing typically takes around four months, and the application fee is NZ$ 27,470 (US$ 15,900). Investors must also have additional funds available beyond the mandatory investment required by the visa program.

Overseas Investment Office approval

After the law comes into force, investors will need separate approval from the Overseas Investment Office before purchasing or building residential property. Application fees are NZ$ 2,040 (US$ 1,180) for purchasing an existing home and NZ$ 3,500 (US$ 2,030) for building a new property. Applications are generally processed under accelerated procedures.

What type of property investors can purchase

Investors may purchase only one residential property under the new rules. To acquire another property, the previously purchased one must be sold. The property may be used as a primary residence, holiday home, or business base. However, the property purchase itself does not count toward the visa’s investment requirement.

Additional restrictions apply to sensitive land, including coastal areas, islands, and large land parcels, which require separate government approval. The general foreign buyer ban introduced in 2018 remains in place and continues to apply to most overseas buyers.

New Zealand housing prices and investment yields

New Zealand’s residential property market entered a stabilization phase in 2025 after a period of decline. According to the Real Estate Institute of New Zealand, the median house price rose by 1.4% year-on-year in December 2025 to NZ$ 786,977 (US$ 455,069). Excluding Auckland, the median price reached NZ$ 718,000 (US$ 415,184), up 2.1%. In Auckland, the country’s largest city, the median price remained above NZ$ 1 million (US$ 586,924), increasing by 1.5% year-on-year.

Over the long term, the market has shown significant growth. Since 2000, the median house price has increased more than fourfold, from NZ$ 170,000 to current levels. However, the outlook for 2026 remains moderate, with projected price growth ranging between 2% and 5%, depending on interest rates and macroeconomic conditions.

Residential property yields remain stable but moderate. As of January 2026, the average gross rental yield stands at approximately 4.12%, up from 3.99% in mid-2025. Other estimates place yields at around 3.8%. The rental market is cooling, with the average weekly rent at NZ$ 568 (US$ 334), down 0.6% year-on-year due to declining migration and weaker demand.

Conclusion

The government expects the law’s entry into force to enhance New Zealand’s attractiveness for high-net-worth investors and support additional capital inflows without placing significant pressure on the broader housing market.

Analysts at International Investment note that the updated investor visa framework and new property purchase rights are creating a structural, rather than cyclical, source of demand. Unlike previous cycles driven primarily by price appreciation, current capital inflows are linked to migration and long-term strategic investment decisions.

At the same time, the market remains challenging. Rental yields of around 4% limit short-term income potential, while moderate price growth reduces the likelihood of rapid capital gains. Additional constraints include high entry thresholds, regulatory requirements, extended approval procedures, and sensitivity to interest rate and migration trends.

New Zealand real estate can serve as an effective long-term capital preservation asset, but it requires a longer investment horizon and careful timing and asset selection.